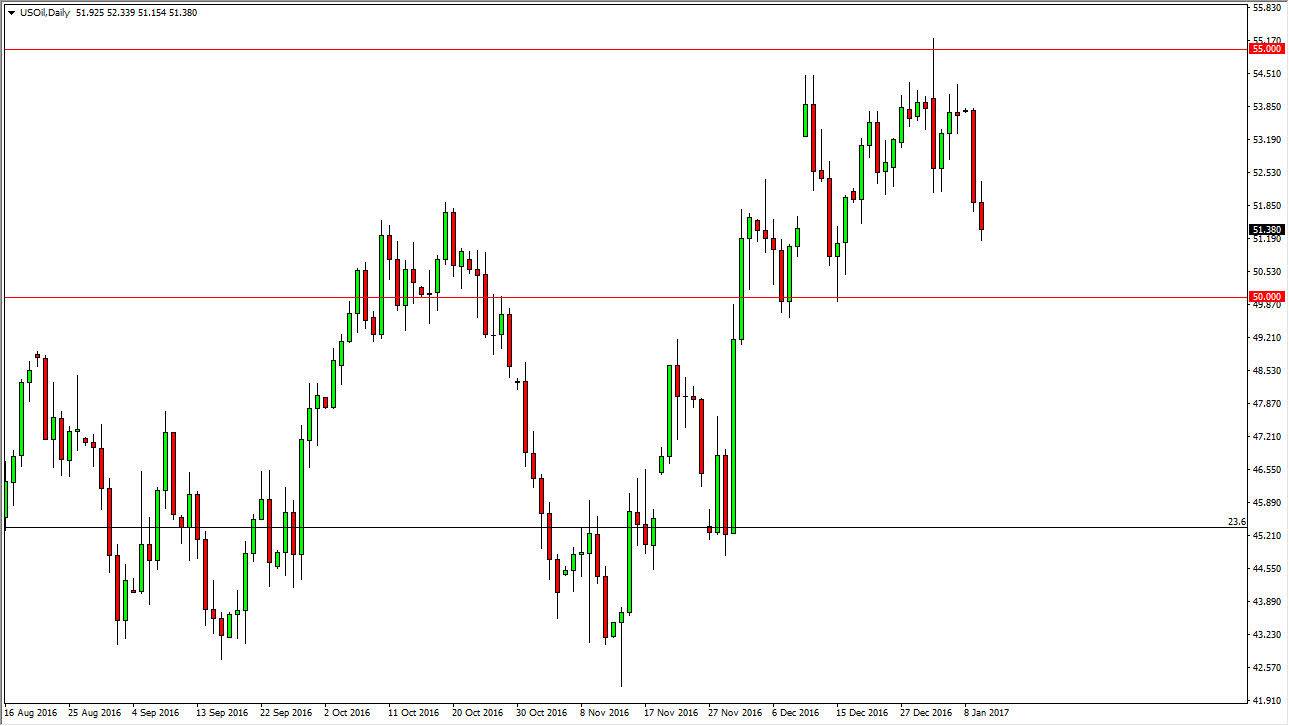

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Tuesday, showing signs of exhaustion soon after. Because of this, the market turned right back around to show signs of exhaustion further, dropping significantly. Because of this, I think today will be an interesting session for oil, as we get the Crude Oil Inventories announcement, it’s likely that the traders will react violently to this announcement. If we get a bearish number, I believe we reach down towards the $50 level below. That’s an area that should be massively supportive, so I think in the short-term that’s where were going. Short-term rally should show selling opportunities, especially on exhaustive candles on short-term charts. I believe the oversupply issue is starting to come back into focus.

Natural Gas

Natural gas markets continue to show signs of volatility as we bounced significantly during the day on Tuesday, reaching above the $3.25 level. There is a significant amount of resistance just above that level, so we pulled back just a bit. However, I feel that the market will eventually try to go even higher, perhaps even trying to fill the gap above. While this could be a buying opportunity for some of you, I prefer to wait for an exhaustive daily candle to continue selling. This is because I know that the oversupply issue will continue to be a problem for natural gas traders, not to mention the fact that the forecast for weather conditions in the northeastern United States continues to show signs of warmer than expected temperatures.

Keep in mind that the United States and Canada have well over 300 years’ worth of natural gas energy just waiting to be extracted in the ground. Because of this, it’s difficult to imagine that the market is going to go on some type of massive rally to the upside. Longer-term, this continues to be a very negative market.