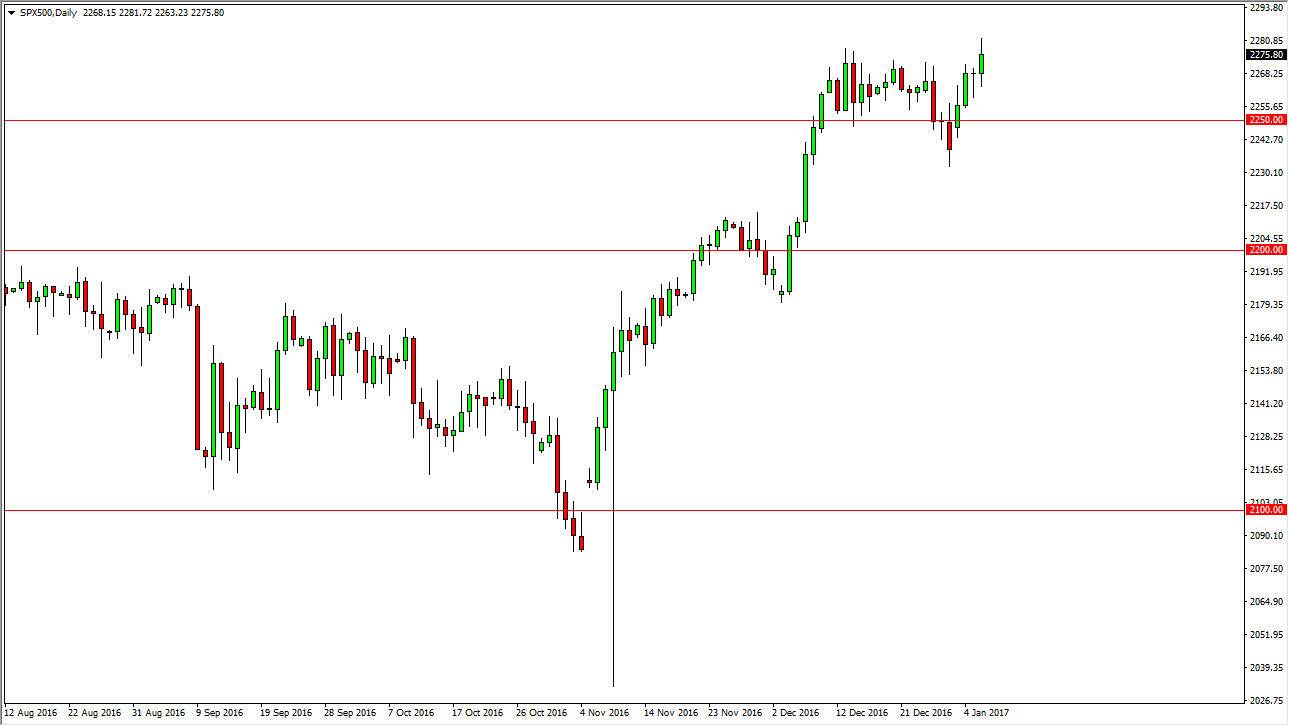

S&P 500

The S&P 500 had a volatile session on Friday, as the jobs numbers came out of the United States. The market looks as if it is trying to break out to the upside, and continue the longer-term uptrend. I have no interest in shorting this market, I believe that every time we pullback it should be an opportunity to pick up value and a market that shows signs of longer-term move to the upside. I think that the 2250 level underneath will continue to be a bit of a floor, and as a result the market continues to be one that I have no interest in selling. The US indices overall very healthy, but we are a bit overextended so don’t be surprised if it’s a choppy move to the upside.

NASDAQ 100

The NASDAQ 100 broke above the 5000 level during the day on Friday, psychologically important feat. The fact that we have broken out to the upside signals that we are going to go higher over the longer term in my estimation. By breaking above the top of the range for the session on Friday, that should attract more buyers in a market that has been very strong to begin with. Pullbacks should continue to enjoy support below, extending all the way down to the 4900 level but quite frankly I think it would be difficult to break below the 4950 handle, which looks to be supportive in its own right.

As we break higher, I believe the next level that the market will go looking for is the 5100 level but I also believe that long-term traders are starting to put large amounts money into the market and hanging onto the trade. Ultimately, selling is almost impossible to do against any US index, especially one that is trying to catch up to the other ones like the NASDAQ 100 days.