GBP/USD

The British pound had a very strong week, but we still see quite a bit of resistance on the 1.25 handle. I believe that if we can get above there, then the market will try to go higher. This is a very bullish candle and it is engulfing a hammer, so I should suggest that perhaps we are trying to form a bottom in the British pound. Nonetheless, expect quite a bit of volatility.

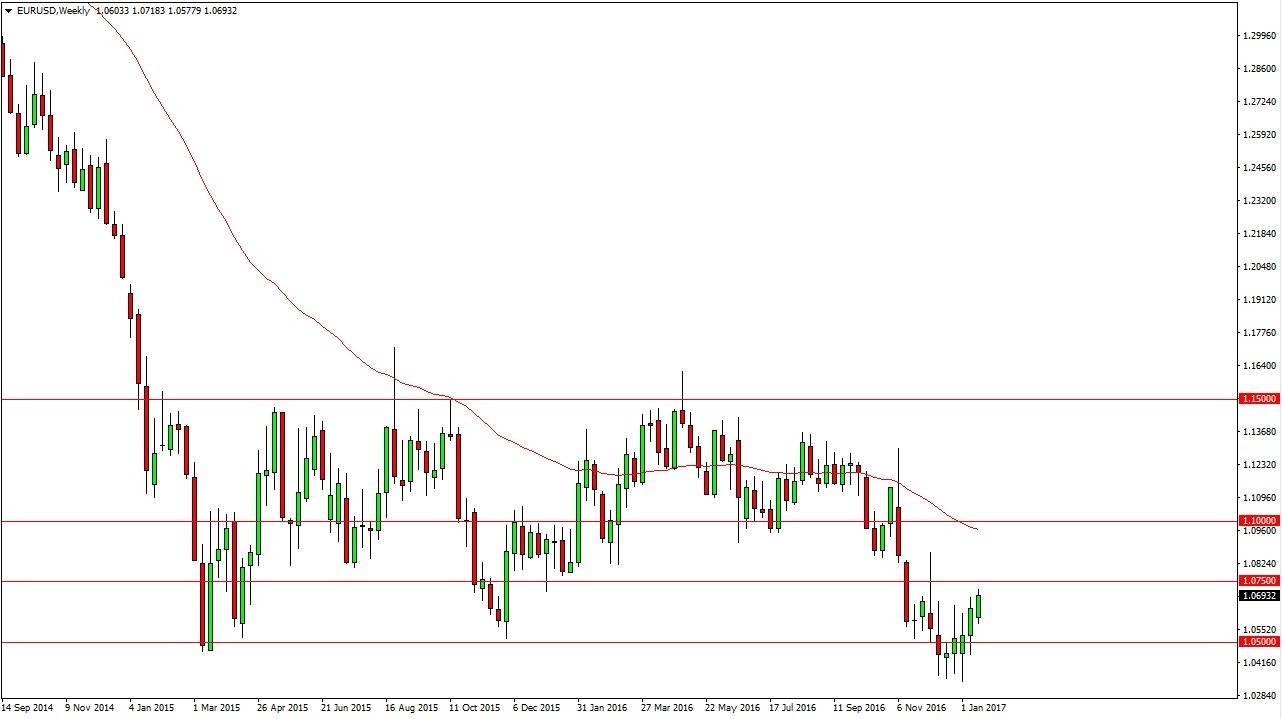

EUR/USD

The EUR/USD pair rallied during the week, as we continue to try to reach the 1.0750 level. That’s an area that is resistive though, so I think it’s only a matter of time before the sellers get involved. However, I believe that if we break above the 1.05 level, the market should continue to go to the upside, perhaps reaching towards the 1.10 level above.

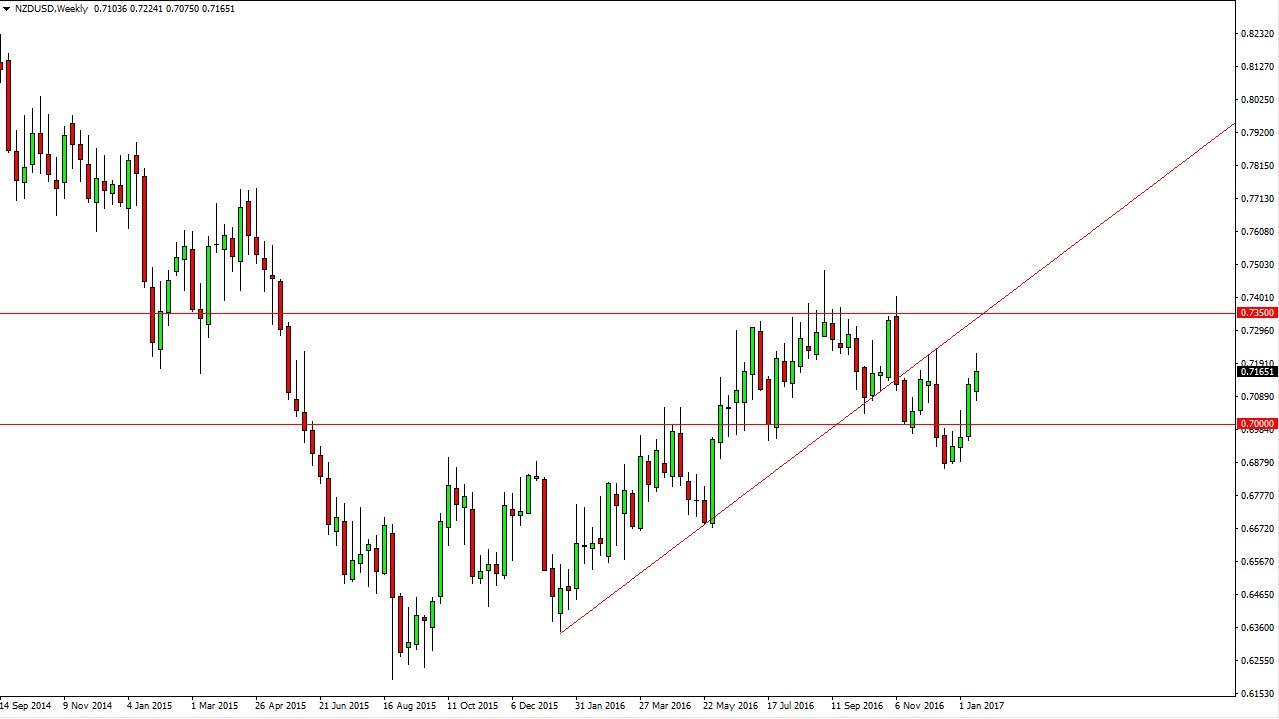

NZD/USD

The New Zealand dollar tried to rally during the past week, but found enough resistance to the 0.72 level to cause quite a bit of trouble. Ultimately, I believe that the market is going to trying to fall back towards the 0.70 level, and therefore I’m selling it resistive looking candles. However, if we break out above the range of the week, we will then more than likely try to go to the 0.7350 level.

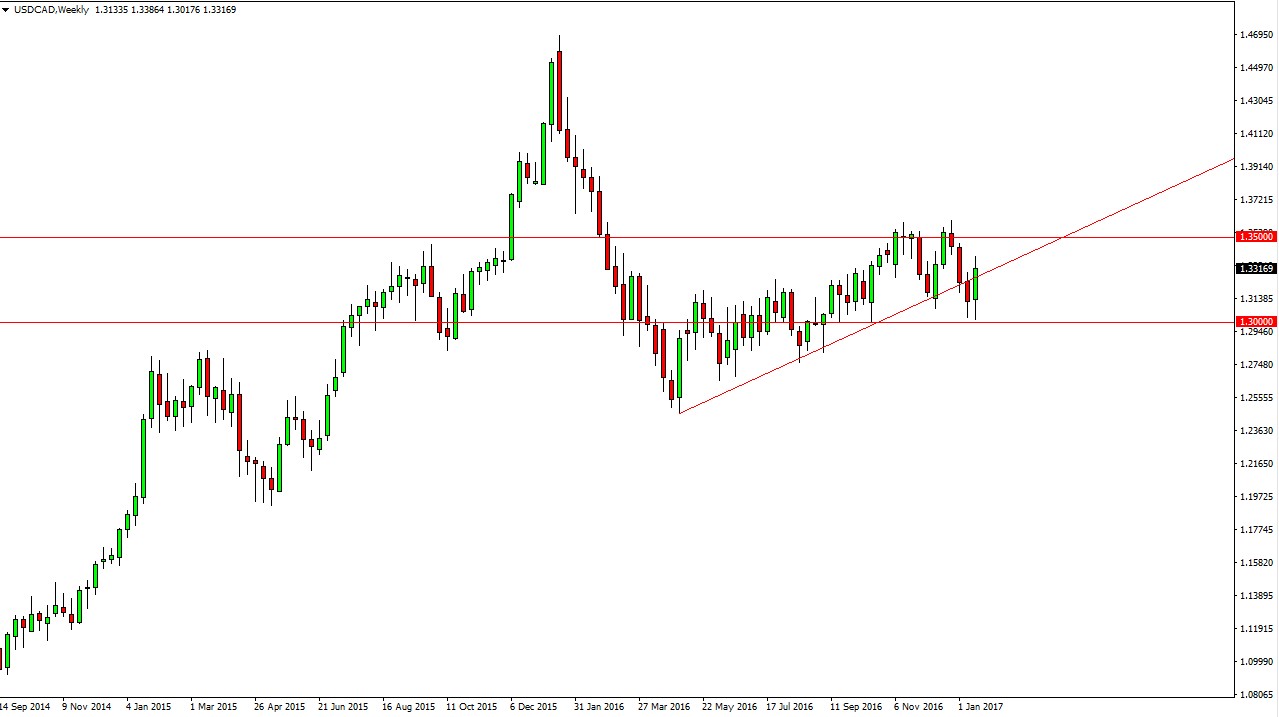

USD/CAD

We had a very volatile week in the Canadian dollar, but it looks as if the 1.30 level has offered a bit of a “bottom” currently. The 1.35 level above is resistive, so I think that it’s only a matter time before the sellers get involved as well. However, we can close above there on the daily chart, the market should continue to grind to the upside. I would expect a lot of back and forth trading over the next week though.