EUR/USD

The EUR/USD pair had a bullish week, testing the 1.07 level. However, we cannot break above there yet, and I believe what we are going to do is continue to bounce around between the 1.05 level, and the 1.07 level. With this in mind, expect range bound trading, and I doubt that we will be able to hang onto a trade for more than 24 hours.

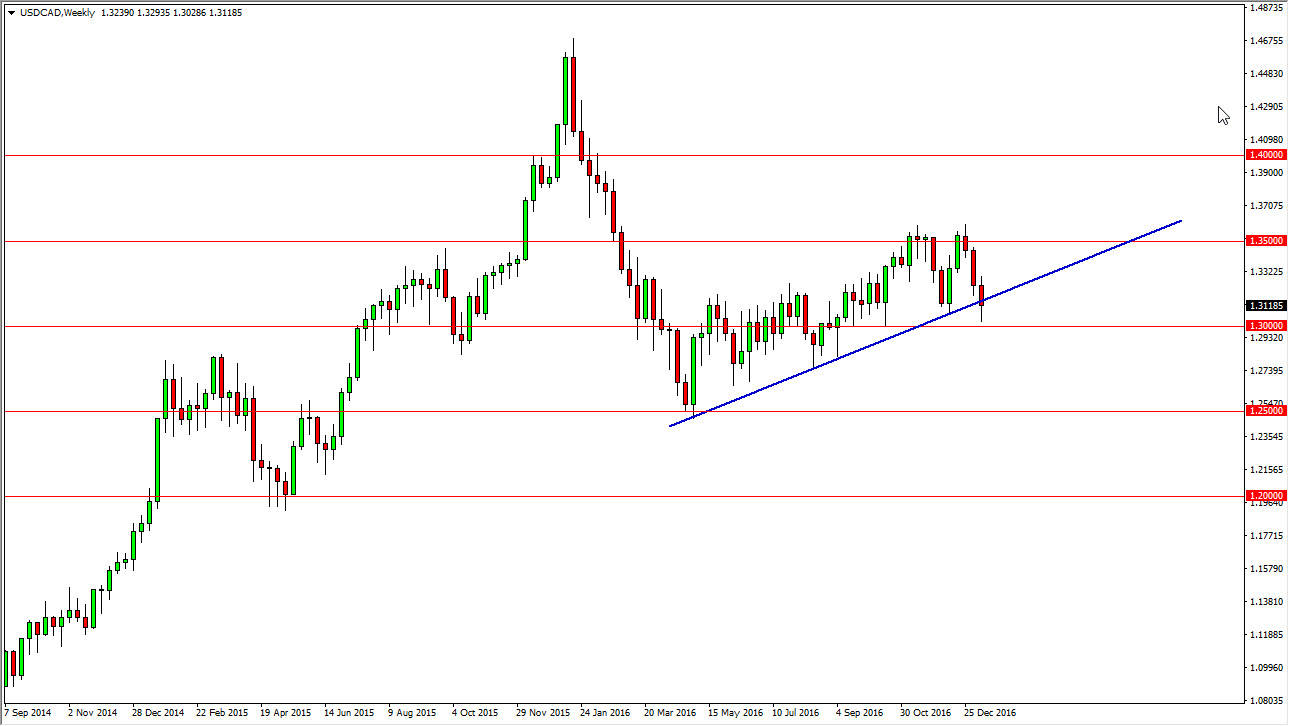

USD/CAD

The pair broke down during the week, breaking below the uptrend line at one point. However, by the time we close on Friday at looks as if the market is ready to turn around and go higher, so if we can break above the highs from the Thursday session, the market should then reach to the 1.35 level above. There’s a lot of noise just underneath, so I think that given enough time we will probably rally. However, pay attention to oil as it has such an influence.

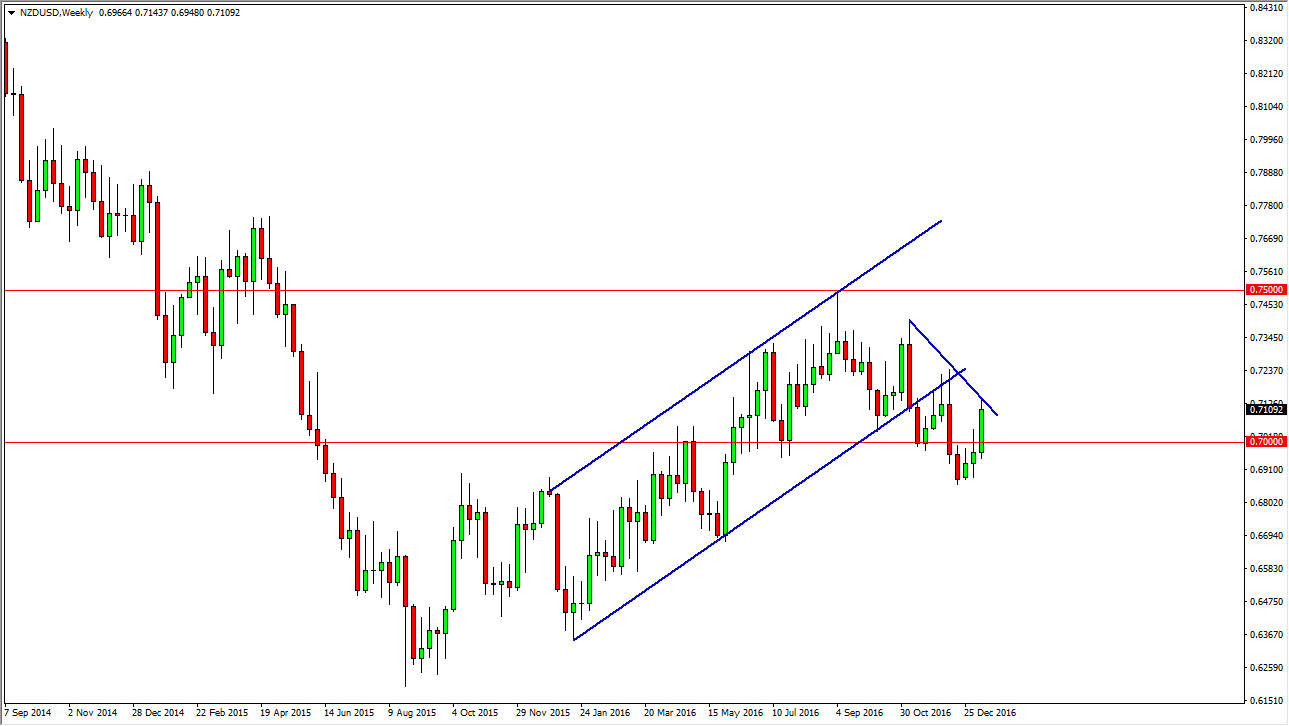

NZD/USD

The New Zealand dollar rallied during the week, but ran into a downtrend line again. With this being the case, if we can break above the uptrend line, I feel the market will then reach towards the 0.75 level. Alternately, if we roll back over we could find yourselves reaching towards the 0.70 level underneath. Ultimately, the market should have to make a decision sometime by the end of the week, but in the meantime, expect quite a bit of volatility.

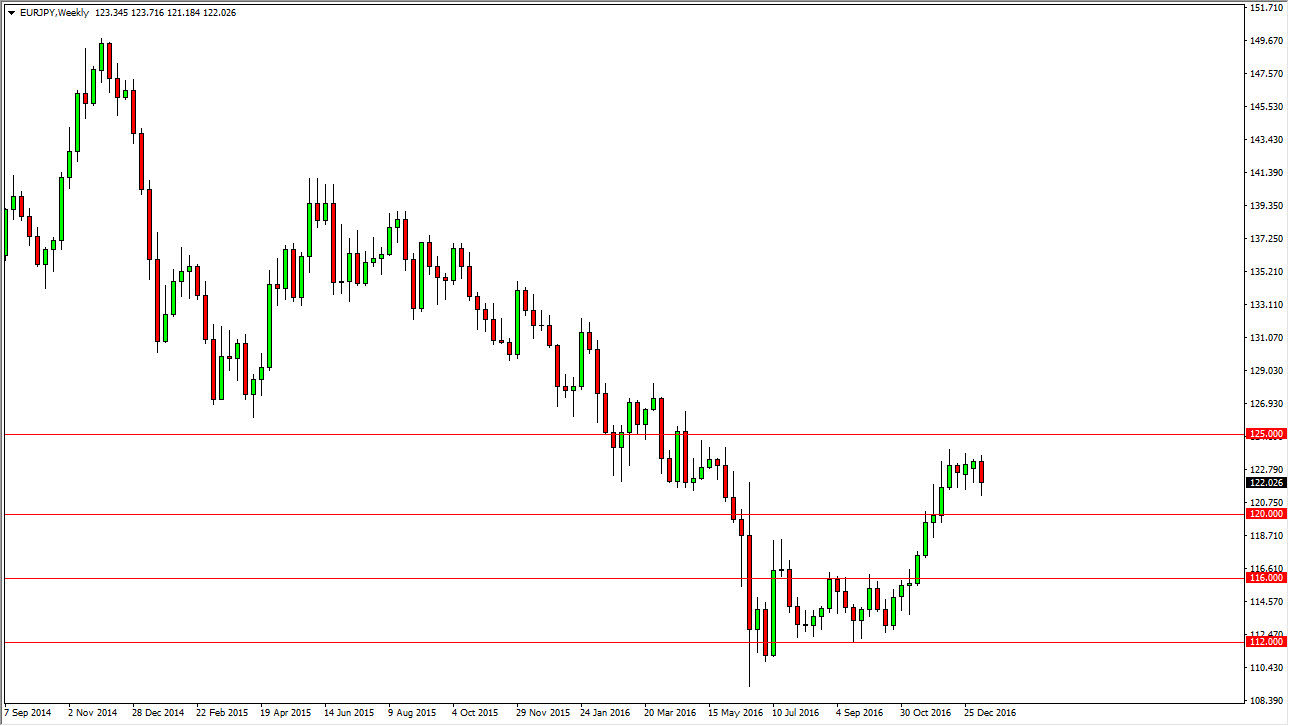

EUR/JPY

The EUR/JPY pair fell during the week, but continues to find support just below. I believe that the 125 level will be the target, and this week we will spend most of her time trying to rally towards that direction. Expect a lot of short-term choppiness, but buying on the dips will be the way going forward. I believe currently about the 120 level is the “floor.”