USD/CHF Signal Update

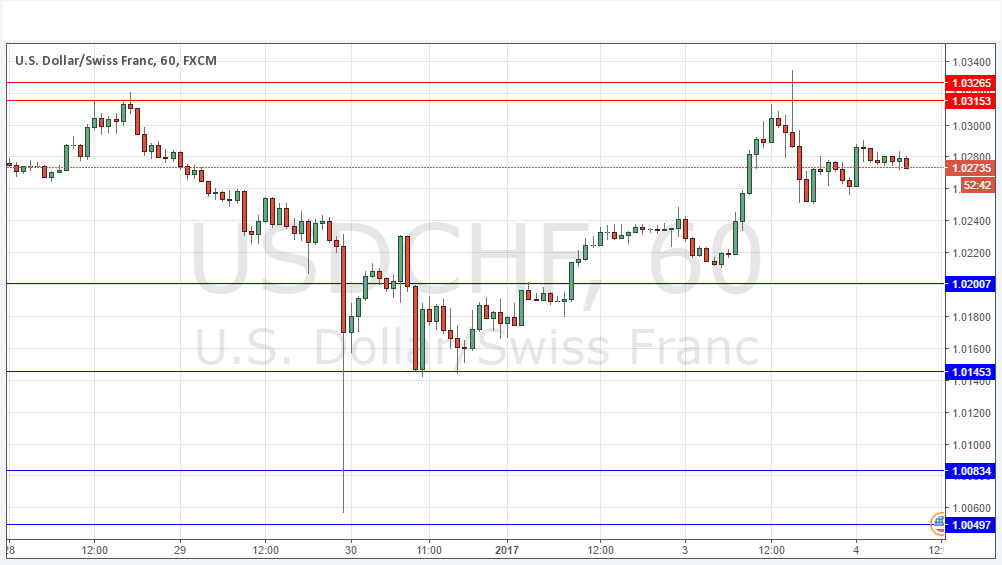

Yesterday’s signals were not triggered as unfortunately the bearish rejection of the identified resistance level at 1.0315 only formed at the end of the session.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be entered between 8am and 5pm London time today.

Long Trade 1

Go long after bullish price action on the H1 time frame following the next touch of 1.0200.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short after bearish price action on the H1 time frame following the next entry into the zone between 1.0315 and 1.0327.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

I wrote yesterday that I expected the upwards movement would falter at about 1.0250 and that the resistance at 1.0315 looks strong. I was wrong about the first part but right about the second part. There is still a long-term bullish trend in this pair but weaker than the bearish trend in the highly positively correlated EUR/USD pair, which suggests this is not the best pair to use to long the USD now. Shorting rejections of the strong resistance above is likely to be a better bet.

There is nothing due today regarding the CHF. Concerning the USD, there will be a release of FOMC Meeting Minutes at 7pm London time.