The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 19th February 2017

Last week, I predicted that the best trade for this week was likely to be short EUR/AUD. The result was a winning trade producing a small gain of 0.20%.

The Forex market seems to be getting back into a bullish trend in the USD although the trend is much weaker than it was during the weeks immediately following 8th November.

Despite this, a few major currencies are now starting to move into long-term bullish territory against the U.S. Dollar, most notably the Australian Dollar. Therefore, I suggest that the best trade of the coming week will be long the Australian Dollar and short of the Swiss Franc, which is the most technically bearish of all the major currencies.

Fundamental Analysis & Market Sentiment

There are few fundamental or sentimental factors driving the Forex market right now. Last week had a light flow of economic data. The most notable bullish stand-outs lie in last week’s better than expected Australian and U.S. economic data, which are likely to boost these respective currencies. There is also renewed concern over dealings between Greece and the E.U. which is not helping the Euro, which remains bearish.

Technical Analysis

USDX

The U.S. Dollar printed a bearish, near-pin candle within the scope of a wider bullish trend that is manifested over the long term. Note that in the event of a further fall, the price may find support at the confluence of the supportive trend line and the horizontal level at 122186, as shown in the chart below. However, the price is now below its level from 3 months back, which is a sign the bullish trend is technically in heavy doubt.

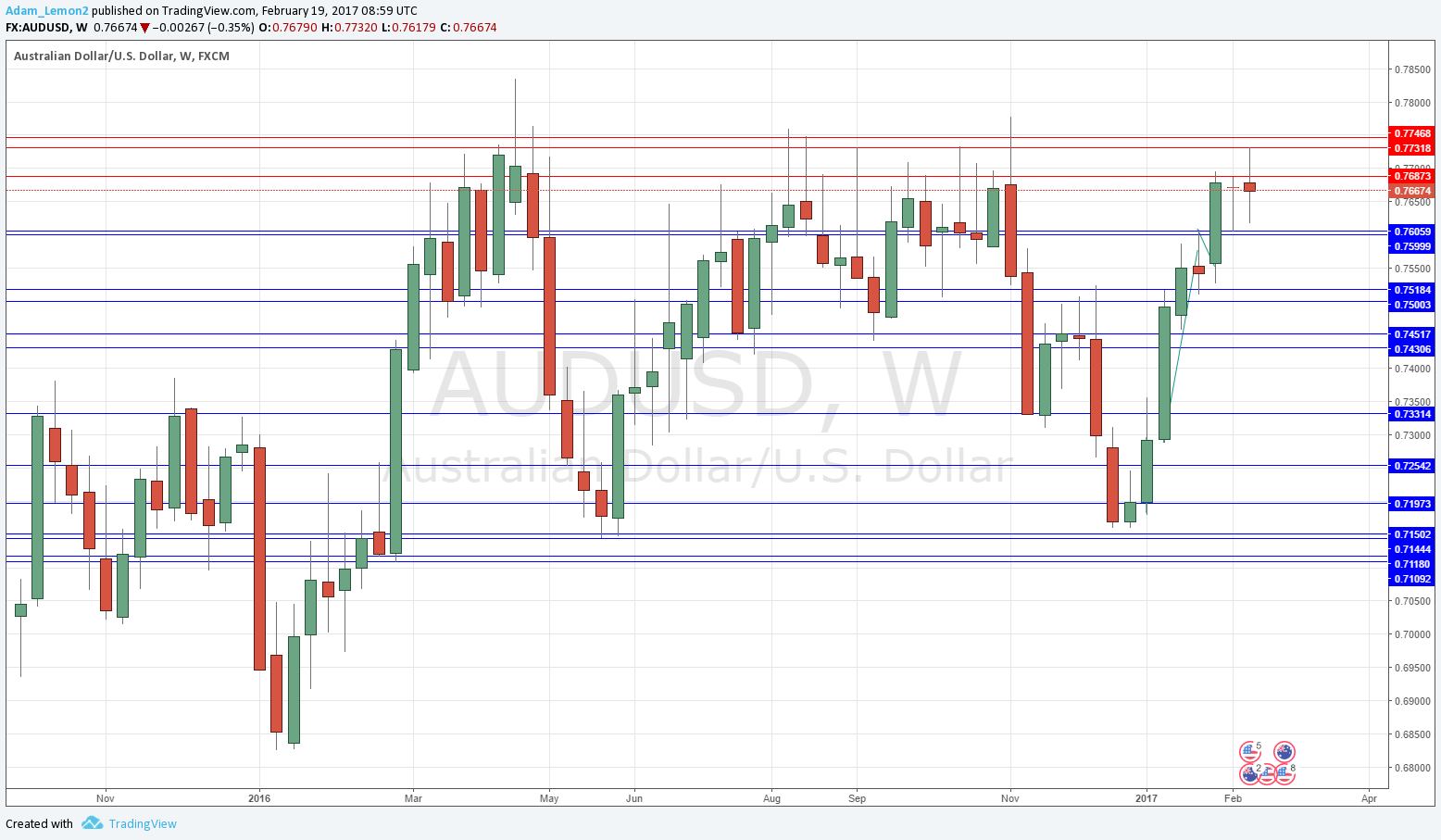

AUD/USD

This week we see a reasonably large doji candle, which is significant for its indecisiveness. This suggests that anything might happen next, including a major bearish reversal, and it must be noted that the price has reached an area which has proved to be resistant over a lengthy multi-month period. Nevertheless, the price has a lot of bullish momentum and is high, which suggests higher prices still.

USD/CHF

This week we see a reasonably large doji candle, which is significant for its indecisiveness. This suggests that anything might happen next. Nevertheless, the price still has some residual bullish momentum and is higher than its level from 3 months back, which suggests higher prices still.

Conclusion

Bullish on the AUD, bearish on the CHF.