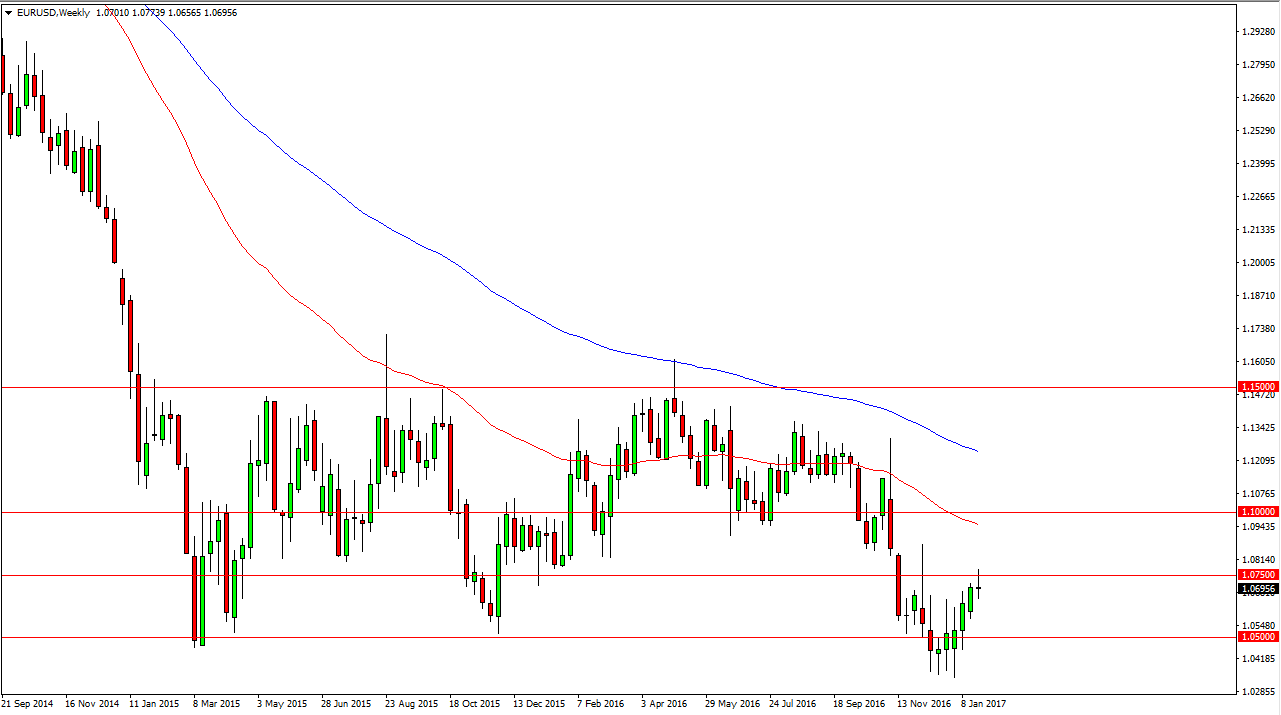

EUR/USD

The EUR/USD pair trying to break above the 1.0750 level during the week, but struggled and turned around to form a shooting star on the weekly chart. Because of this, if we can break down below the range for the week, I feel that this pair is probably going to go down to the 1.05 handle next. Alternately, a break above the highs of the week should send this market looking for the 1.09 level.

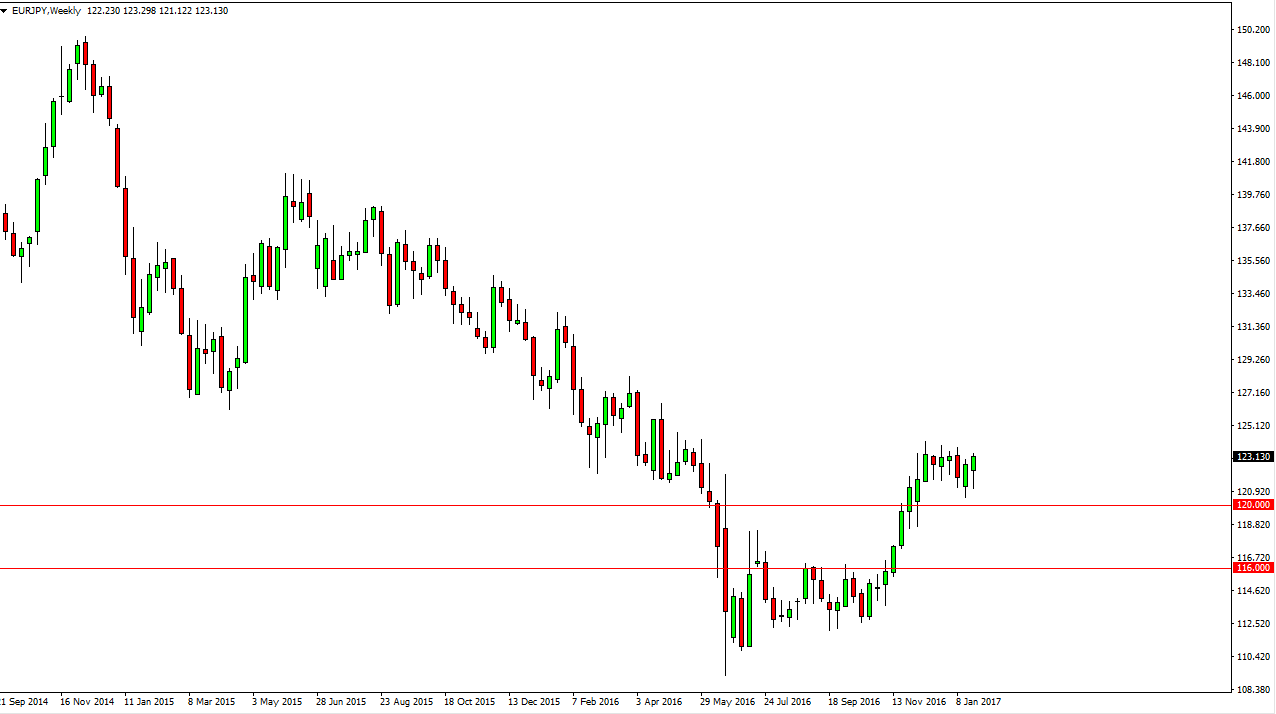

EUR/JPY

The Euro initially fell against the Japanese yen during the week but turned around to form positive momentum. Because of this, I believe that the market is trying to reach the 125 level. However, there is a significant amount of resistance at the 124 level, so I prefer buying short-term pullbacks that offer support to go back and forth in this market.

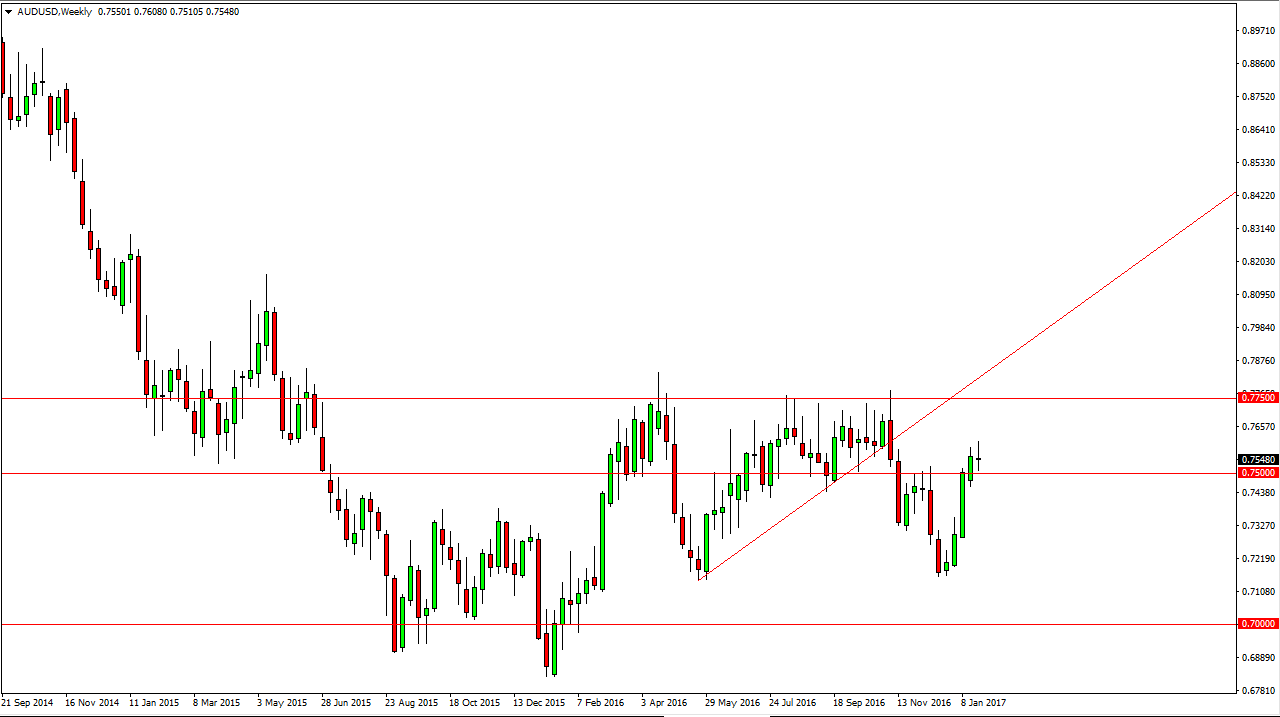

AUD/USD

This could be one of the more interesting markets during the week, because of the way we ended. We ended up unchanged, and essentially forming what could be looked at as a potential shooting star. If we break below the 0.75 level AND we start falling in the gold market, I feel the Australian dollar could suddenly find itself in serious trouble. Alternately, we break above the top of the candle for the week, the Aussie will more than likely try to reach towards the 0.7750 level.

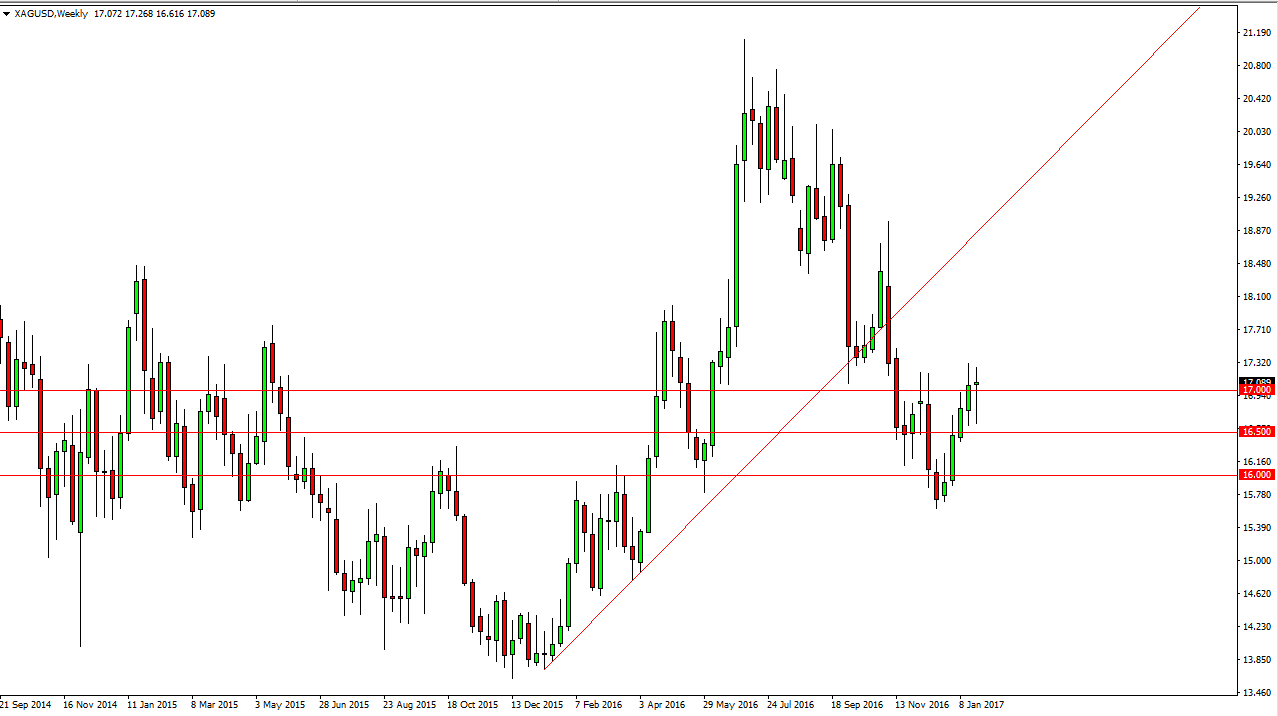

Silver

Silver markets ended up showing real strength by the end of the week, as we had initially reached towards the $16.50 handle. By forming a massive hammer that sits just above the $17 level, silver looks as if it is ready to continue going higher. A break above the highs from the week should send this market towards the $18.50 level over the longer term. Alternately, if we breakdown below the $16.50 level, the market should then go to the $16 level.