USD/JPY

The US dollar initially tried to rally on Monday but turned around to show weakness against the Japanese yen. I still see a significant amount of support below at the 115 handle, so I will look at short-term charts for signs of bouncing. Even if we break down below there, I believe that the market will find plenty of support all the way down to the 111.50 level underneath. Ultimately, this is a longer-term uptrend that is simply taking a break, and I believe that we will eventually reach towards the 120 handle above. I have no interest in shorting this market, and believe that longer-term we will continue to see buyers of the US dollar.

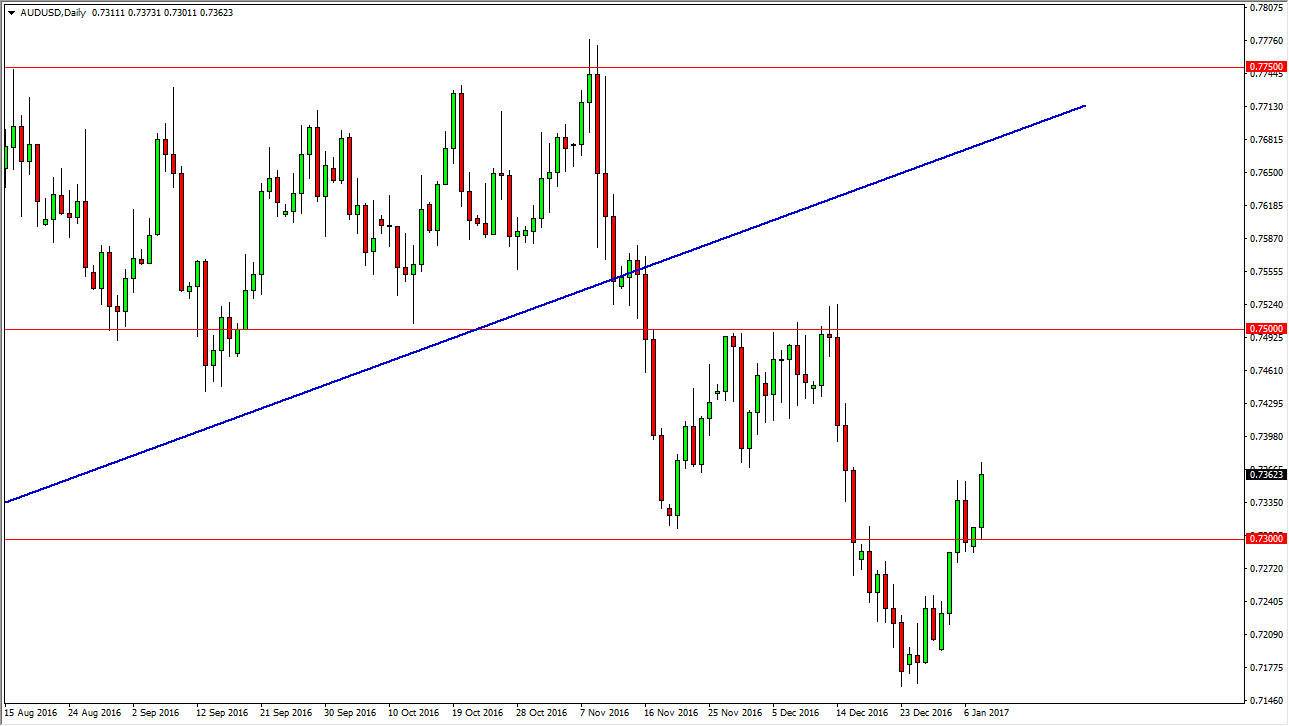

AUD/USD

The Australian dollar rallied on Monday, showing signs of strength again. However, there is quite a bit of resistance all the way to the 0.75 level above, which shows quite a bit of choppiness. Because of this, I think it’s only matter time before we see the exhaustion that we can start taking advantage of in order to pick up value in the US dollar. Gold markets obviously have a significant amount of influence on the Australian dollar, so having said that if they roll over I think we can start selling right away.

A break down below the 0.73 level would send this market looking for the 0.7150 level. I believe that the 0.75 level being broken to the upside and of course the market closing above there at the end of the day would be a bullish sign. However, I don’t think that’s likely and sooner or later we will get an exhaustive candle on the daily chart that we can take advantage of. You could you shorter-term charts, but I believe that there is quite a bit of pent-up energy in this market, so it could be somewhat dangerous to jump the gun.