USD/CHF Signal Update

Last Thursday’s signals were not triggered as none of the key levels were ever reached.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be entered between 8am and 5pm London time today.

Long Trades

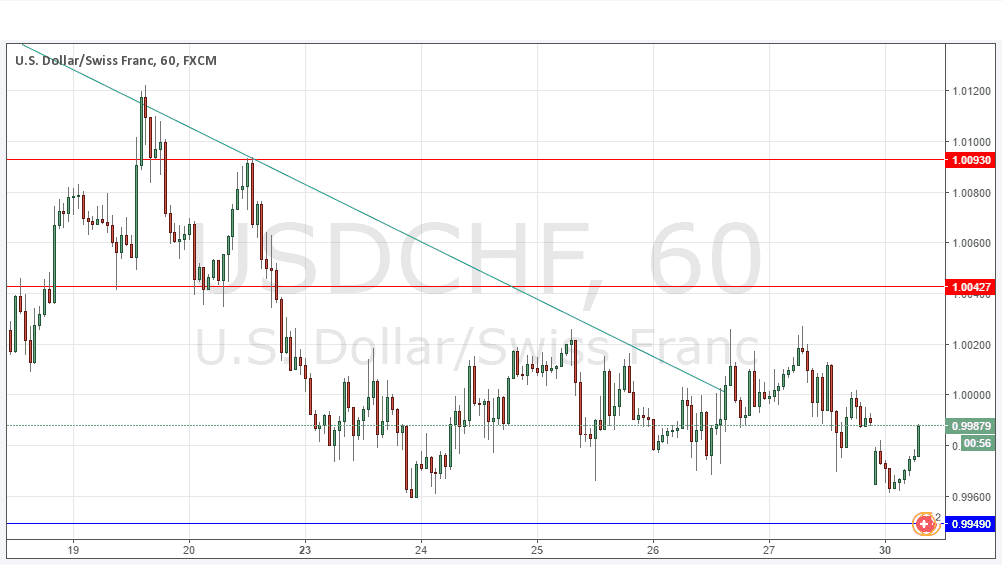

Go long after bullish price action on the H1 time frame following the next touch of 0.9949 or 0.9902.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short after bearish price action on the H1 time frame following the next touch of 1.0043.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CHF Analysis

I had thought that the price would test 0.9950, but it seems as if the support has made its presence felt without the price having to reach the level precisely. The bearish trend line has been broken and so the outlook for this pair seems more bullish now, especially with the strong rise in the price over recent hours.

There is nothing due today concerning either the CHF or the USD.