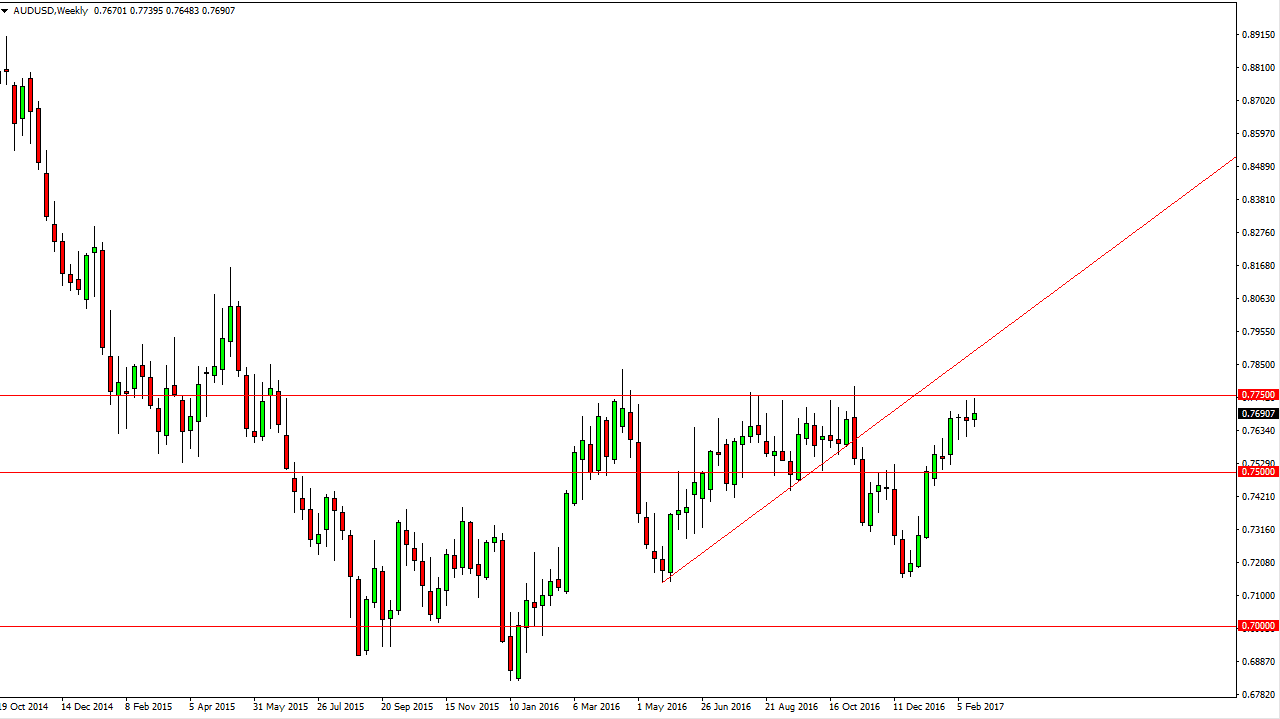

AUD/USD

The Australian dollar had a very volatile week again, testing the 0.7750 level. However, the resistance offered a bit too much in the way of trouble. Nonetheless, when I look at the totality of the move I still believe that pullbacks will be bought, especially considering that gold markets continue to go higher. Eventually will break above the 0.7750 level and continue towards the 0.80 level above.

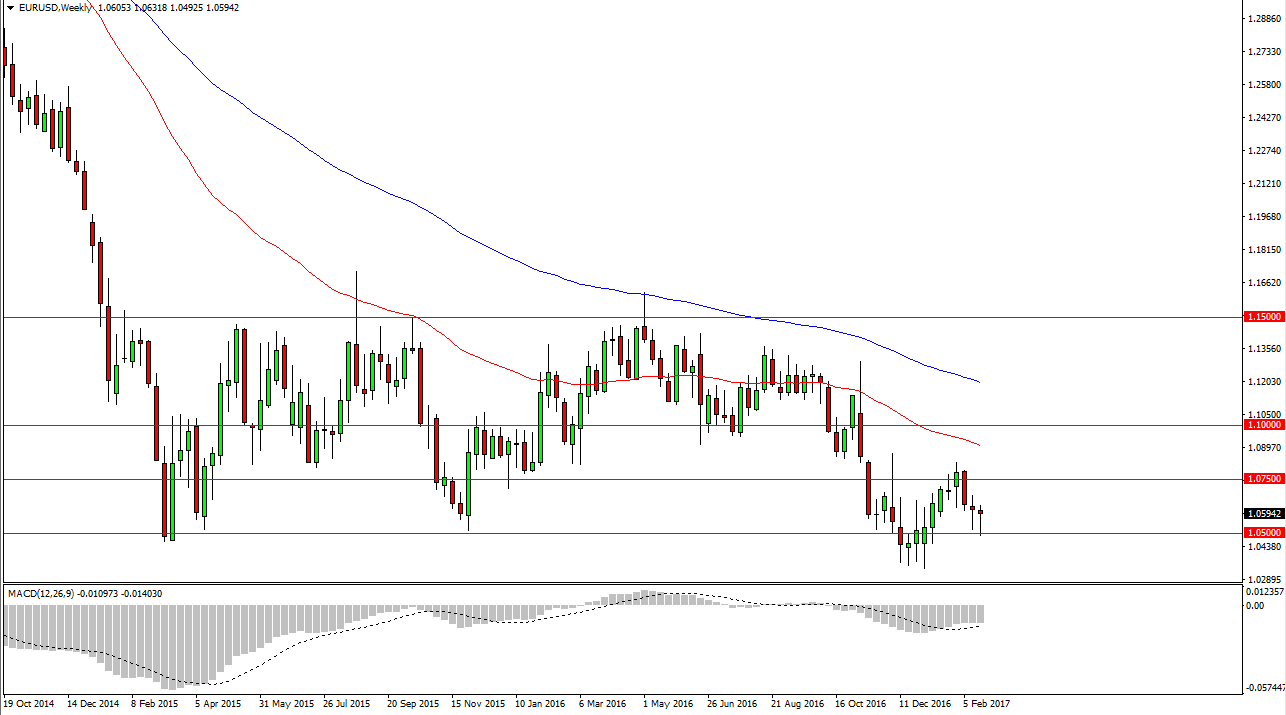

EUR/USD

The EUR/USD pair initially fell during the week, testing the 1.05 level for support. We found enough support there to turn things around and form a hammer, which of course is a bullish sign. I believe the fact that we formed when the previous week as well suggests that we are going to see short-term bounce. However, the daily candles don’t exactly look healthy. I think a short-term bounce about is all as we are going to see.

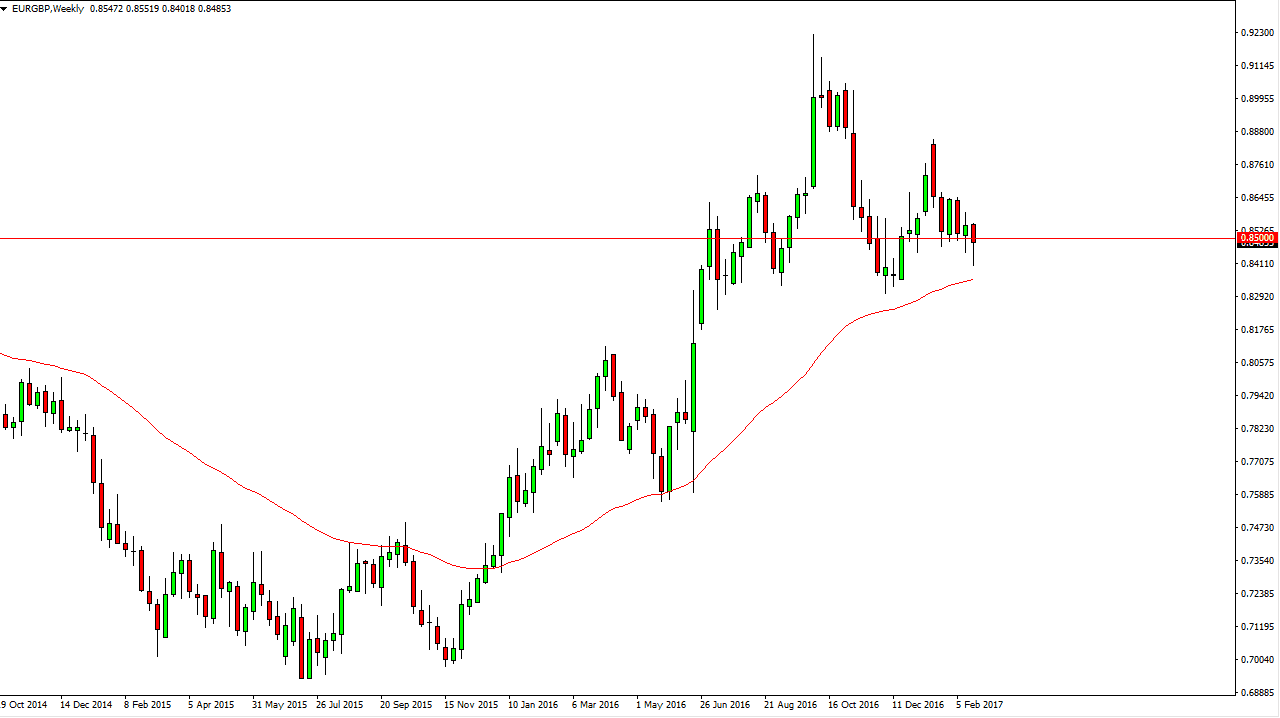

EUR/GBP

The EUR/GBP pair formed a hammer like candle for the weekly chart, but I think looking at the daily chart shows a little bit of a different story. I think we are starting to slide lower, and if we break down below the 0.83 level, that then census market much lower as it is a head and shoulders. I believe that we will initially see some positivity in this pair, but then start to drift lower again this week.

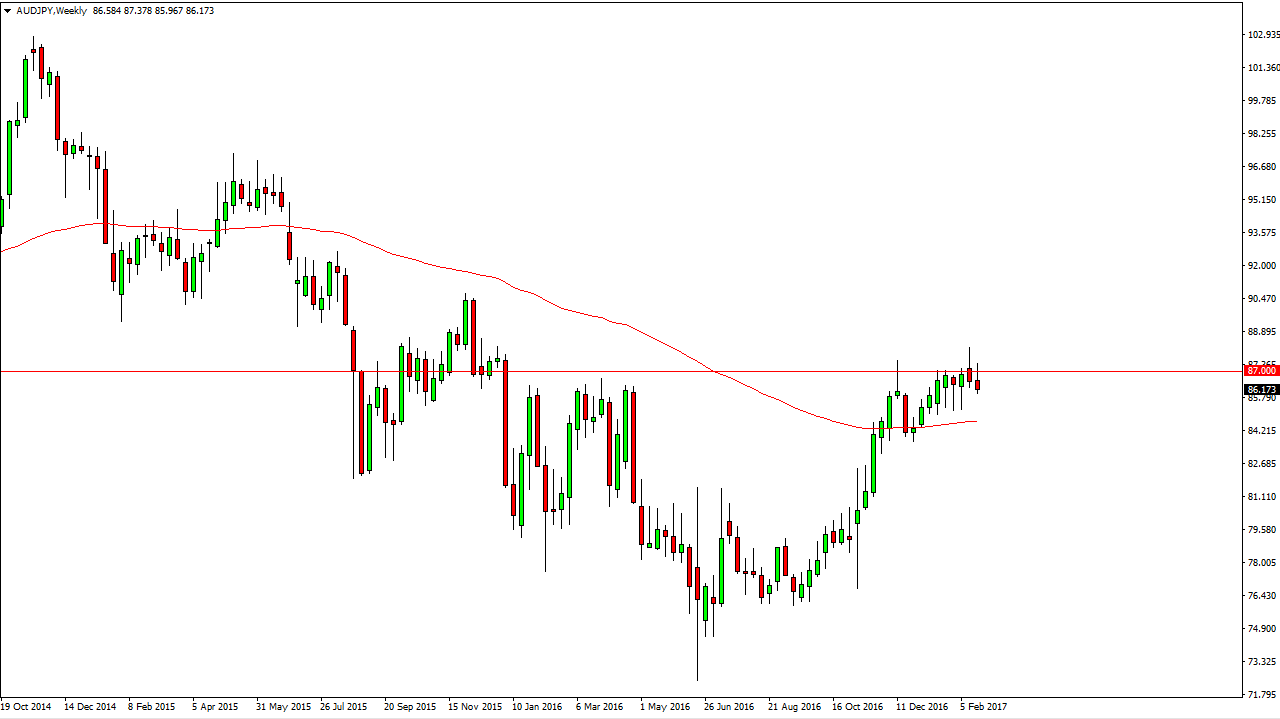

AUD/JPY

The AUD/JPY pair tried to break above the 87 handle, but pulled back. Quite frankly, I believe there is quite a bit of support just below, and thus I think that the buyers will return. We recently broke above the 100-week moving average, and I believe that a break above the top of the candle for the week should send this market much higher. Currently, I think we are trying to pick up more momentum.