USD/CHF Signal Update

Yesterday’s signals were not triggered as none of the key levels were ever reached.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today only.

Long Trades

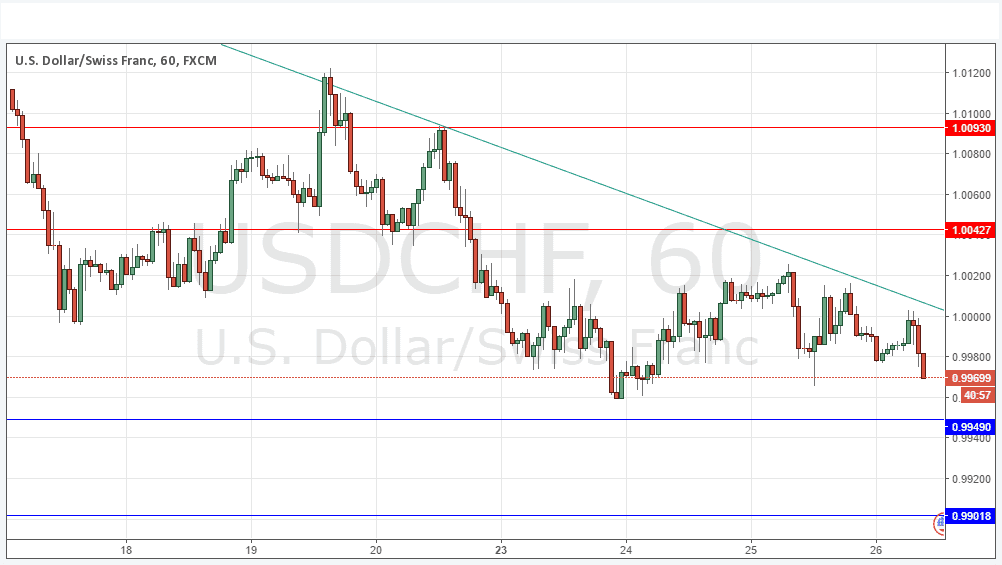

* Long entry after bullish price action on the H1 time frame following the next touch of 0.9949 or 0.9902.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Short entry after bearish price action on the H1 time frame following the next touch of 1.0043.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CHF Analysis

I wrote yesterday that the bearish trend here was still intact, and it remains so, with the bearish trend line exerting downwards pressure even though it has not quite been reached. A bullish reversal is looking increasingly unlikely, but we must wait and see what happens when the price tests 0.9950 and 0.9900, which looks as if it will happen soon.

There is nothing due today concerning the CHF. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time.