WTI Crude Oil

The WTI Crude Oil market fell during the day on Friday, as we continue to run out of steam. However, it’s the end of the year so it’s difficult to imagine that there would’ve been a lot of buying pressure on such and illiquid day, and I believe that the $55 level above will be resistive going forward. I think that pullbacks will be buying opportunities, and a break above the $55 level since this market looking for $60. However, inventory numbers in the United States are on the rise, and of course the rig count keeps climbing as well, almost ensuring that the oversupply will continue going forward. With this, I’m waiting for an exhaustive candle to start selling but in the meantime, I recognize the short-term traders will probably favor the upside.

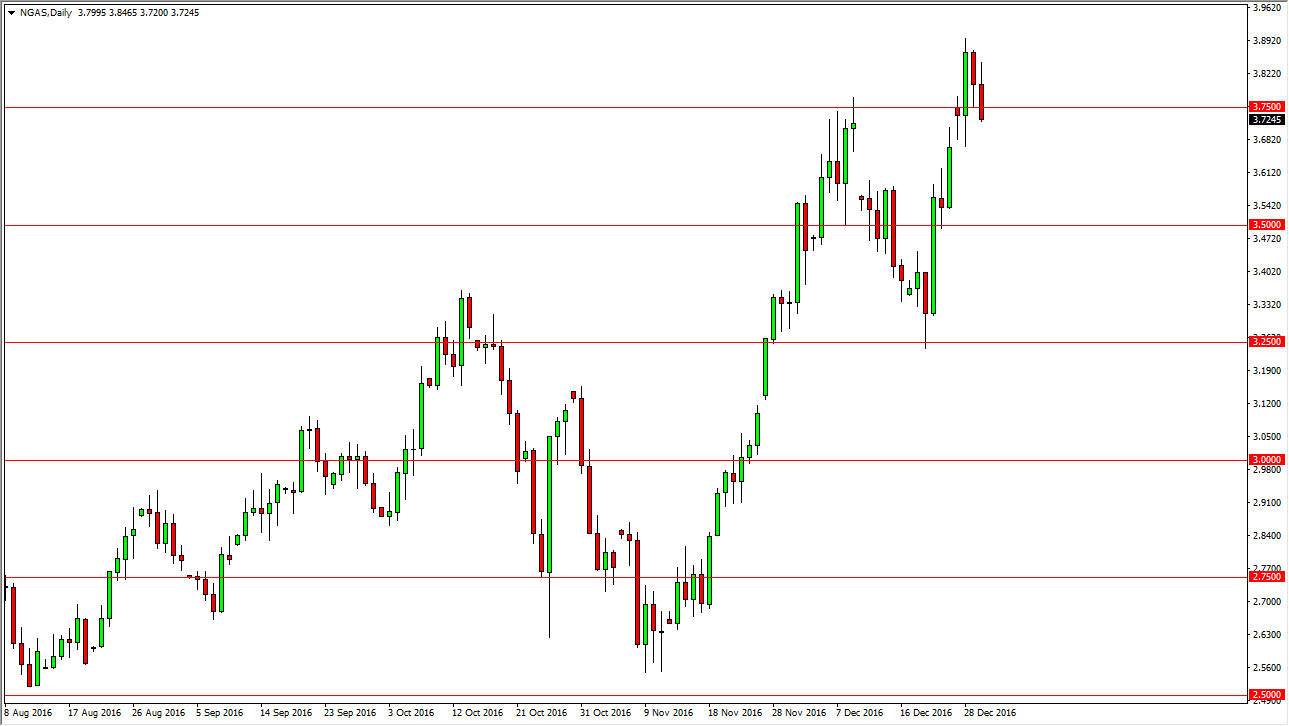

Natural Gas

The natural gas markets initially tried to rally and Friday but then turned around to crash through the $3.75 level. With the lack of liquidity for the session on Friday, I find it very difficult to read too much into this trade. A break down below the $3.65 level should send this market to the $3.50 level going forward. Colder temperatures coming in the month of January will probably drive up the price in the short-term, but I think that there is a lot of noise between here and the $4.00 level, so given enough time the sellers will return. I think this will be a very volatile back-and-forth type of market over the next several weeks, but I have to believe that there is still more than enough bullish pressure underneath the keep this market going higher in the short-term.

Ultimately, I think that we turned back around and crash much lower, as the oversupply will continue to haunt the market, but currently traders seem to be focusing on the next few weeks more than anything else.