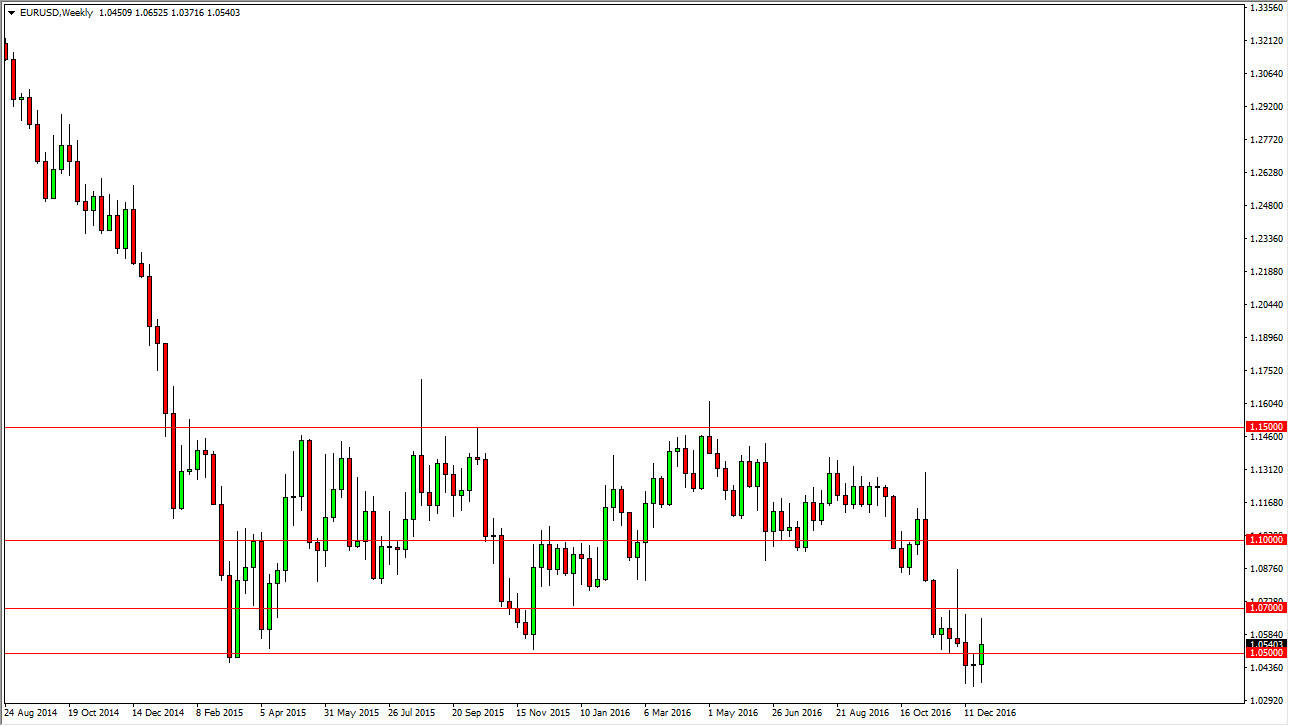

EUR/USD

The EUR/USD pair rallied over the last couple of sessions during the previous week, but ultimately this is a market that should continue to see quite a bit of volatility due to lack of liquidity. However, I believe that the downward pressure continues in this market, as we have seen quite a bit of the spike on Thursday given back already. Selling on short-term rallies is how I’m going to pursue the market.

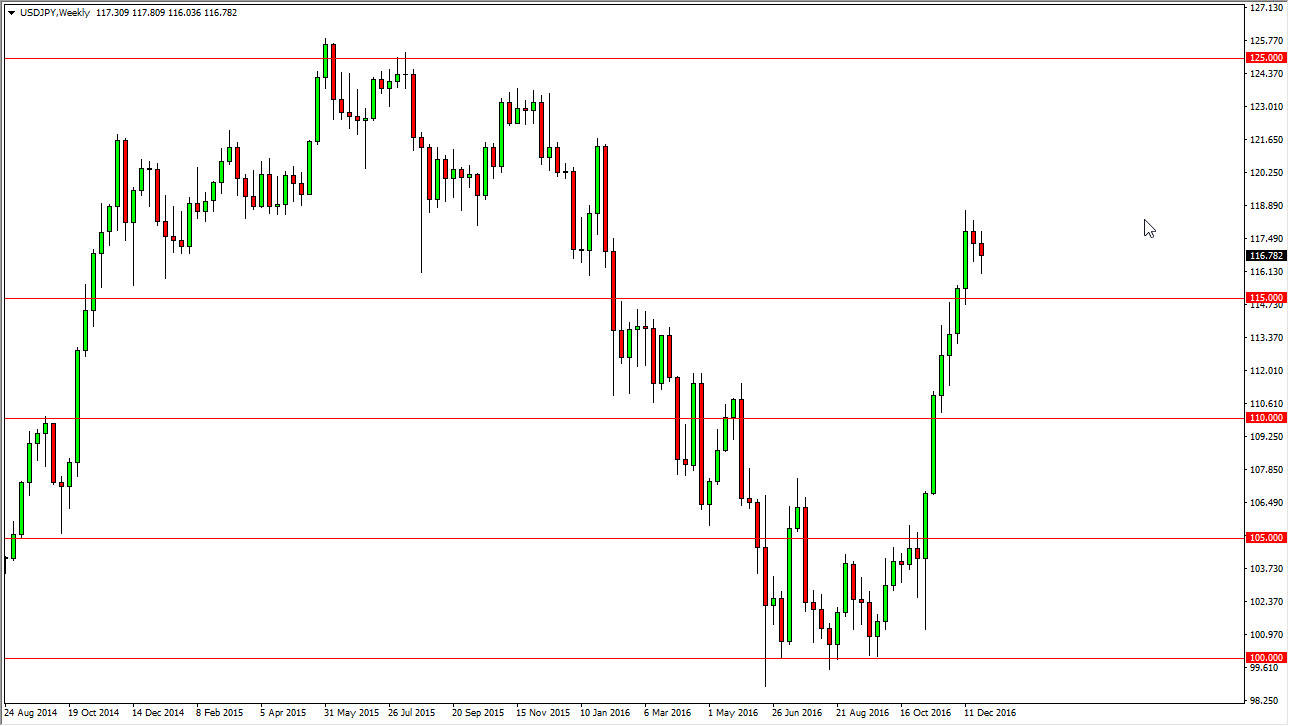

USD/JPY

The USD/JPY pair fell during the course of the week, but found support towards the Friday session. I believe that the 115 level below is massively supportive, and as a result I feel that it will act as a bit of a floor. However, the market is overextended so I think we could see a little bit of negativity followed by strength down the road.

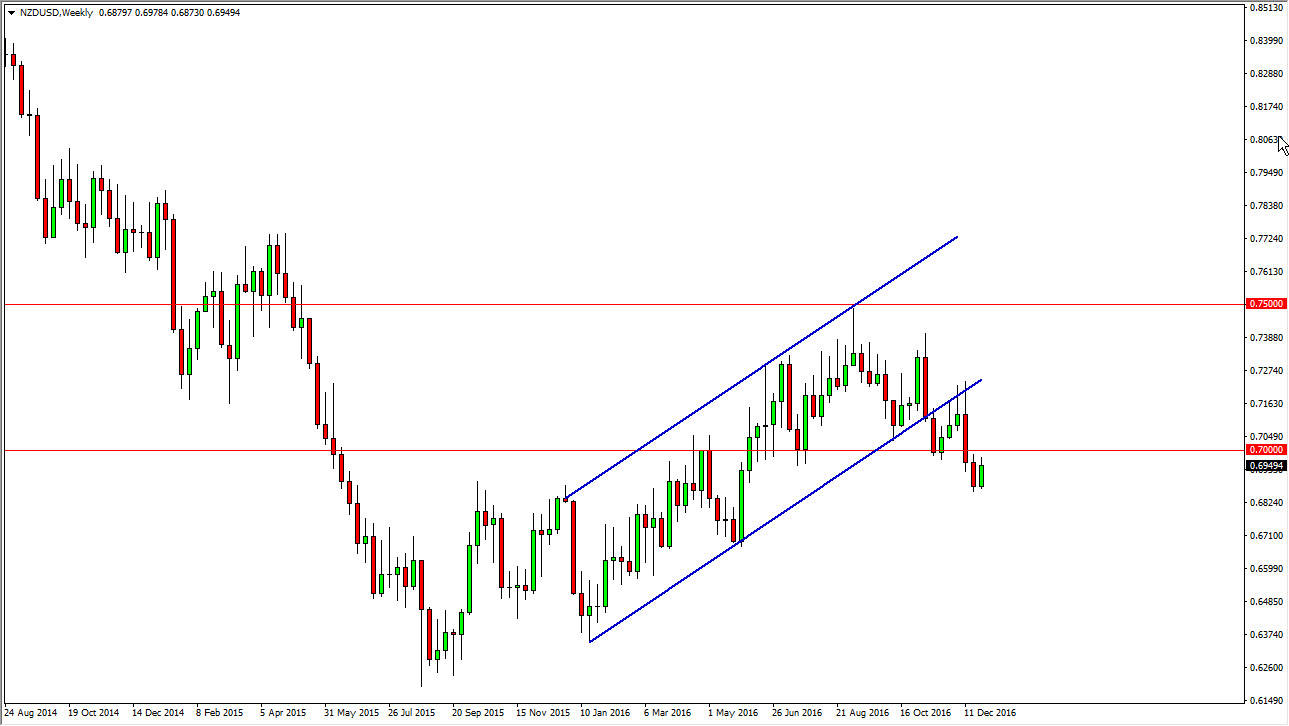

NZD/USD

The New Zealand dollar rally during the week, but stayed just below the 0.70 level. That’s an area that has previously been supportive and resistive, so I believe that there will be reaction to that area sooner rather than later. I believe that the New Zealand dollar will continue to struggle, as US dollar is the favored currency in the world. However, it could be a bit choppy so I believe that the sellers will return every time we rally.

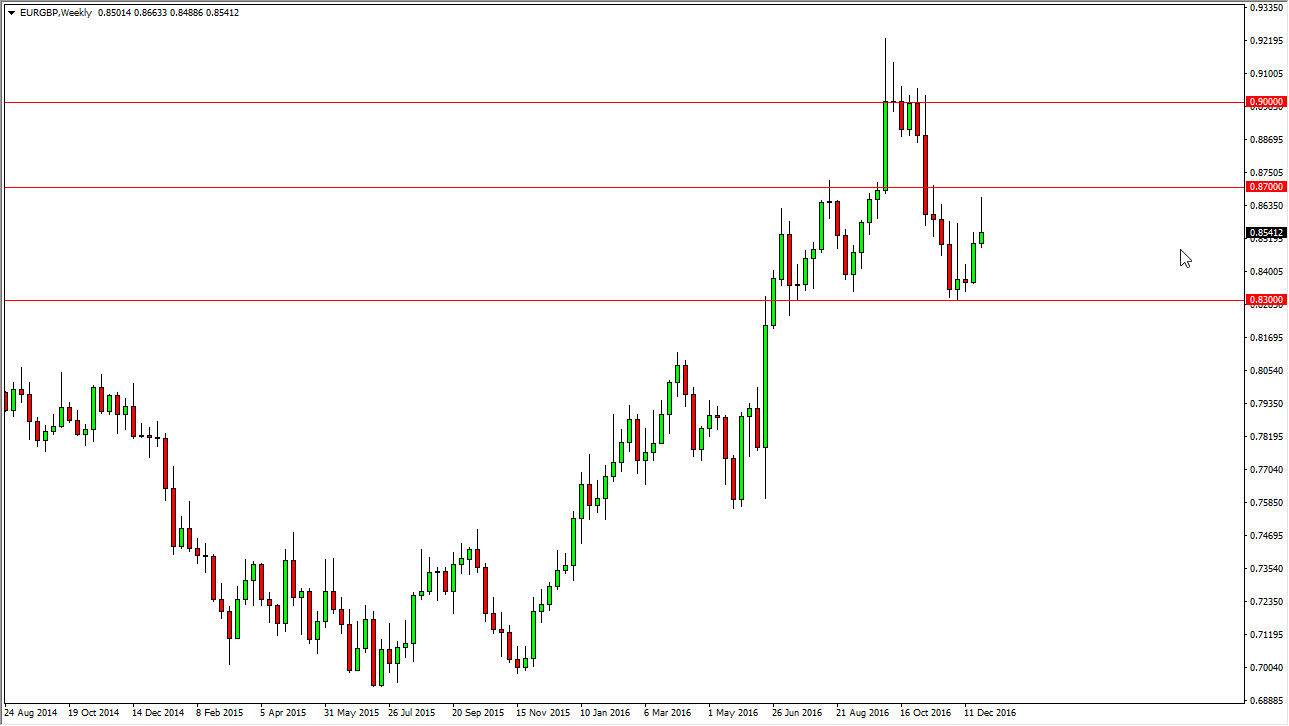

EUR/GBP

The EUR/USD pair initially tried to rally during the week but found enough resistance near the 0.87 level to turn things around and form a shooting star. I believe that the market will continue to grind lower, perhaps reaching towards the 0.83 level underneath there. If we did somehow break above the 0.87 handle, the market could then reach to the 0.90 level above. A break down below the 0.83 level is a massive break of support. Ultimately, I am bearish in the meantime.