Gold prices ended Wednesday’s session up $1.11 as the American dollar weakened after the release of the minutes from the most recent Federal Open Market Committee meeting. The minutes showed mixed comments from the U.S. central bank; there was growing support for an interest rate hike "fairly soon" among committee members but with no real urgency. "Members agreed that there was heightened uncertainty about the effects of possible changes in fiscal and other government policies... Many members continued to see only a modest risk of a scenario in which the unemployment rate would substantially undershoot its longer-run normal level and inflation pressures would increase significantly" the Fed said in the minutes.

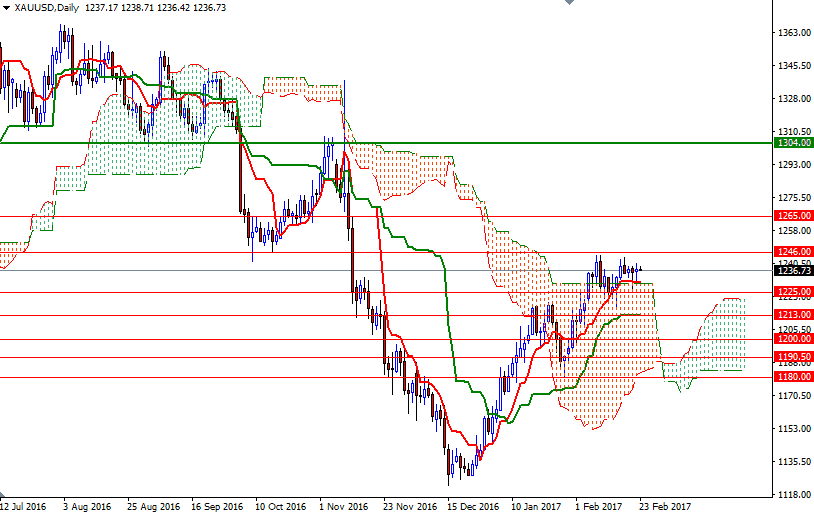

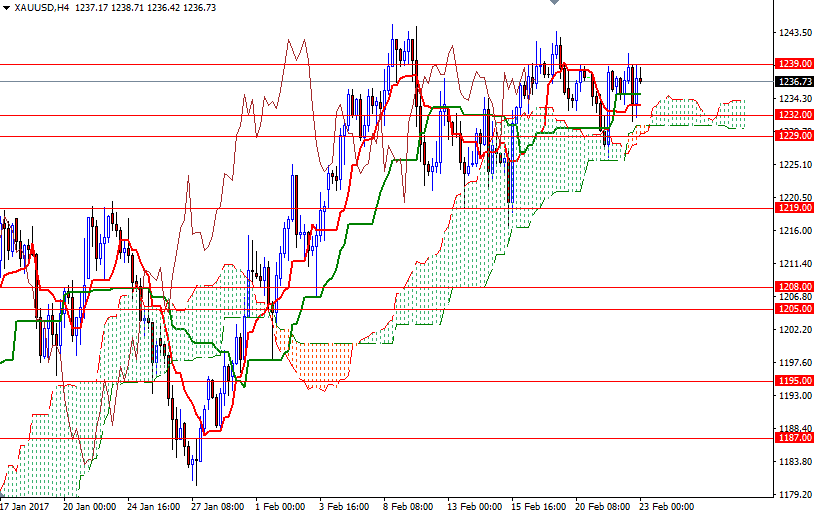

The key levels remains unchanged, as the market continues to consolidate between the 1239 level on the top and the 1232 level on the bottom. The short-term technical charts remain bullish, with the market trading above the daily and the 4-hourly Ichimoku clouds. If XAU/USD convincingly breaks through 1239, we might see a bullish attempt targeting the 1247/6 region. The bulls have to capture this strategic camp in order to gain momentum and challenge the bears on the 1252 battlefield.

On the other hand, if the bulls run out of steam and prices drop through 1232/29, the market will probably head down to 1225. A break below 1225 would set the XAU/USD pair up for a test of the support in the 1220/19 zone. Closing below this support on a daily basis would open up the risk of a move towards the 1213/1 region.