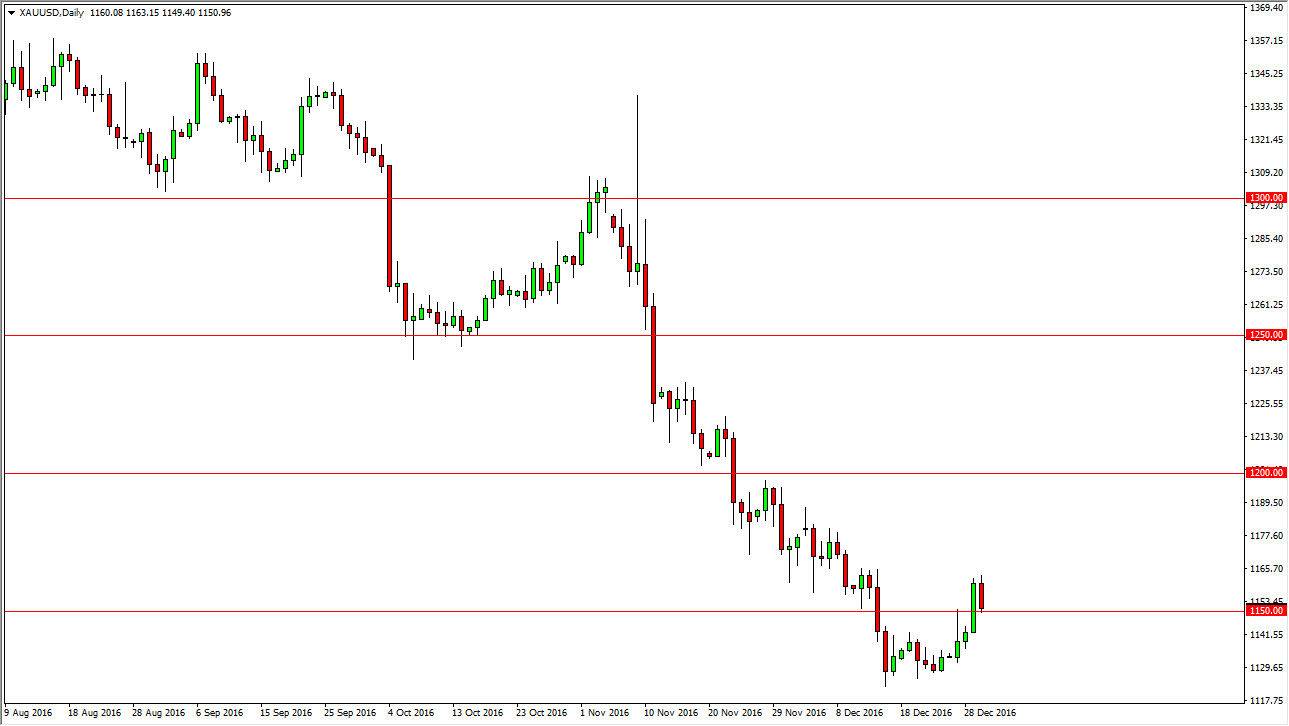

Gold markets continue to see negative pressure, as the session on Monday went long. We tested the $1150 level, that I have marked on the chart. This area offered a bit of resistance recently, so it’s not surprising to me that we found support. However, I recognize that we are in a longer-term downtrend, so I still prefer selling gold as the US dollar continues to strengthen. I recognize that the downtrend has gone on for quite some time, so I think the easy money selling gold has already been had.

I believe that the $1150 level remains very important, as it was previously. I think that a bounce from here is possible, but we can stay below the $1150 level for more than a four-hour candle, I’m willing to start shorting the gold contract again. On the other hand, we bounce from here I will not by gold I will simply wait for exhaustion to set into the markets I can start selling in going with the longer-term trend. Currently, it’s difficult to buy gold as demand just isn’t there.

This isn’t to say that the market will turn around someday, and quite frankly I think sometime this year it will. However, I recognize that longer-term charts tend to favor support near the $1100 level, and then eventually the $1000 level. I believe that the buying pressure in that area will be massive, and that will be enough to turn the market around. Until then, I remain very skeptical of rallies unless of course we can break above the $1225 level, which is obviously quite some distance above current trading.

This will be a volatile market, but ultimately as long as the US dollar continues to strengthen, I don’t see any reason for gold to suddenly take off to the upside. If I were looking for longer-term buy-and-hold investments, this would more than likely be at the top of my shopping list, but can’t pull the trigger yet.