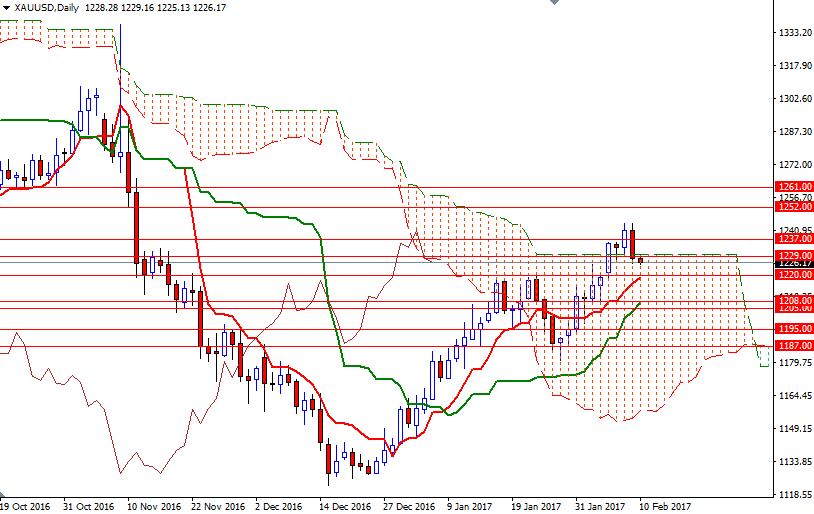

Gold prices dropped $13.18 an ounce yesterday as the strength in the dollar and global equities sapped demand for the metal as an alternative investment. The XAU/USD pair initially tried to break upwards but came under fresh selling pressure at around the anticipated $1242.50 resistance level. The market fell below the $1237 level after data from the Labor Department showed the number of people filing first-time claims for unemployment insurance payments dropped by 12K to 234K.

The short-term charts show signs of exhaustion, with prices trading below the Ichimoku clouds on the M30 and H1 time frames, plus we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on both charts. In other words, the downside risks will remain unless prices climb back above the 1230/29 zone.

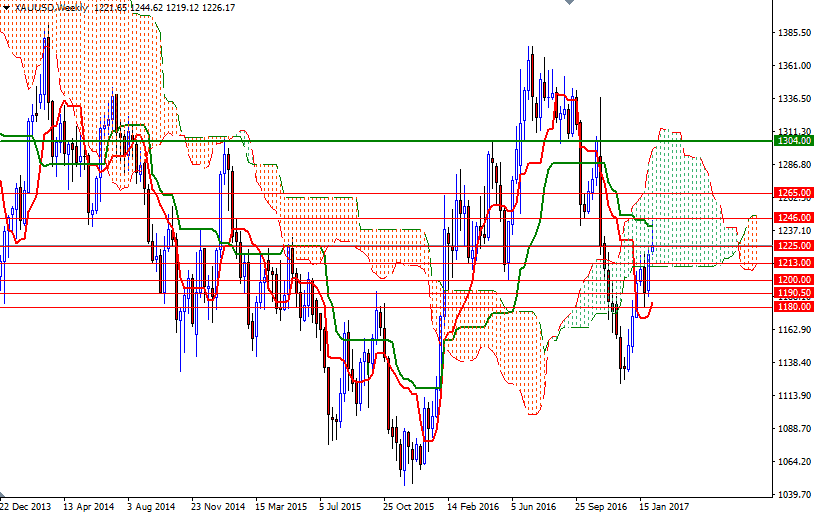

To the downside, the bears have clear nearby support in the 1220/19 region if they intend to push prices lower. In that case, the 1213/1 area where the bottom of the weekly cloud sits will be the next target. Falling through this support may pull the market back to the 1208/5 region. However, if XAU/USD breaks through 1230/29, then it is likely that the market will visit 1233.50 afterwards. Beyond that the next challenge will be waiting the bulls at 1237.