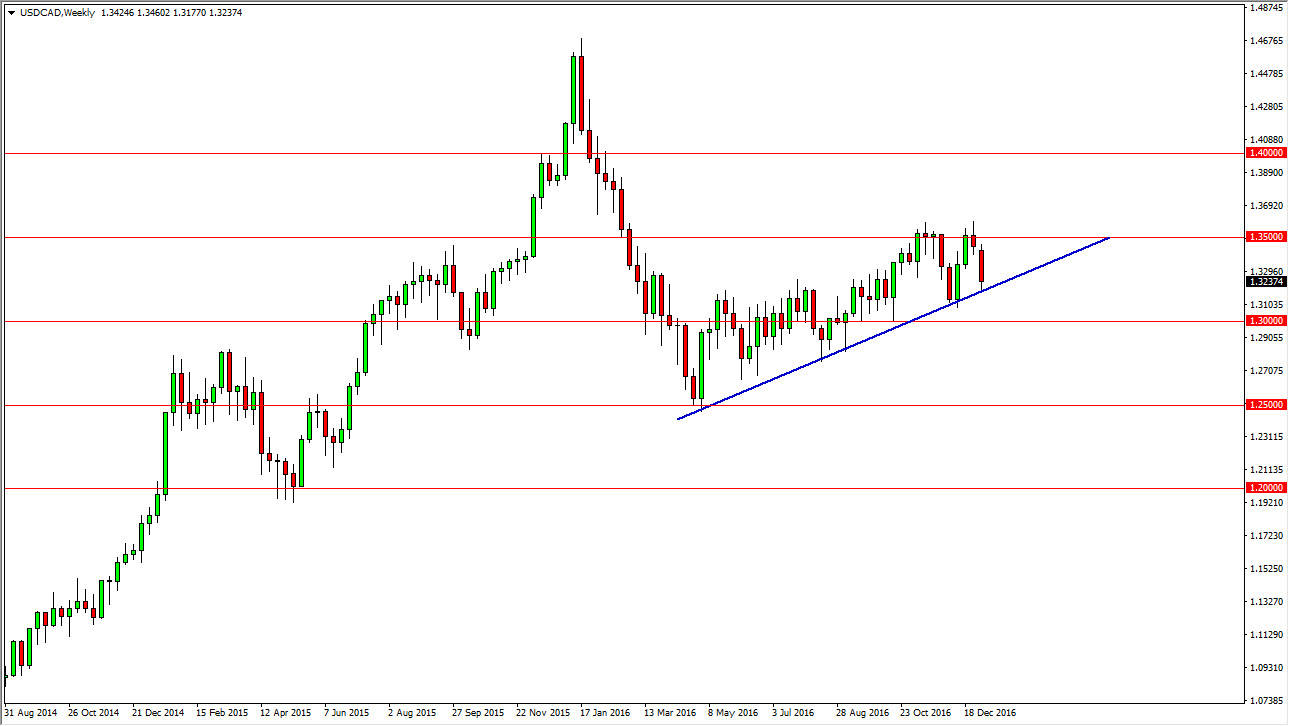

USD/CAD

The USD/CAD pair had a negative week, but found support near the uptrend line that has been a feature of this market since March. Because of this, and the fact that we formed a bit of a hammer during the session on Friday, I feel it’s only a matter time before the buyers reenter and we test the 1.35 handle above for resistance.

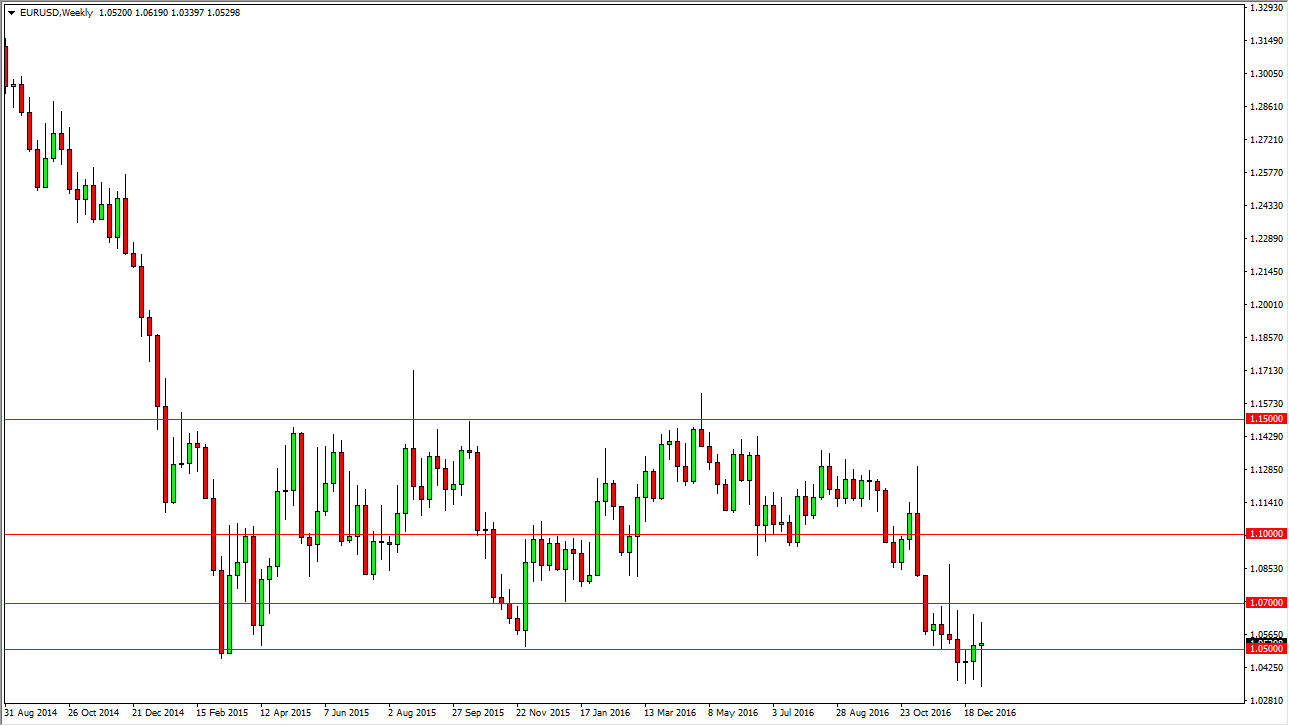

EUR/USD

The Euro went back and forth during the week, but ultimately settled on finding support just below the 1.05 handle. However, I see quite a bit of resistance of the 1.07 handle as well, so I think we’re going to continue to see volatility in this pair, with when I believe will be selling opportunities on signs of exhaustion after short-term rallies more than anything else.

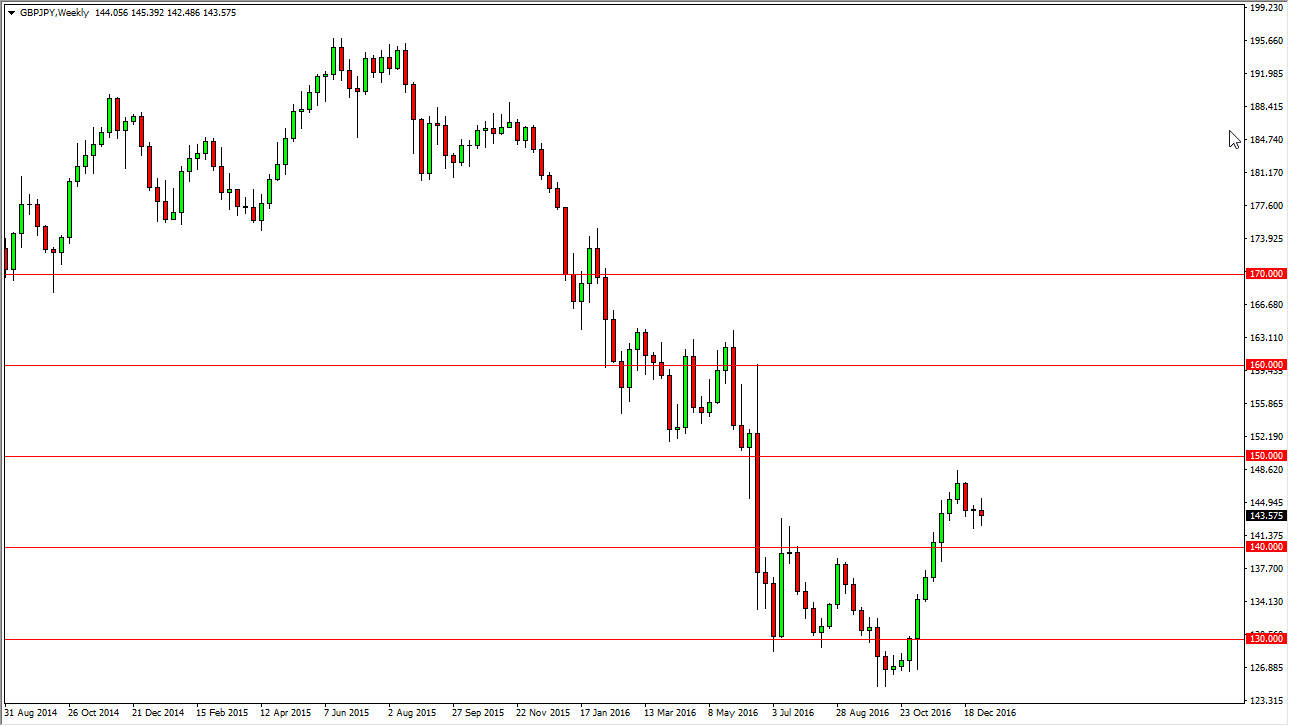

GBP/JPY

The British pound went back and forth against the Japanese yen over the course of the last week, but I still see a massive amount of support at the 140 handle. Because of this, I think pullbacks continue to offer buying opportunities going forward, and that we will eventually try to reach towards the 150 level. I am a buyer and not a seller, but I do recognize that the pullbacks could be rather vicious.

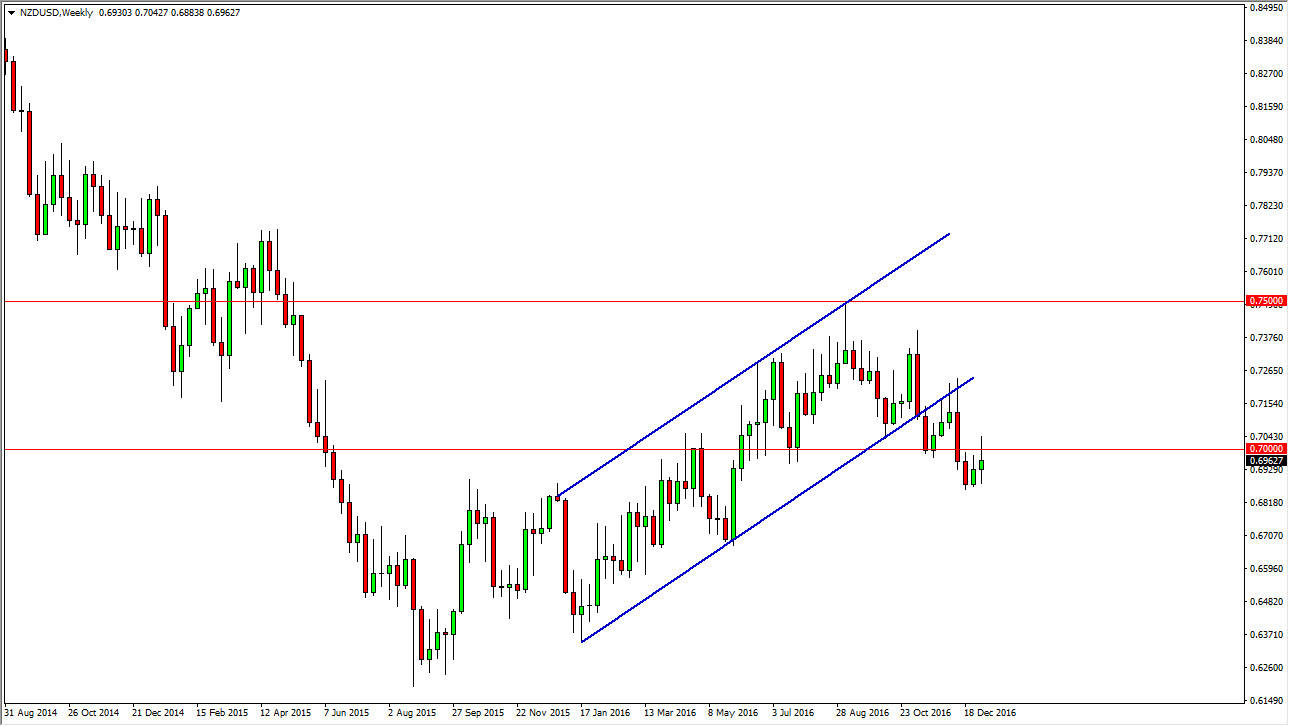

NZD/USD

The New Zealand dollar try to rally during the week, but found the area above the 0.70 to be too resistive, and therefore we turned around to form a shooting star. The market breaking below the bottom of the shooting star would be a nice selling signal, as we should then reach towards the 0.68 handle, and then the 0.65 level below there. I believe that the bearish pressure continues on the Kiwi dollar.