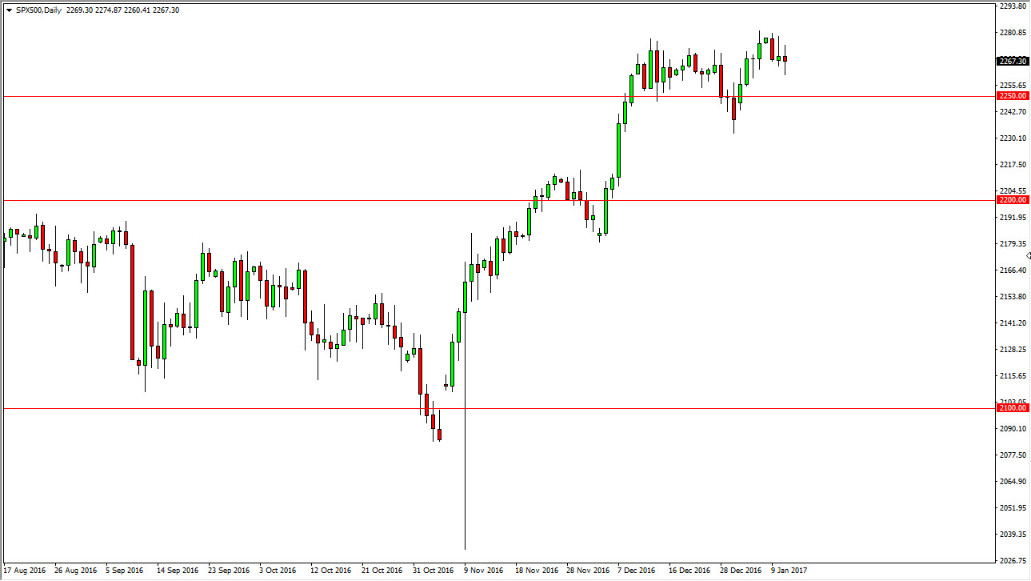

S&P 500

The S&P 500 had a volatile session on Wednesday, chomping around all day. Ultimately, I believe that there is a significant amount of resistance above, but we will eventually find enough momentum to break above there. The 2250 level below should continue to be supportive, and with that I believe that pullbacks offer the value the traders will be looking for. Given enough time, I believe that the market should continue to go to the 2300 handle. Expect choppiness, and take advantage of those pullbacks to write the higher pricing that’s almost undoubtedly coming. I have no interest in selling, the market looks to be far too bullish for doing something like that.

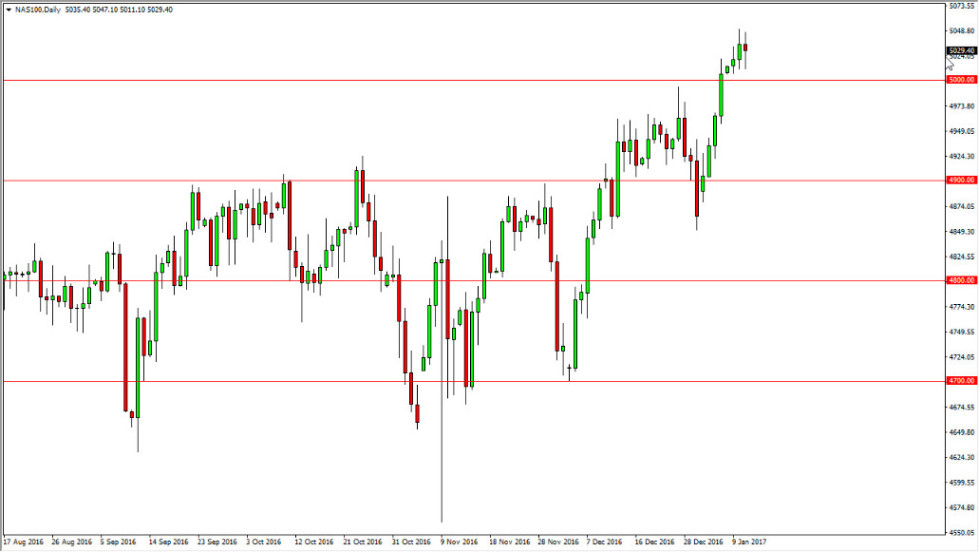

NASDAQ 100

The NASDAQ 100 went back and forth on Wednesday as well, as we continue to see volatility. However, the most important thing on this chart is that the 5000 level has offered quite a bit of support, as it was previously was resistive. The market looks as if it is trying to go higher, perhaps reaching towards the 5100 level over the next several sessions. I have no interest in selling, and I believe that there is more than enough support underneath to continue to push to the upside. The 4950-level underneath should continue to be the “floor” in the market, so it’s not until we break down below there that I would even remotely consider selling.

I believe that the NASDAQ 100 will probably continue to lead the way for the higher pricing of US indices overall, and with the US economy outperforming European and Asian ones, it makes quite a bit of sense that we will continue to see buyers jump into the NASDAQ 100, the S&P 500, and of course the Dow Jones 30. I’m bullish of all 3 of those markets, and believe that the NASDAQ 100 will be the harbinger of where we go next.