Gold prices rose $7.87 on Monday as the majority of investors opted to remain on the sidelines ahead of Federal Reserve Chair Janet Yellen's congressional testimony. Yellen is scheduled to appear before the Senate Banking Committee today. The impressive run in major equity markets around the globe also depressed the attractiveness of gold. Asian and European stock markets were mostly higher and U.S. stock indexes hit new record highs yesterday.

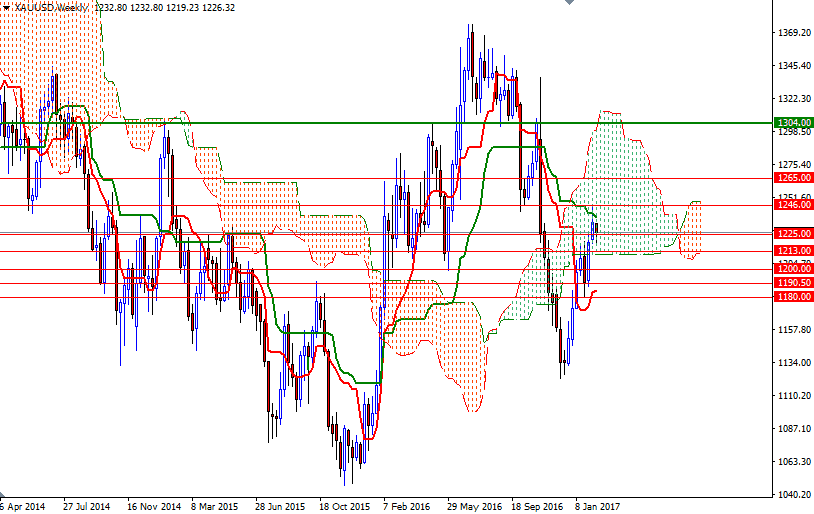

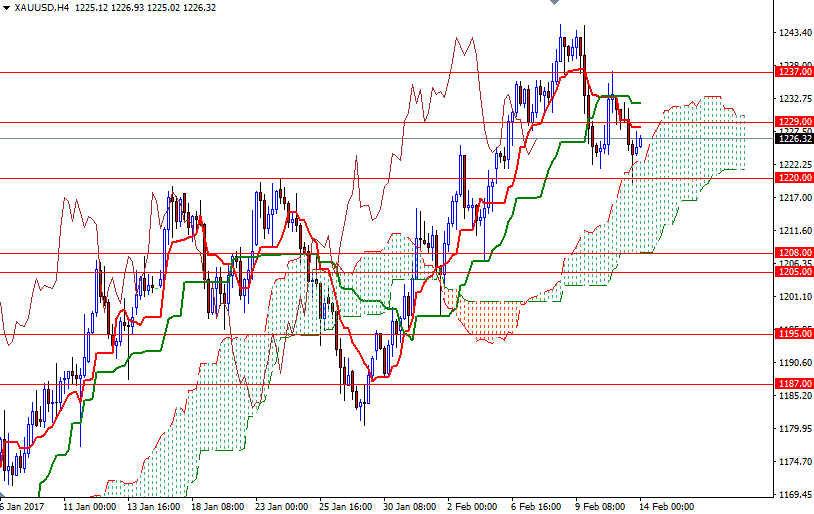

Not surprisingly the XAU/USD pair extended its losses after the 1225 level was broken, though the expected support in the 1220/19 zone kicked in and held the market, pushing prices back above the 4-hourly Ichimoku cloud. The daily and the 4-hourly charts paint a slightly positive picture but on the other hand the market is still trading below the Ichimoku clouds on the M30 and H1 time frames, suggesting that a rest of the 1220/19 region is likely if prices fall through 1225/4. The bears have to drag prices convincingly below 1219 so that they can tackle 1213/1. I think that eliminating this support is essential for a continuation towards the 1208/5 area.

To the upside, the initial resistance sits in the 1232/29 zone where the M30 and H1 clouds overlap. A break through there brings in 1237/5. Clearing this barrier suggests that XAU/USD is getting ready to march towards 1247/6. Beyond that, the 1252 level stands out as an obvious technical key resistance.