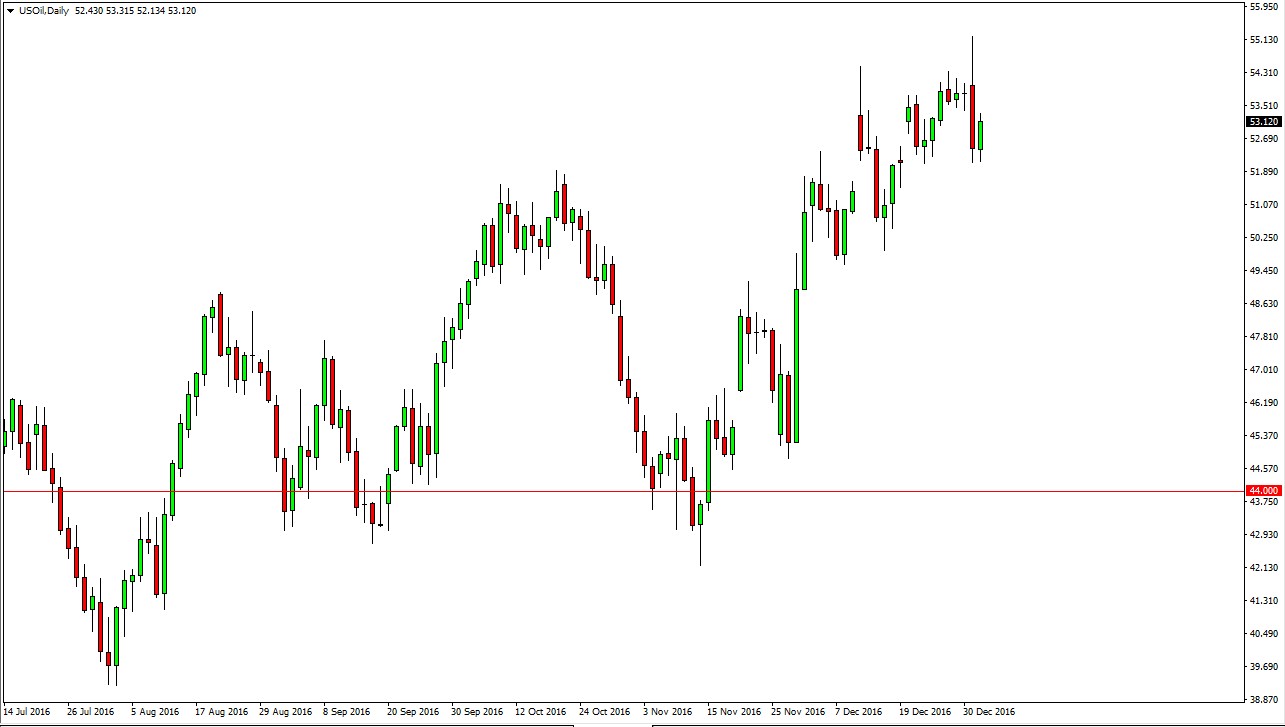

WTI Crude Oil

The WTI Crude Oil market rallied on Wednesday, using the $52 level as support. It looks as if we are trying to consolidate at current levels, which makes a lot of sense considering we are waiting the jobs number. In the current area, I see quite a bit of noise, but I do think that eventually the sellers return. After all, Canadian and American the shale oil producers find these prices quite agreeable, and will almost certainly flood the market with supply again. Because of this, I have no interest in buying oil currently, at least not until the jobs number comes out. I think there’s a longer-term ceiling at the $60 handle, so the rally could have a little bit of life left in it. However, I’m a bit more interested in shorting exhaustive candles.

Natural Gas

Natural gas markets continue to look unhealthy, as we have now lost about 9% in the last couple of sessions. We are a bit oversold now, so we could get a vicious bounce, but that only offers a better selling price as far as I can see. The gap above will be resistive, and it’s only a matter of time before the sellers return after any type of bounce. I would love to see this market bounce, forming exhaustive candle that I can sell, and ride natural gas down to the three dollars handle. However, I also recognize that we could break down below the lows from the session on Wednesday, and just simply go straight to the three dollars handle. Either is a possibility, but I feel more comfortable shorting after a rally as it offers the opportunity to pick up real momentum to the downside.

With warmer than anticipated amateurs in January for the northeastern part of the United States, I think demand is going to taper off, and then oversupply will enter the thought process of traders yet again.