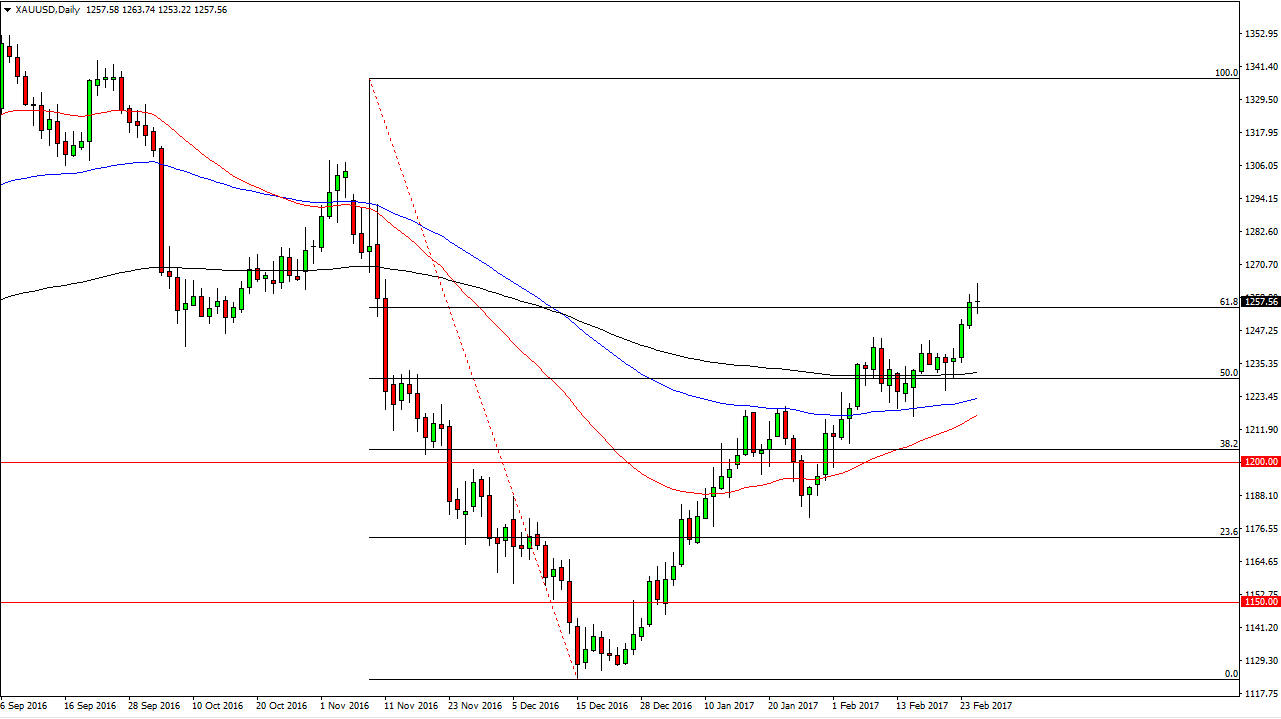

Gold markets had a choppy session on Monday, as we broke above the $1260 level initially, but turned around to form a shooting star. The shooting star of course is a negative sign, and we are a bit overextended. It is because of this that I believe it’s only a matter of time before the sellers get involved and go looking for support at lower levels. I believe they will find it, and therefore give us an opportunity to start buying at lower levels. I believe that the $1245 level underneath should continue to be an area where buyers are interested, so if we get a supportive candle in that area I more than likely going to start buying.

The alternate scenario of course is a break above the top of a shooting star for the day and that shows a significant amount of strength as we would go higher. At that point, I would anticipate that the market would try to reach the $1300 level but it’s probably going to be rather choppy. Nonetheless, we have certainly seen a massive move higher and therefore I believe there’s plenty of interest.

Looking at moving averages, the 50, 100, and 200 day moving averages all look as if they are ready to start crossing. When they do, a lot of traders will look at it as a potential trend change. It is because of this that I believe the buyers will continue to return. Once these moving averages cross, it will become more of a “buy-and-hold” type of situation for longer-term traders.

The US dollar has been getting a little bit softer again some currencies, as the bullishness is starting to subside. That could help gold, but quite frankly even though there is a correlation between the two markets, they don’t have to run opposite. Because of this, expect choppiness but I think gold ends up being a buy.