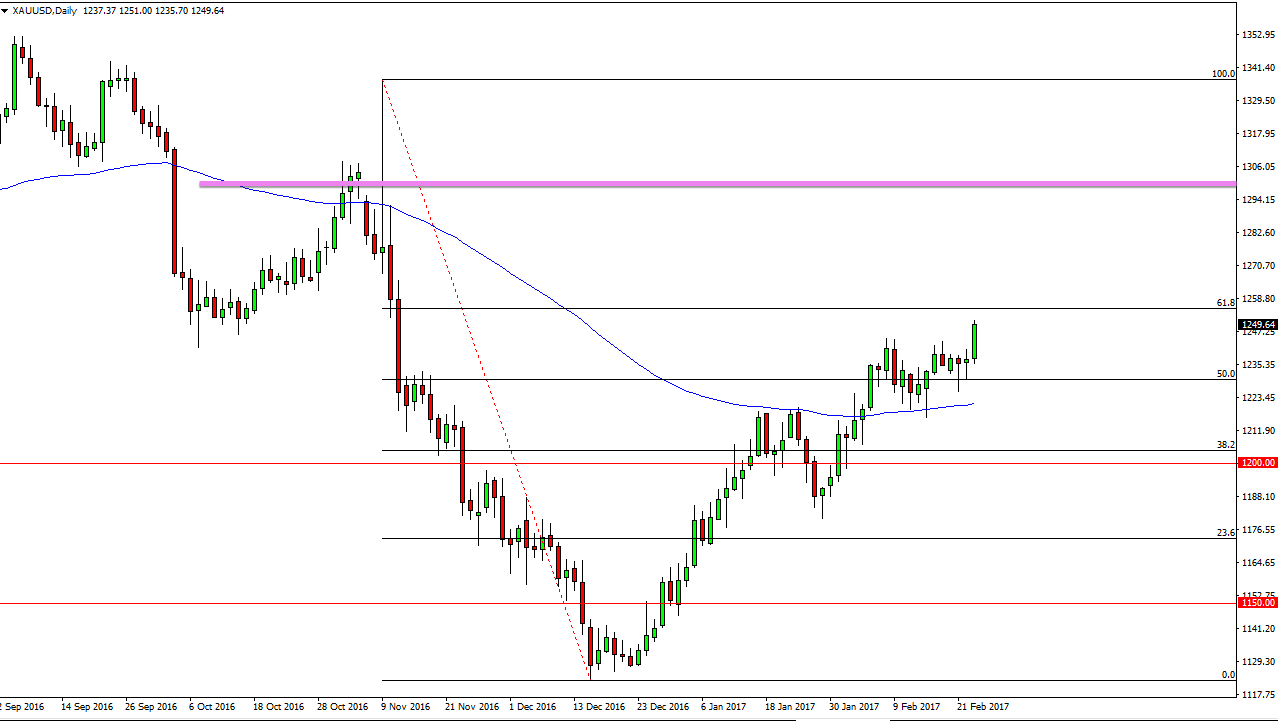

Gold markets rallied during the day on Thursday, showing real strength as we approached the $1250 level. I do recognize that there’s a lot of resistance just above but I think it shows that we are eventually going to break out. This should continue to see buyers every time it pulls back, and quite frankly looking at the short-term charts for a little bit of value might not be the worst idea. Once we break above the $1250 level, we should then reach towards the $1300 level.

Trend change

This market has obviously seen a lot of bullish pressure over the last couple of months, and I believe it represents a trend change. Breaking above the 61.8% Fibonacci retracement level just above should also send this market looking for higher levels, as I typically recognize a break above the 61.8% Fibonacci retracement level as a potential run all the way to a “round-trip.” Remember that this move started when Donald Trump was elected in a surprise result, and at this point I think that the market may be coming to grips with the fact that it wasn’t the end of the world.

Pullbacks of this point should be supported at the 100-day exponential moving average, pictured in blue on the chart. To be honest, I would be surprised if we even reached down that far. Supportive candles below are buying opportunities, and I will continue to use them as such. Again though, we could see a bit of volatility so short-term charts will probably be the best way to trade this market. Pay attention to silver as well, as it has been leading the way. If Silver goes higher, typically the gold markets will as well.

I have no scenario now that I’m willing to sell gold, I believe that we are starting to see the longer-term trend change, and although it will be volatile, a round-trip could send us all the way to the $1340 level.