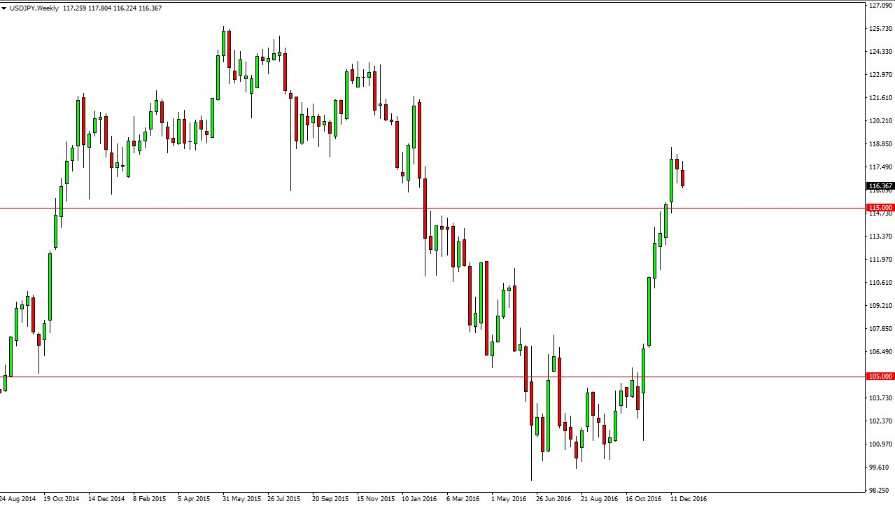

The USD/JPY pair has seen a massive explosion to the upside over the last several weeks. At this point, I believe that we are overbought and at the very least we will need to test the 115 level for support. We could very well find it there, but given enough time I think we could break down even lower than that. Certainly, it would make a much easier trade to the upside if we got some type of pullback, but I am willing to buy at the 115 level to see whether we can continue to go higher and reach towards the 120 level above. The market should have plenty of support near the 110 level as well, and quite frankly I find that much more palatable. The Federal Reserve should continue to raise interest rates, while the Bank of Japan is light years away from doing so.

Interest-rate differential

The interest-rate differential should continue to be the spreading in favor of the US dollar over the longer-term, so with this being the case I feel that this pair has broken to the upside for an absolute trend change, but trend changes tend to be very tricky things when it comes to this market. Expect soft markets in the beginning of the month, but by the time we get towards the end of the month of January, I believe buyers will return as the longer-term move continues to look like the more reasonable direction.

Ultimately, I think that this pair will go higher for the next several months, but we have gotten a little bit ahead of ourselves, so it makes sense that we need to take a little bit of a breather and I think that’s what the first week of January will be, possibly even the first half of the month. Given enough time though, I will be vying for a longer term “buy-and-hold” type of position.