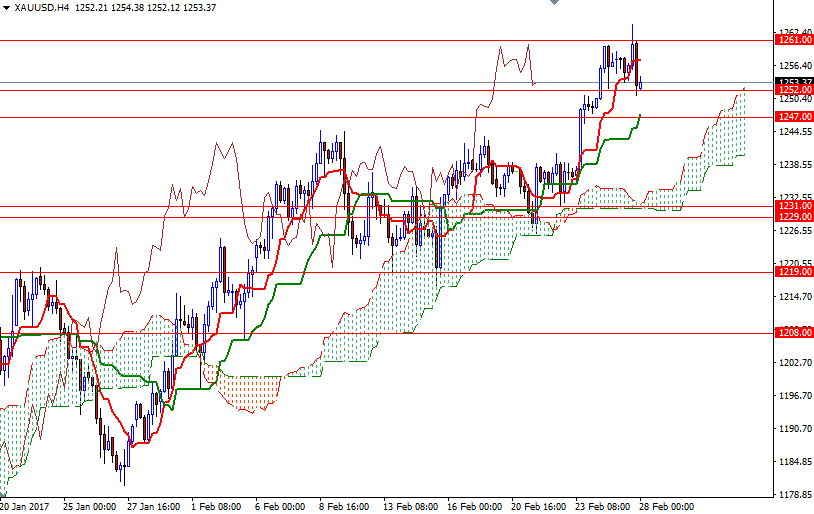

Gold prices fell $4.79 on Monday, ending a three-day streak of gains, as investors awaited comments from President Donald Trump on Tuesday that could shed some light on his economic plans. Although gold started the week with a bullish tone and tried pass through the 1265/1 area, which I had identified as a key to higher levels, after U.S. housing data came in weaker than expected, the initial rally faded as buying dried up. As a result, prices reversed and returned to the 1252/0 area.

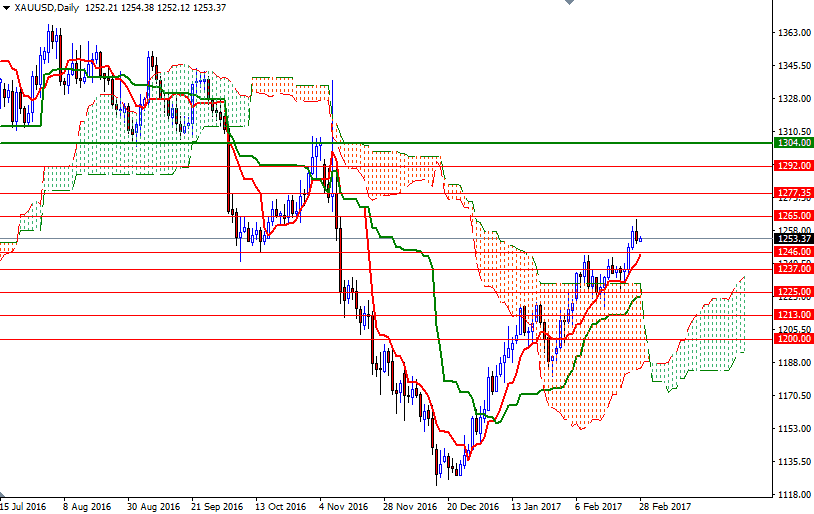

Another key focus this week is a speech on the economic outlook by Federal Reserve Chair Janet Yellen on Friday. This could be one of Yellen’s last opportunities to influence market sentiment before the next Fed meeting on March 14-15. While persisting worries about European elections over the next several months are likely to be supportive for gold, the prospect of a rate hike next month could weigh on the market in the near term. With these in mind, I wouldn't eliminate the possibility of a pullback before gaining enough momentum to move towards the top of the weekly cloud.

The key levels remains unchanged, as the market remains in between 1261 and 1252/0. The bears will need to drag prices back below 1252/0, if they don't intend to give up. There is likely to be minor support in 1247/6. Below that we can expect the previous resistance in 1243/2 to flip and act as support. A break down below 1242 would suggest that XAU/USD might revisit the 1238/5 zone. Anchoring somewhere above the 1261 level, on the other hand, could see a test of 1265. Clearing this resistance could attract some new buying and push prices towards 1270. Once above there, we could possibly see the bulls make a run for 1277.35-1275.