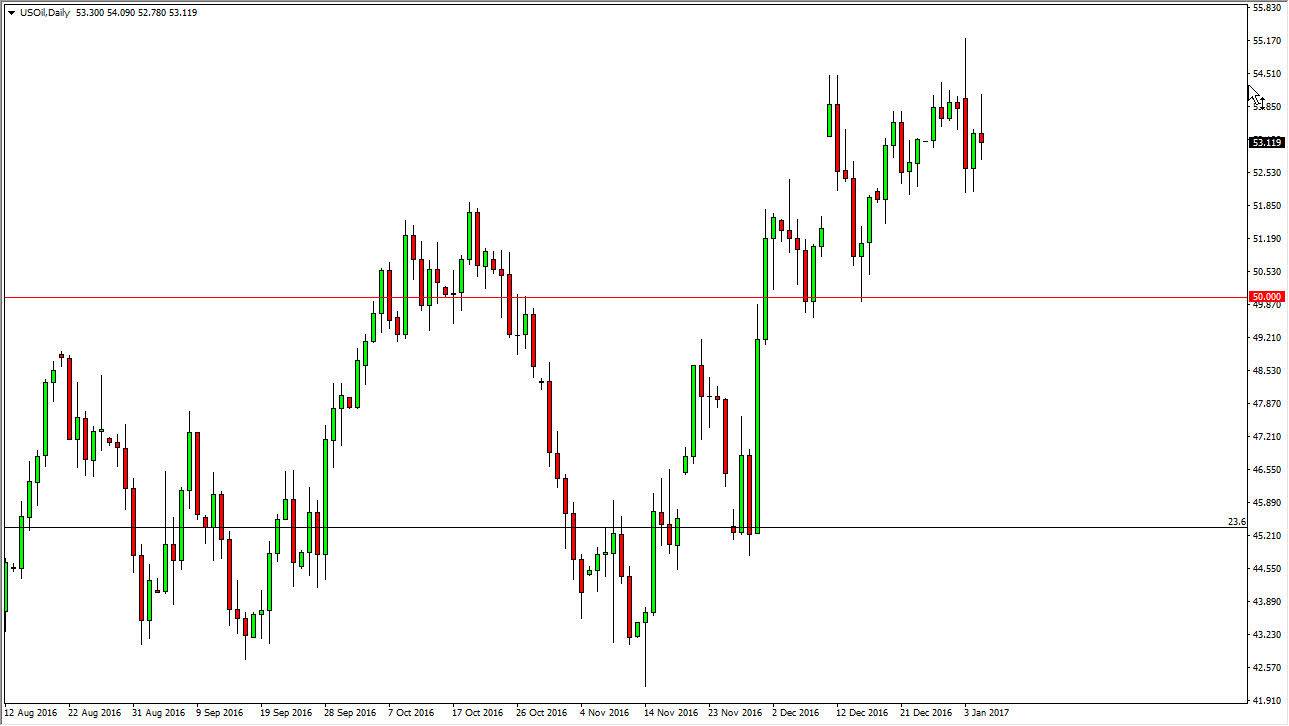

WTI Crude Oil

The oil markets were very volatile during the Thursday session as we initially tried to rally, but gave back most of the gains and ended up forming a less than impressive candle. This makes a lot of sense though, because it’s going to be difficult to put on large position the head of the employment number in the United States. After all, this shows quite a bit of demand for lack of depending on how the numbers come out. I believe that the market is a bit overdone to the upside, and we are starting to see the realization that oversupply may continue to be a longer-term problem. With higher prices, US and Canadian shale drillers will continue to flood the market with oversupply. I prefer selling, but need to see short-term rallies to take advantage of exhaustion.

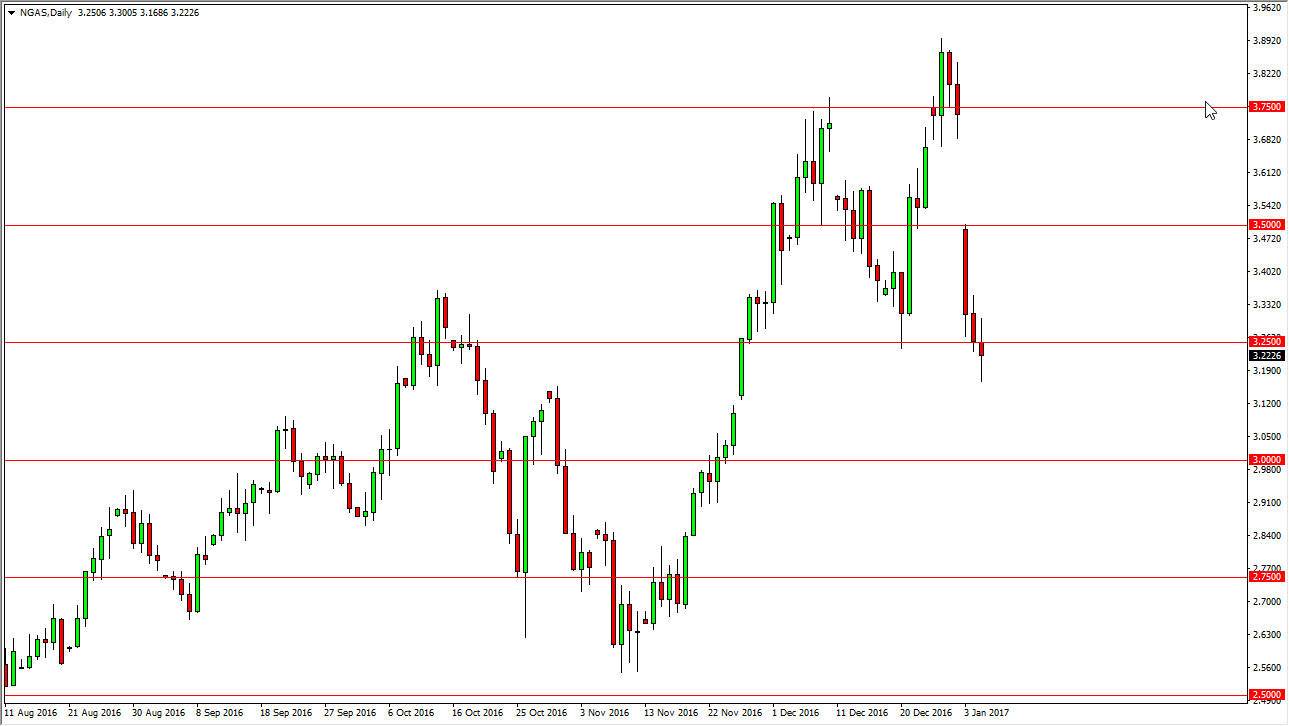

Natural Gas

Natural gas markets were volatile as well, as we broke below the $3.25 level finally. Now that we have done that, I believe that the market will eventually break down. However, gaps in the market tend to get filled, and we have not done that yet. If we break above the top of the candle for the session on Thursday, the market will more than likely try to go to at least the $3.50 level where sellers will jump back into the market. Whether you follow that move comes down to your timeframe, but I do believe that longer-term we will continue to break down. If we break down below the bottom of the range for the session on Thursday, I believe that the next major support area will be near the $3.00 level.

Warmer than anticipated forecast for the month of January in the northeastern part United States has put bearish pressure back into this market, and of course we have a massive amount of oversupply anyway.