GBP/USD Signal Update

Yesterday’s signals were not triggered as there was insufficiently bullish price action at 1.2300.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today only.

Long Trades

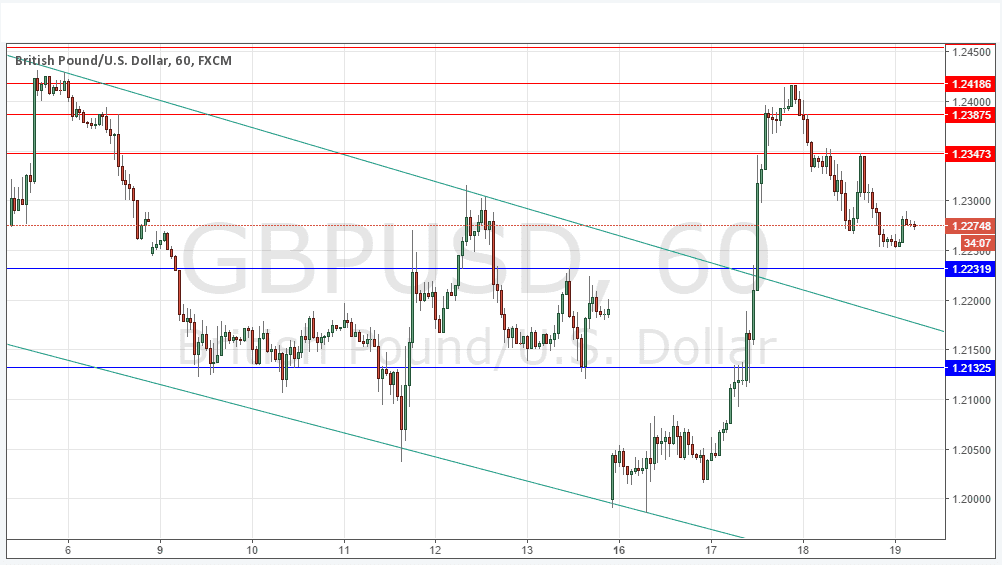

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2232.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Short Trades

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2347, 1.2388 or 1.2419.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

The higher than usual volatility continued yesterday, but the pair sold off in what looks like a natural reaction after its very strong rise the day before. The support level at 1.2300 was invalidated but it looks as if new resistance was printed at 1.2347. What happens if and when the price reaches 1.2232 will probably be the real test as to whether the price will hold up or drop back down into the bearish channel.

There is nothing due regarding the GBP. Concerning the USD, there will be releases of Building Permits, Philly Fed Manufacturing Index, and Unemployment Claims data at 1:30pm London time followed by Crude Oil Inventories at 4pm.