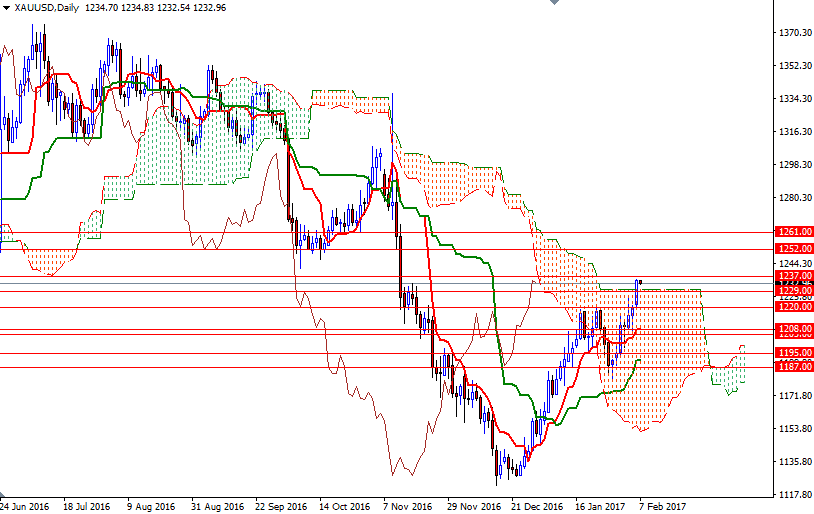

Gold prices ended Monday’s session up $13.31, extending gains to a third straight session, as economic and political risk elements sent investors seeking shelter in safe havens. The XAU/USD pair broke through the $1225 resistance and marched towards the $1237 level as expected. Investors are monitoring developments in the euro zone and wondering country will be next on U.S. President Donald Trump’s list to call out.

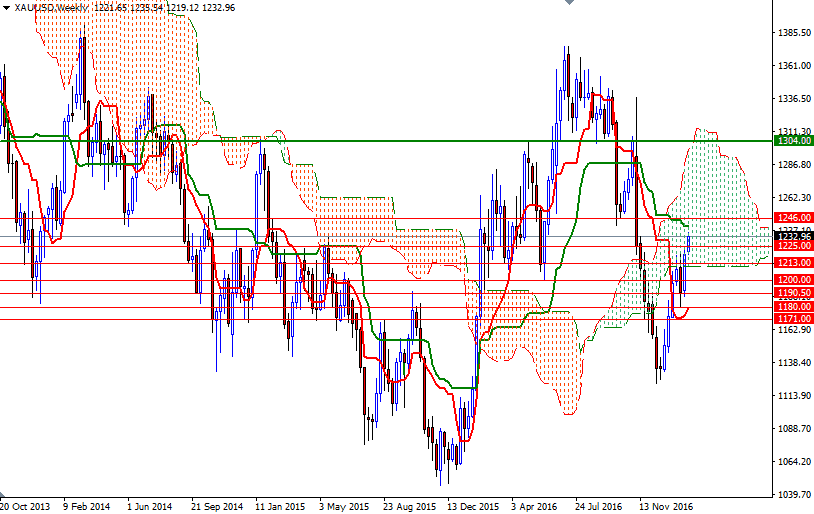

Yesterday’s advance pushed prices above the Ichimoku clouds on the daily time frame, which is a positive sign. The market is currently trading above the daily and 4-hourly charts. We have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on both charts. The bulls have to convincingly push prices beyond 1237 so that they can challenge the bears waiting at around 1242.50. If the bulls pass through 1242.50, then 1247/6 and 1252 could be the next possible targets.

However, beware that the daily Chikou-span (closing price plotted 26 periods behind, brown line) is right below the cloud. A failure to break above 1237 could weigh on the market and pull prices back to the 1230/29 area where the top of the daily cloud sits. If this support is broken, then we are likely to test 1225 afterwards. Below there, I would expect the previous resistance in the 1220/19 zone to flip and act as good support.