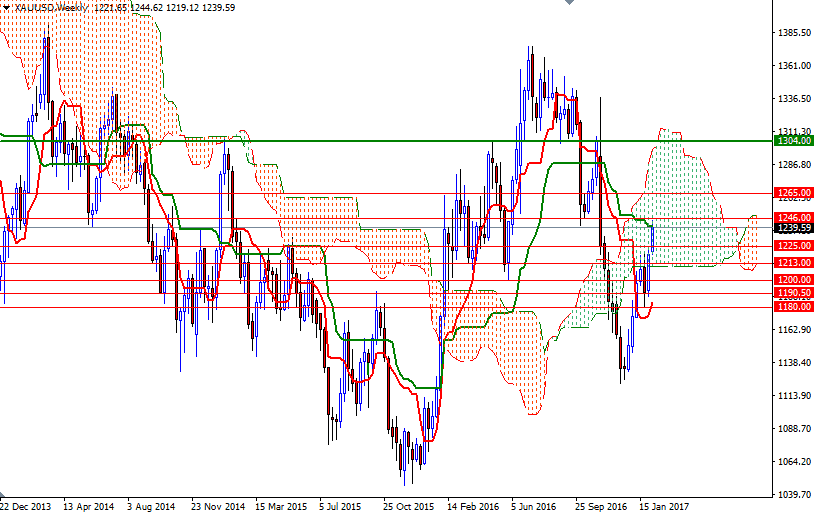

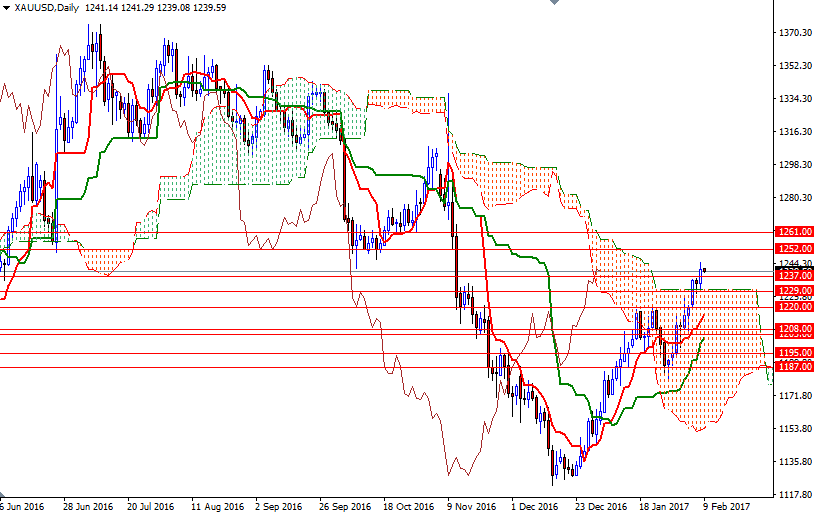

Gold prices rose $7.77 on Wednesday as anxiety over political and economic policy changes in the United States and Europe drove investors into safer assets. The XAU/USD pair initially tested the 1230/29 area but found enough support to reverse, and eventually broke through a key resistance at 1237. Consequently, the market approached the next barrier sitting in the 1247/6 zone.

The market is trading above the daily and 4-hourly Ichimoku clouds, and that suggests the bulls have the near-term technical advantage - a case I have been highlighting for the past few weeks. I advise a bit of caution at this point as we are coming closer to the next significant barrier at around 1252. Only a daily close above 1252 could provide the bulls extra fuel they need to march towards the 1261 level.

On the other hand, if the resistance in the 1247/6 region prevents the market from going higher, keep an eye on 1237/4. The bears have to drag prices below 1234 so that they can have a chance to test the 1230/29 support. A break down below 1229 would imply that the 1225 level might be the next port of call.