Gold prices ended the week up $22.31 at $1172.61 an ounce, as a retreat in the dollar took some pressure off the precious metal. The XAU/USD pair traded as high as $1185 but gave up some its gains on Friday after the December U.S. employment report showed a slowdown in hiring but the strongest wage growth since 2009. Minutes from the Federal Reserve's December 13-14 meeting released Wednesday showed that the biggest risk to the economic outlook was a continued drop in the unemployment rate which might spark inflation. "While viewing a gradual approach to policy firming as likely to be appropriate, participants emphasized the need to adjust the policy path as economic conditions evolved. They pointed to a number of risks that, if realized, might call for a different path of policy than they currently expected" according to the minutes. Gold has rebounded nearly 4.45% from last month's low of $1122.55.

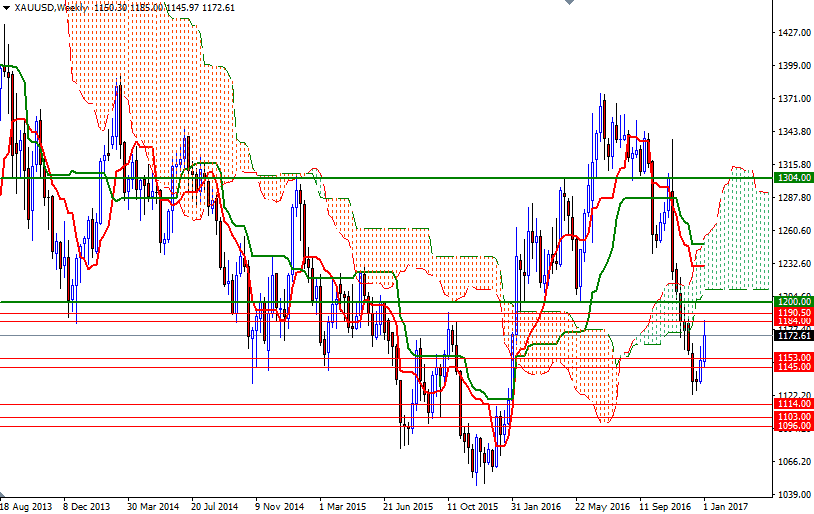

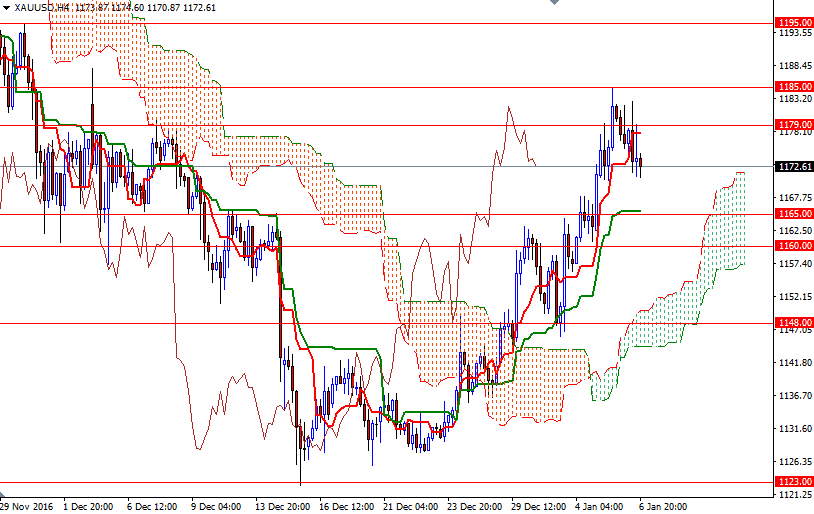

Fed officials say that they will not hesitate to shift gears to do what is right to meet the Fed's long term objectives, if inflationary pressure increase. However, there is still a lot of uncertainty about the incoming Trump administration and I think that could give a temporary respite to gold - though prices are likely to face significant amount of resistance in the 1212.60-1230.55 area where the weekly and daily Ichimoku clouds overlap. On the 4-hour time frame, XAU/USD is trading above Ichimoku clouds and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-day moving average, green line) lines are negatively aligned, indicating that the bulls are currently in charge. On the other hand, the market still resides below the clouds on the weekly and daily time frames, suggesting that the downside risks over the medium-term remain.

With these in mind, I don't expect to move too far outside of the 1200-1145 range over the short term. The first hurdle gold needs to jump is located around the 1179 level. I think penetrating this level could provide the bulls the extra power they need to visit 1190.50. Closing above 1190.50 would make me think that XAU/USD is on its way to test 1200. The 1208/5 area is the key resistance for the bulls to capture if they intend to challenge the bears on the 1212.60-1218 battle field. If XAU/USD can't go climb back above the 1179 area, then we will eventually retreat to the support at around 1165. Below that, the 1160-1156.50 zone, where the daily Tenkan-sen and the Kijun-sen lines converge, stands out and the bears will have to demolish this strategic support so that they can test 1248/5.