USD/JPY Signal Update

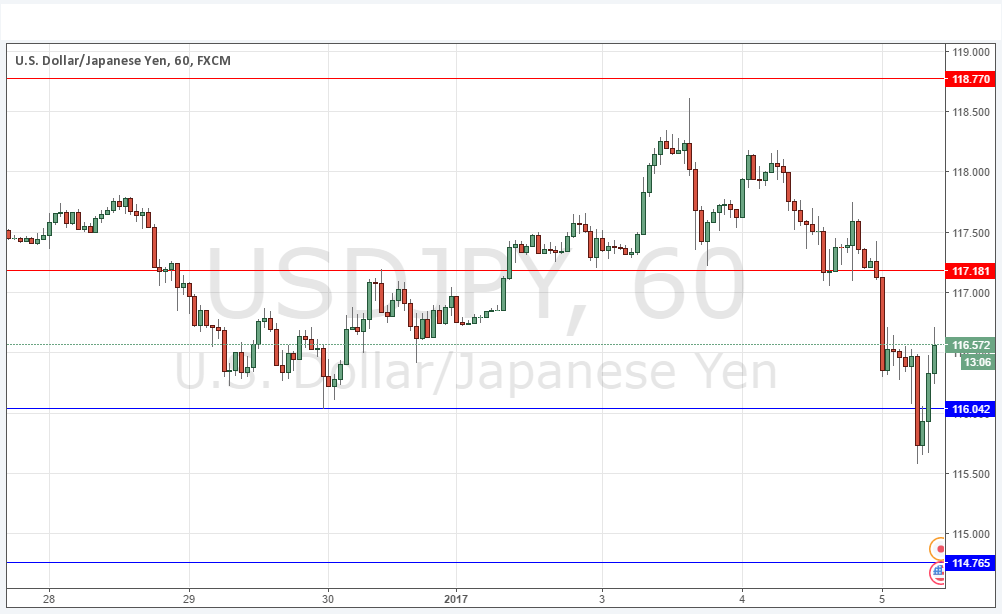

Yesterday’s signals produced a small winning trade following the doji rejecting the support level at 117.19.

Today’s USD/JPY Signals

Risk 0.75%.

Trades may only be entered between 8am New York time and 5pm Tokyo time, over the next 24-hour period.

Long Trades

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 116.04 or 114.77.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 117.18.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

I wrote yesterday that the odds on the trend undergoing a significant reversal soon were increasing, and this is what happened following the news release last night, which initially boosted the pair before it dropped sharply during the Asian session.

It looks as if the price is now finding support around the 116.00 area and the next move is uncertain as we have some key U.S. economic data coming later after New York opens.

There is nothing due today regarding the JPY. Concerning the USD, there will be a release of the ADP Non-Farm Employment Change at 1:15pm London time, followed by Unemployment Claims at 1:30pm, ISM Non-Manufacturing PMI at 3pm and Crude Oil Inventories at 4pm.