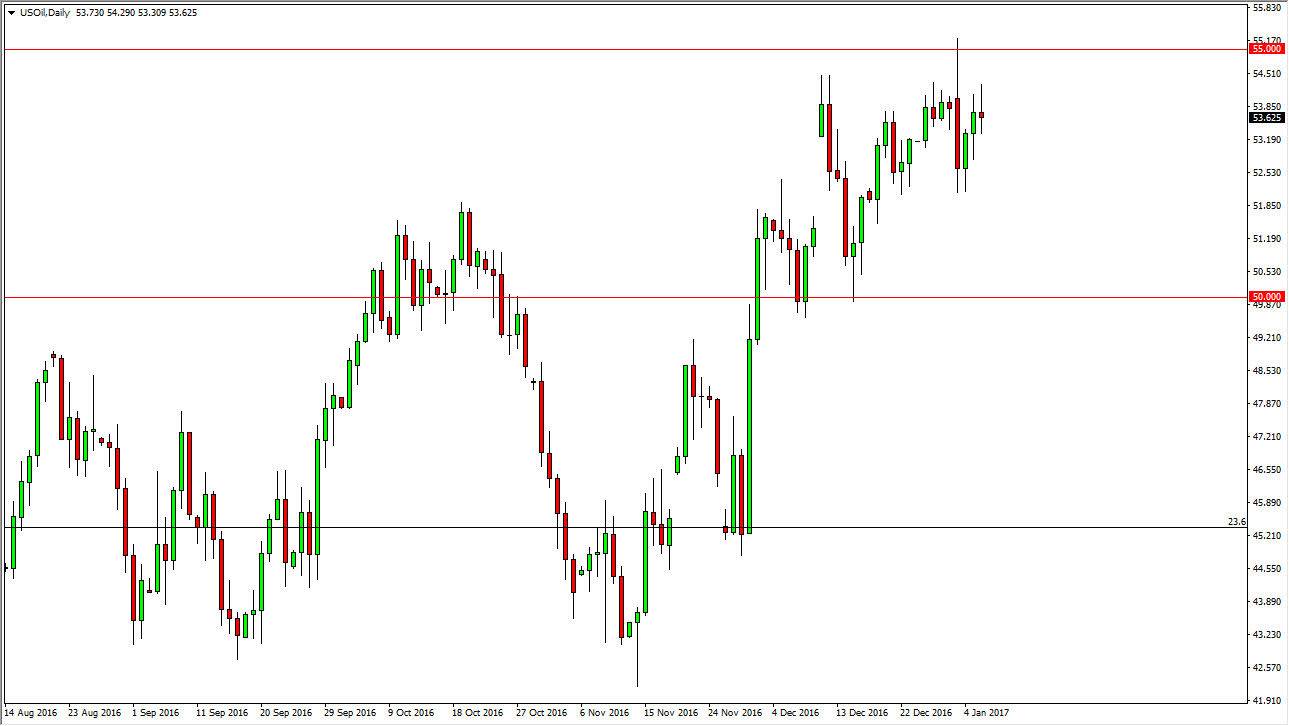

WTI Crude Oil

The WTI Crude Oil market had a choppy session on Friday as traders received the jobs number out of the United States. The oil markets have been rather bullish as of late, especially since the announcement of the OPEC led production cuts. However, oversupply as sooner or later going to be an issue in this market, especially with higher pricing as the US and Canadian shale oil drillers are attracted to these high prices. If we can break above the $55 level, I think that it’s only matter of time before we see massive amounts resistive action at the $60 level, which I believe is the absolute top of the market. At this point, a break down below the bottom of the range for Friday could offer short-term selling opportunities.

Natural Gas

Natural gas markets went back and forth on Friday, testing the $3.25 handle, which of course is supportive as we have seen over the last several sessions. If we can break down below the bottom of the Thursday range, I feel the market will continue to go lower, perhaps reaching down to the $3.00 level underneath which is even more supportive. On entering, if we can break above the top of the range for the session on Friday, the market could bounce to the $3.50 level, and possibly even higher than that, reaching towards the top of the gap that should continue to offer selling pressure.

I believe that the warmer than anticipated forecast for the northeastern part United States in January will continue to have a negative effect on the price of natural gas, and of course the massive amounts of oversupply will do the same. Ultimately, I have no interest in buying, but I do recognize that short-term buying opportunities may present themselves for those of you who are more nimble.