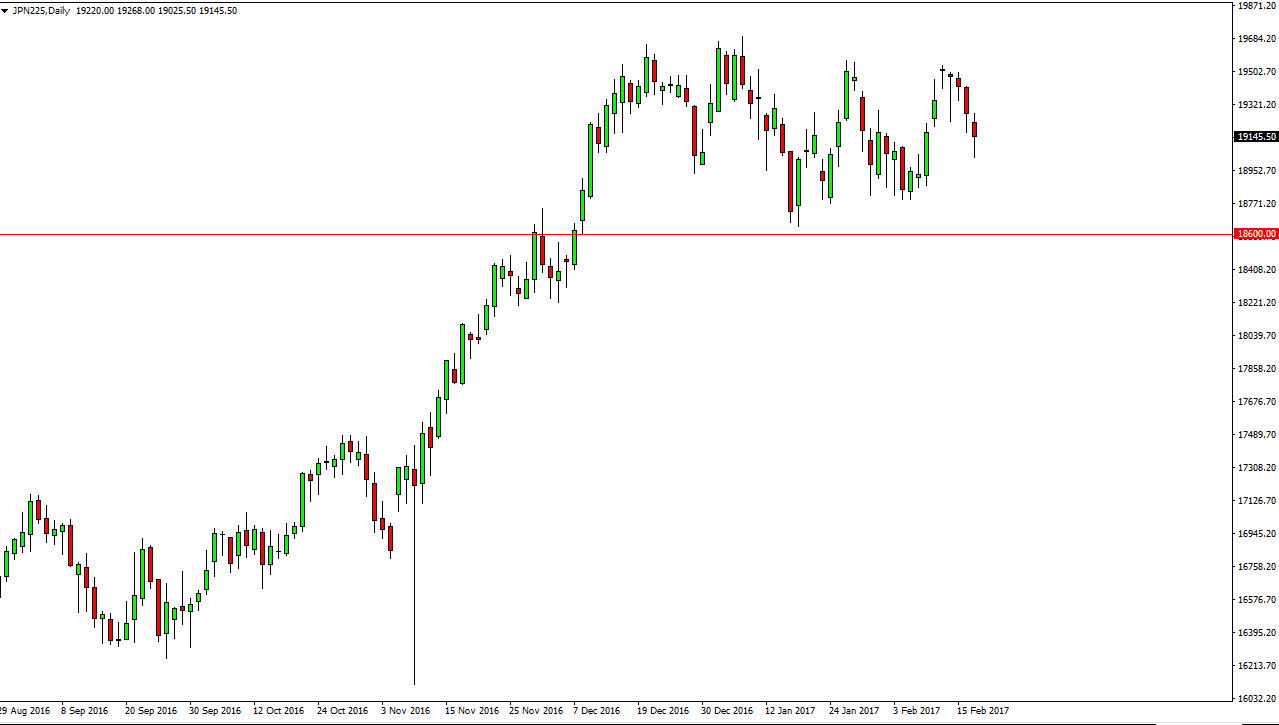

The Nikkei 225 fell initially on Friday but found enough support at the ¥19,000 region to turn around and form a hammer. This is a very bullish sign and I think that we are starting to make a “higher low”, suggesting that we are going to continue going higher. I have marked on the chart the ¥18,600 level, which I think is the absolute “floor” in this market, and that it’s only a matter of time before the market recognizes that it’s time to buy every time we go in that direction. In fact, that might be what happened on Friday, and now looks as if we can break above the top of the candle we should then reach towards the ¥19,600 level, which of course has recently been massive resistance.

Export driven

The Nikkei 225 level of course is heavily influenced by exports coming out of Japan, which is heavily influenced by the USD/JPY pair. After all, cheaper Japanese yen would make Japanese exports cheaper for Americans to buy, which is one of their biggest potential customers. Because of this, it’s very likely that the Japanese yen weakening should continue to push this market to the upside. If we can break above to a fresh, new high, I believe that the market will finally be able to make its move towards the ¥20,000 level. Pay attention to the currency markets, they are extraordinarily important when it comes to this type of trading, as it is without a doubt one of the biggest factors when it comes to trading Japanese equities.

Even if we fall from here, I believe that it’s only a matter of time before we find buyers jumping into the market and taking advantage of what would be perceived value. I have been calling for a ¥20,000 target over the last several months, and it looks like this recent consolidation may be another attempt to build up the momentum to finally reach that goal.