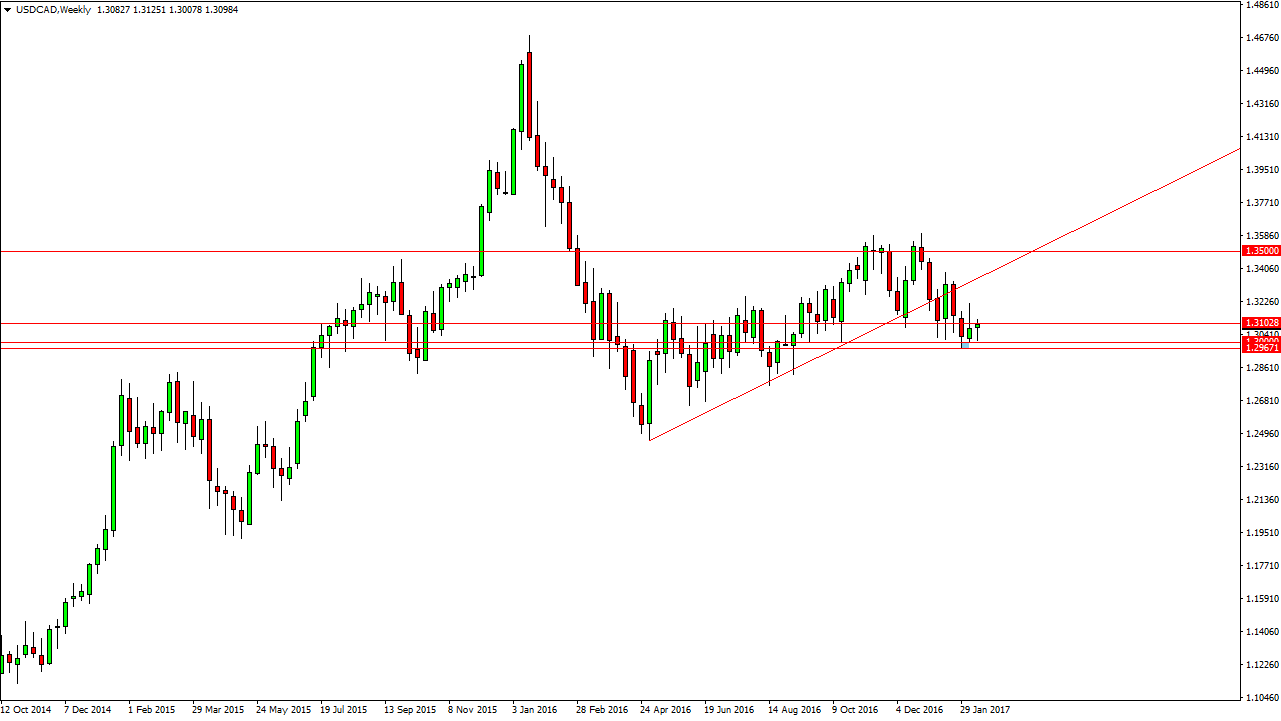

USD/CAD

The USD/CAD pair initially fell during the week but found enough support near the 1.30 level to turn things around and form a nice looking hammer. A break above the top of the candlesticks in this market is looking for the 1.32 level but as long as we have confusion in the oil markets, there will be confusion here.

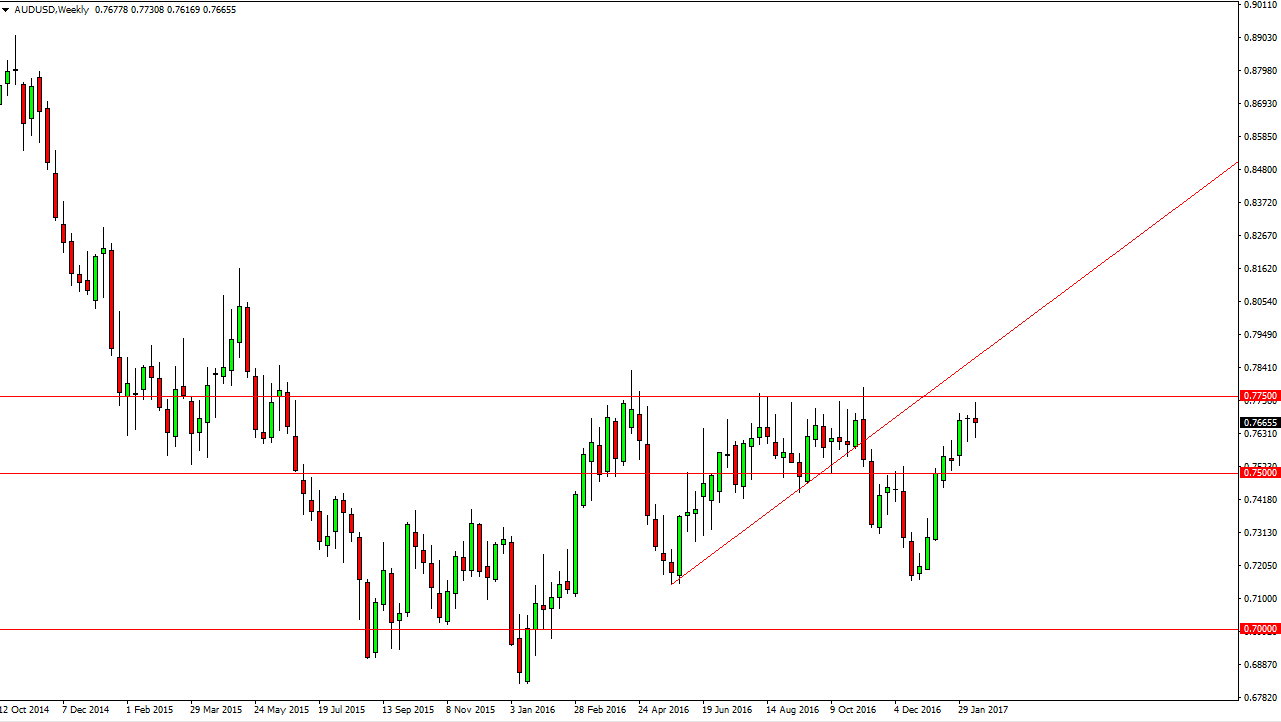

AUD/USD

The Australian dollar went back and forth during the week, selling on neutrality. However, the previous week had formed a hammer, so that suggests to me that we will eventually try to break out to the upside. If we can clear the 0.7750 level that would be a significant move just waiting to happen. I believe that point we would reach towards the 0.80 level above which has been a magnet for price on longer-term charts more than a couple of times. Pullbacks should offer value.

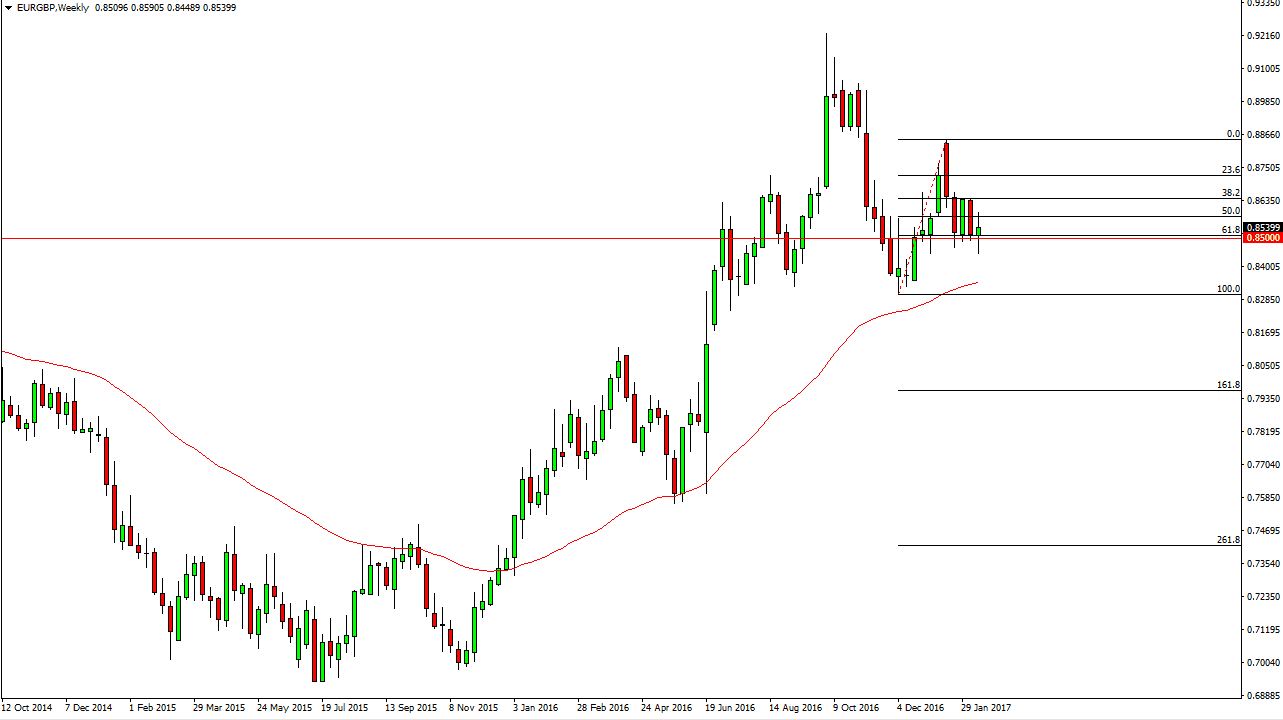

EUR/GBP

The EUR/GBP pair had a volatile week, breaking down below the 0.85 level at one point. However, we offered enough support below there to turn things around and I believe that the buyers are to get involved again as this level is not only psychologically important, but it is also the 61.8% Fibonacci retracement from the latest moved to the upside. However, if we break down below the bottom of the candle I think we then reach towards the 0.83 level.

EUR/CAD

The EUR/CAD pair fell initially during the week but found enough support at the 1.38 level to turn things around to form a nice-looking hammer. Because of this, I believe that the market will continue to go higher and if we break above the top of the candle for the week, the market should then reach towards the 1.43 handle.