USD/JPY Signal Update

Last Thursday’s signals were not triggered as none of the key levels were ever reached.

Today’s USD/JPY Signals

Risk 0.75%.

Trades must be entered from 8am New York time until 5pm Tokyo time, during the next 24-hour period only.

Long Trades

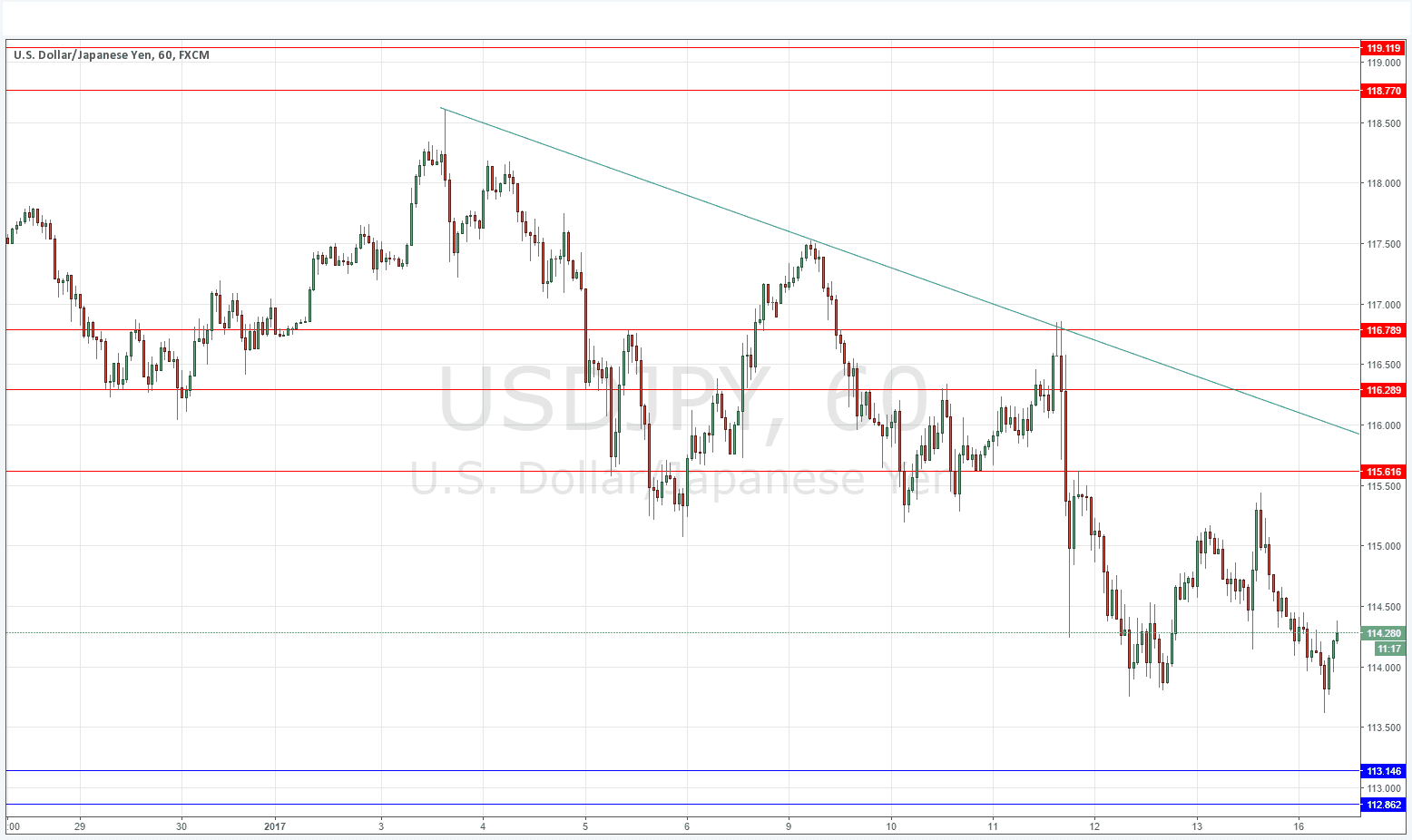

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 113.15 or 112.86.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trades

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 115.62.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Analysis

The medium term downwards trend has continued and even accelerated. We may be finding some support now with a failure to move beyond last week’s lows and some bullish short-term candles. However, it is going to take much more than this for things to start looking bullish again in line with the long-term trend.

There is nothing due today regarding the JPY or the USD. It is a public holiday in the U.S.A.