The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 22nd January 2017

Last week, I predicted that the best trades for this week were likely to be short British Pound against the U.S., Australian and New Zealand Dollars. All these currencies rose during the week, but the British Pound rose the most of all, so the trade overall was not successful. The average result was a loss of 1.04%.

The Forex market seems to be moving into a less predictable mode now, with the well-established bullish trend in the USD since 8th November being called into question, yet still being technically intact.

The Euro and Swiss Franc are currently showing short-term bullishness, as is the British Pound. I therefore suggest that the best trade this week is likely to be short of the Japanese Yen and long of the U.S. Dollar.

Fundamental Analysis & Market Sentiment

The major development making waves in the market right now is President Trump’s assumption of office, and his remark that the U.S. Dollar is “too strong”. He gave a dark and unusual inauguration speech, in which he seemed to strongly emphasize a nationalistic and protectionist economic policy. The effects of this are unclear but it seems to have taken the shine off the U.S. Dollar temporarily at least.

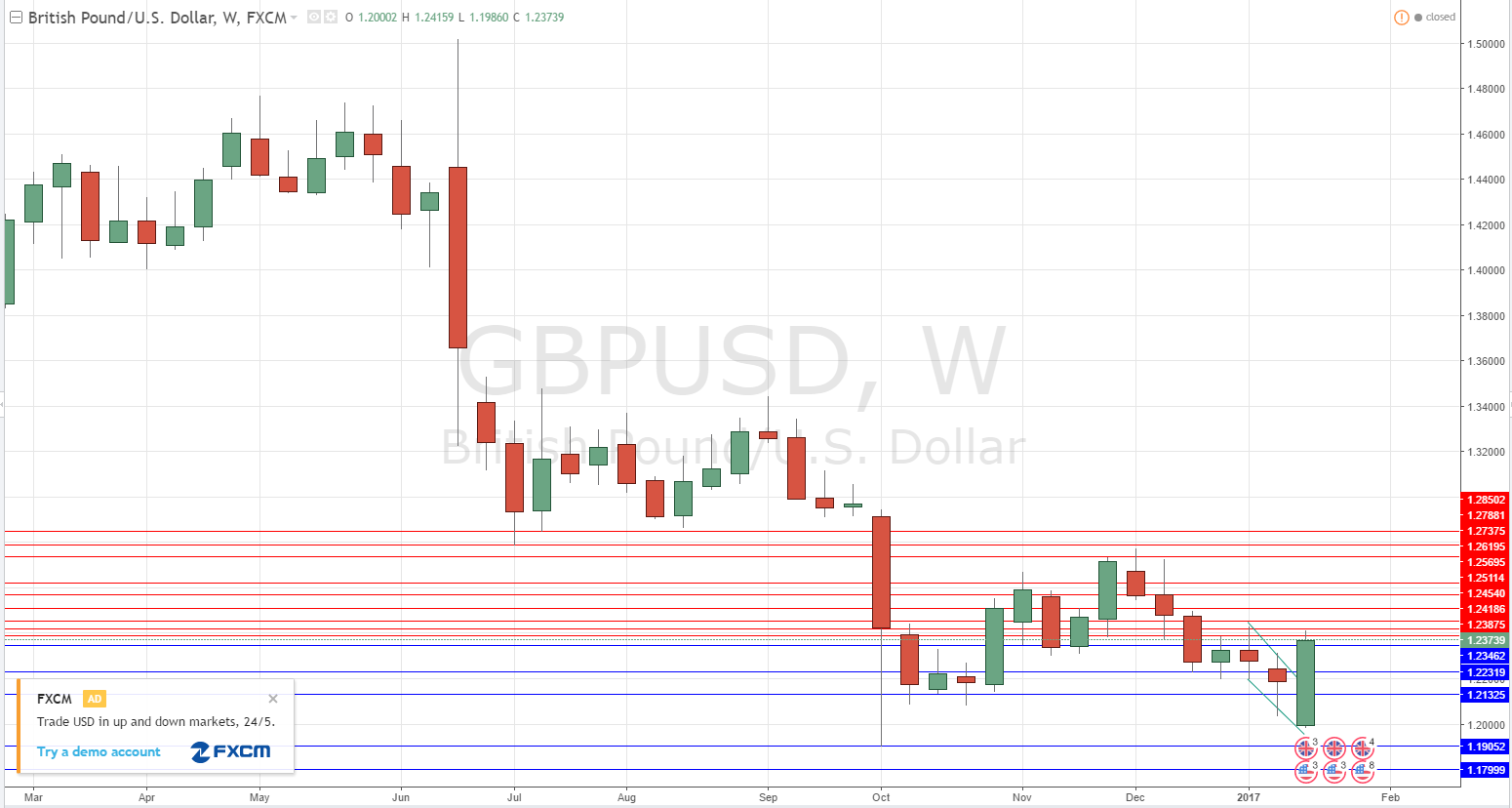

The other major issue is the British government’s confirmation that it will pursue a Hard Brexit yet allow Parliament a vote on the approval of any final deal. Paradoxically, this has had the effect of strengthening the Pound significantly.

Technical Analysis

USDX

The U.S. Dollar printed another solidly bearish candle within the scope of a wider bullish trend that is manifested over both the long and short terms. The bearish candle is strong, but the move can still be called a normal pull back within the trend. Additionally, the price is reaching an area where it had faced a cap a few weeks ago, so there may be support there centered on 12306 as well as the broken upper trend line of the former bullish channel, as shown in the chart below.

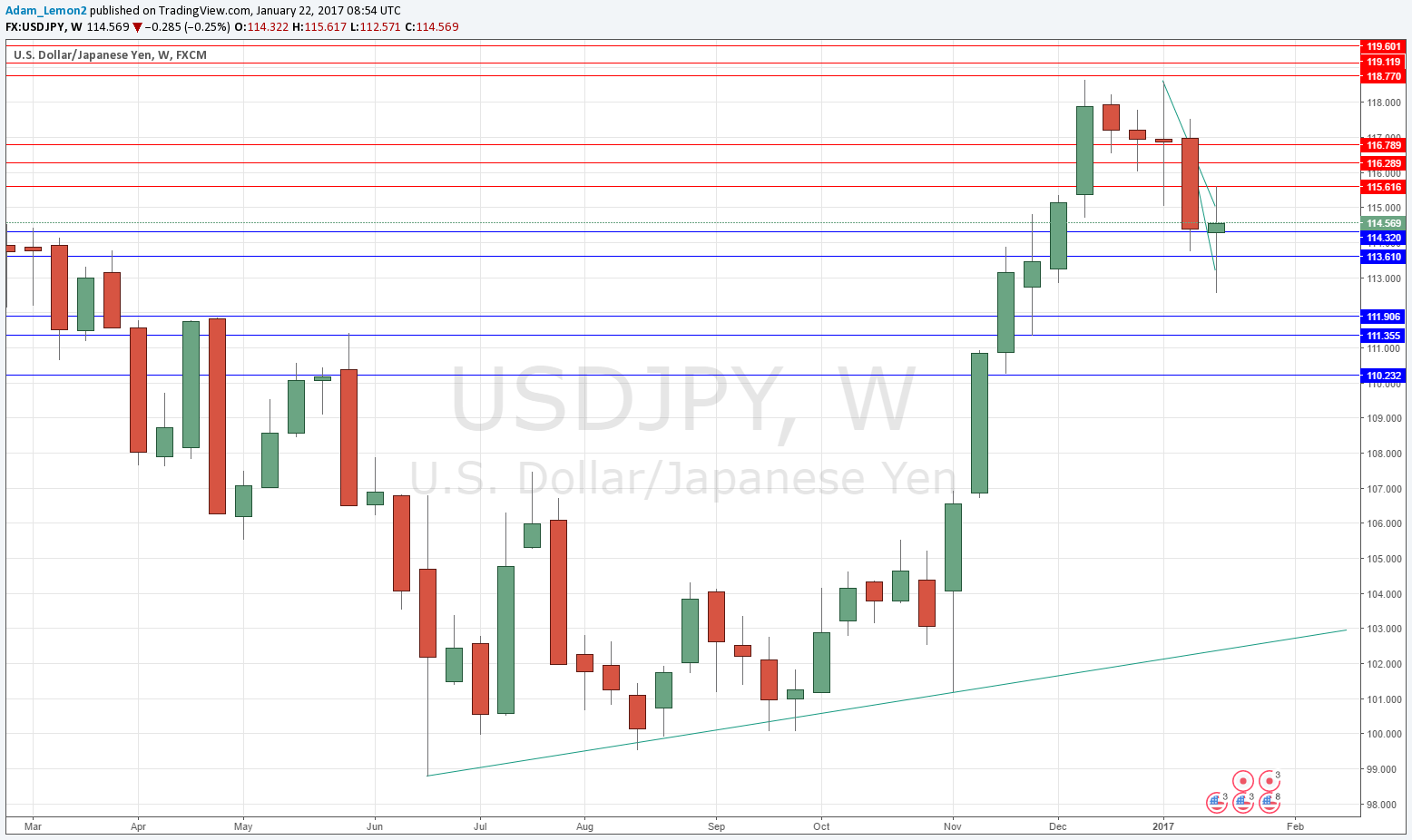

USD / JPY

A large bullish doji, which is significant for its indecision. We are getting the first signs of a possible resumption of the long-term bullish trend, with the price still well above its levels of 3 and 6 months.

GBP/USD

A very strongly bullish weekly candlestick, with the price holding up and closing near its high. The price is now above its level from 3 months. It looks as if the long-term bearish trend might be over.

Conclusion

Bullish on the USD/JPY currency pair.