USD/JPY

The US dollar tried to rally on Tuesday against the Japanese yen, but found selling pressure above. By doing so, it ended up forming a shooting star. The shooting star of course is one of the most negative candle you can get, but quite frankly there so much support below that I don’t think it’s anything to worry about. If we do drift lower from here, my suspicion is that the market is simply trying to build up enough momentum to break out to the upside given enough of a reason. That reason could be the job's number coming up, and I still believe that we are going to try to get to the 120 handle. I believe that the 115 level below is support, and essentially the “floor” in this pair. I have no interest in selling.

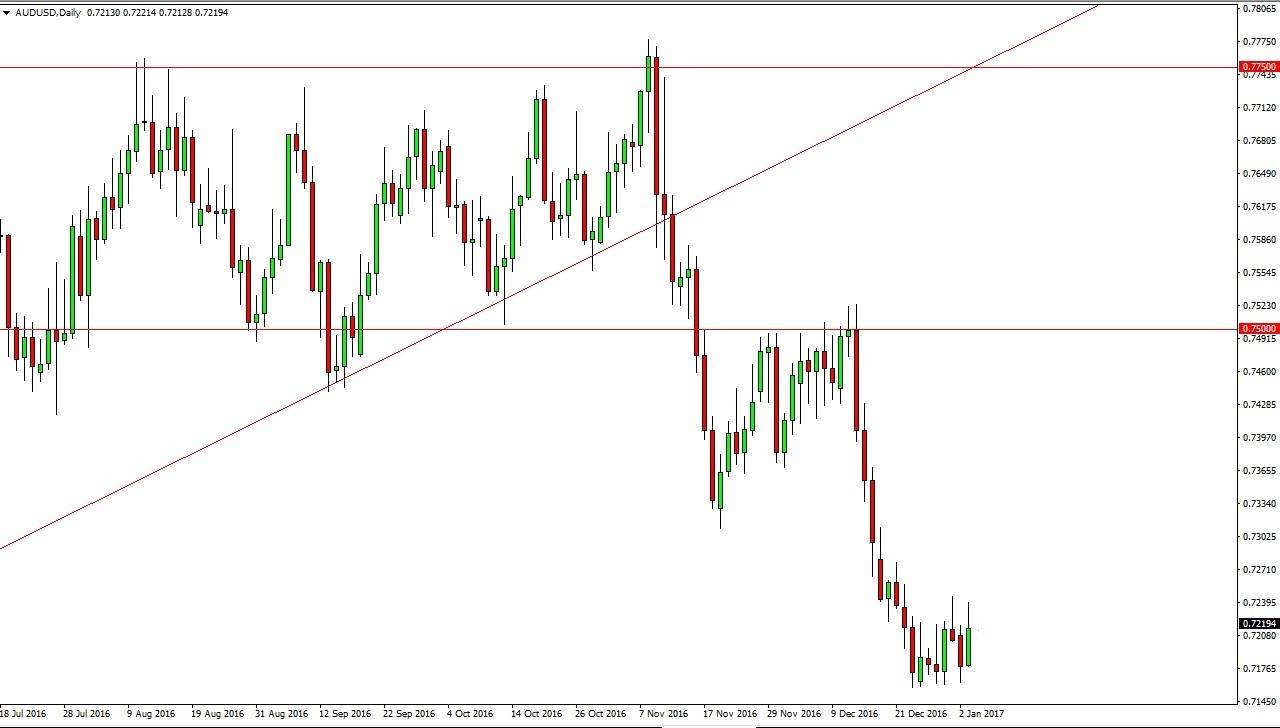

AUD/USD

The Australian dollar had a positive session as we continue to grind sideways overall. I think that we could rally from here, because quite frankly the market is a bit oversold. I think that there is a significant amount of resistance somewhere near the 0.7350 level however, so any type of exhaustive candle in that region could be reason enough to start shorting again. I don’t have any interest in buying though, because the gold market and by extension the Australian dollar, find themselves very soft over the longer term. I believe that this time a year still lacks a certain amount of liquidity, and therefore it’s difficult to take these bounces too seriously.

Having said that, I believe that the target is the 0.70 level below, but it may take a couple of attempts to break down below the recent support that we have seen. Once we do, I don’t feel that there is much in the way of the sellers. If we do rally from here above the 0.7350 level, I feel the absolute ceiling in this market is near the 0.75 handle.