Gold prices ended Thursday's session up $4.48, extending gains to a fourth straight session, as the dollar continued to slide. The XAU/USD pair traded as high as $1206.88 an ounce but erased a portion of initial gains after Fed officials expressed optimism about the U.S. economy. Philadelphia Federal Reserve Bank President Patrick Harker said “the economy is displaying considerable strength” and and Federal Reserve Chair Janet Yellen said “short term I would say I don't think there are serious obstacles. I see the economy as doing quite well”.

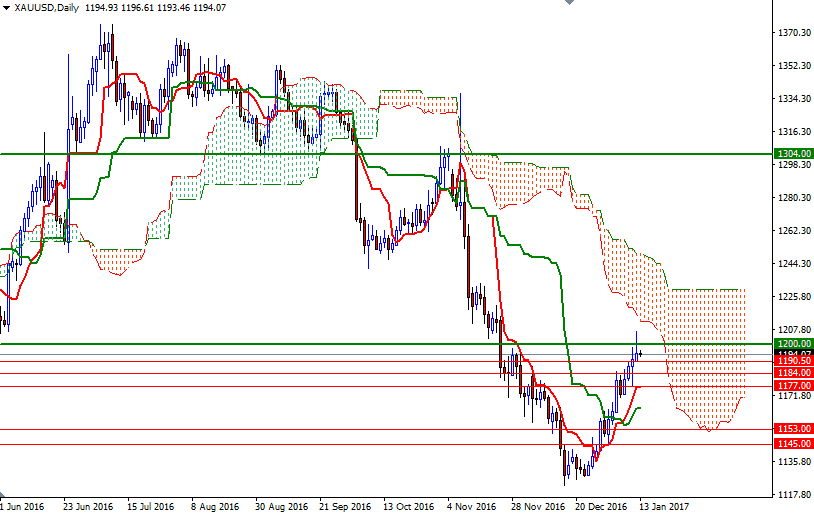

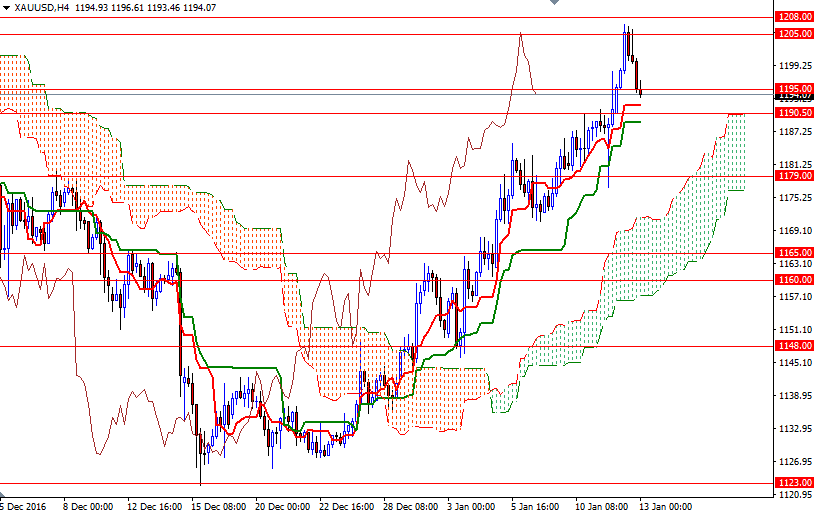

Breaking above the 1190.50 level enabled market to move higher as expected but not surprisingly prices faced downward pressure in the 1208/5 region which I had identified as a significant resistance. Lately, I have been repeating that the short-term technical picture for gold remained positive, with the market trading above the Ichimoku cloud on the 4-hour chart, and an upswing to the 1212.60-1200 area was possible. Since we reached this are, I would I advise a bit of caution. Yesterday's candle which left a tall upper shadow might be a warning sign as well. Despite the short-term positive outlook, XAU/USD still resides below the weekly and daily Ichimoku clouds.

The XAU/USD pair is currently trading at 1194.07, slightly lower than the opening price of 1194.93. To the downside, keep an eye on the 1190.50 level. If the market drops through 1190.50, it is likely that we will test 1187 and perhaps 1184. A break down below 1184 would imply that the 1179 level might be the next port of call. To the upside, the initial resistance stands in the 1201/0 zone. The bulls have to push prices beyond this barrier if they intest to revisit the 1208/5 area. Clearing this resistance could foreshadow a move towards the 1212.60 level which happens to be the bottom of the weekly cloud.