USD/CHF Signal Update

Yesterday’s signals were not triggered as none of the key levels were ever reached.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today only.

Long Trades

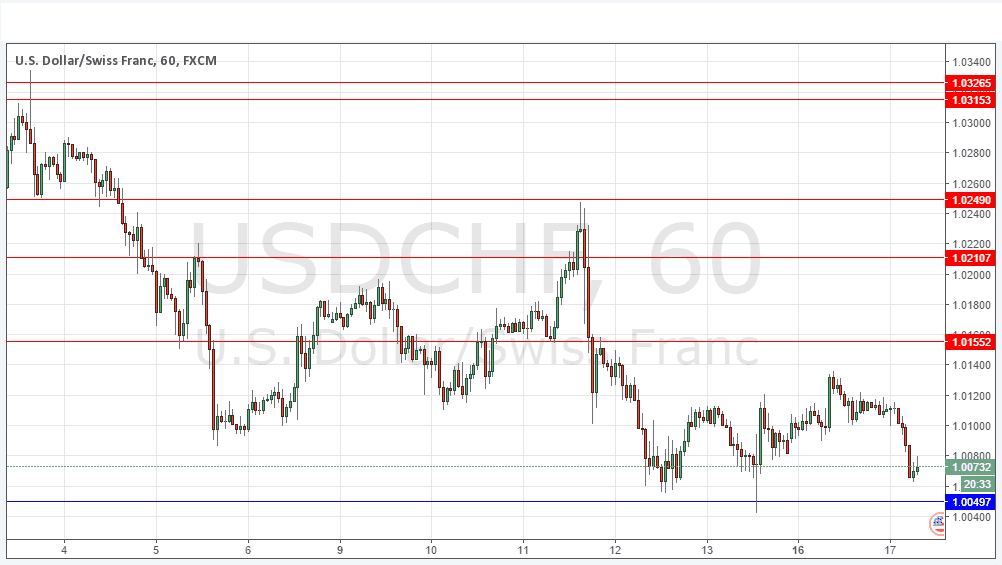

Long entry after bullish price action on the H1 time frame following the next touch of 1.0049 or 0.9993.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry after bearish price action on the H1 time frame following the next touch of 1.0155.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CHF Analysis

I wrote yesterday about how the support level at 1.0050 is starting to look like a very significant anchor, and that the longer it holds, the more supportive it will become. However, although it has not been broken yet, the action is looking less and less bullish and more and more as if there is going to be a downwards break. Below that, the parity level will be psychologically important and very pivotal as a break below there will signify the complete end of any long-term bullishness in this pair.

There is nothing due today regarding the CHF or the USD.