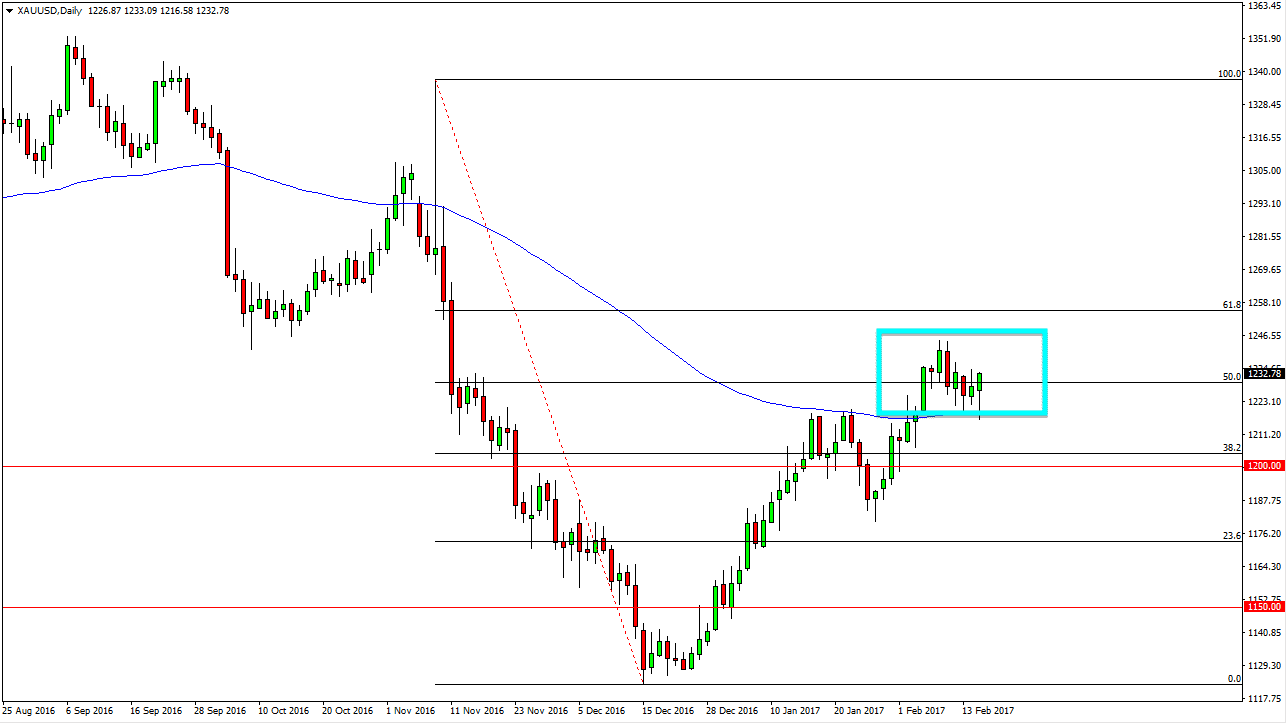

Gold markets had an interesting session on Wednesday, as we initially were quite bearish, but then turned around to form a nice looking hammer. The hammer sits right at the 50% Fibonacci retracement level from the Donald Trump surprise election, and of course it’s right on top of the 100-exponential moving average. Either way, I think it’s only a matter of time before this market goes higher, but you can see on the chart I have a consolidation area marked out. If we can break above the $1250 level, the market should continue to go much higher. Pullbacks should be buying opportunities and I believe that there’s a lot of support extending all the way down to at least the $1200 level.

The 61.8% Fibonacci retracement level is at roughly $1257, and that could be the next target. Once we get above there, I believe that we will continue to reach all the way to the beginning of the move lower, and essentially form a “round-trip.” I don’t really have a scenario in which a willing to sell this market, looks so strong and of course gold has been so reliable over the last couple of months. It’s possible that gold has formed a longer-term bottom, and thus I think the next couple of weeks will be vital.

If you can handle the volatility, this could be an excellent buying opportunity. However, if you find yourself struggling with that predicament, it’s possible that you can buy physical gold as more of an investment and less of a trade. It really comes down to your timeframe and of course your account size, but ultimately, I believe that gold goes higher either way, and it just comes down to whether you can take advantage of this scenario.

We also have the ability to play binary options to the upside, but I would prefer to see short-term pullbacks on short-term charts that show signs of support in order to place those trades.