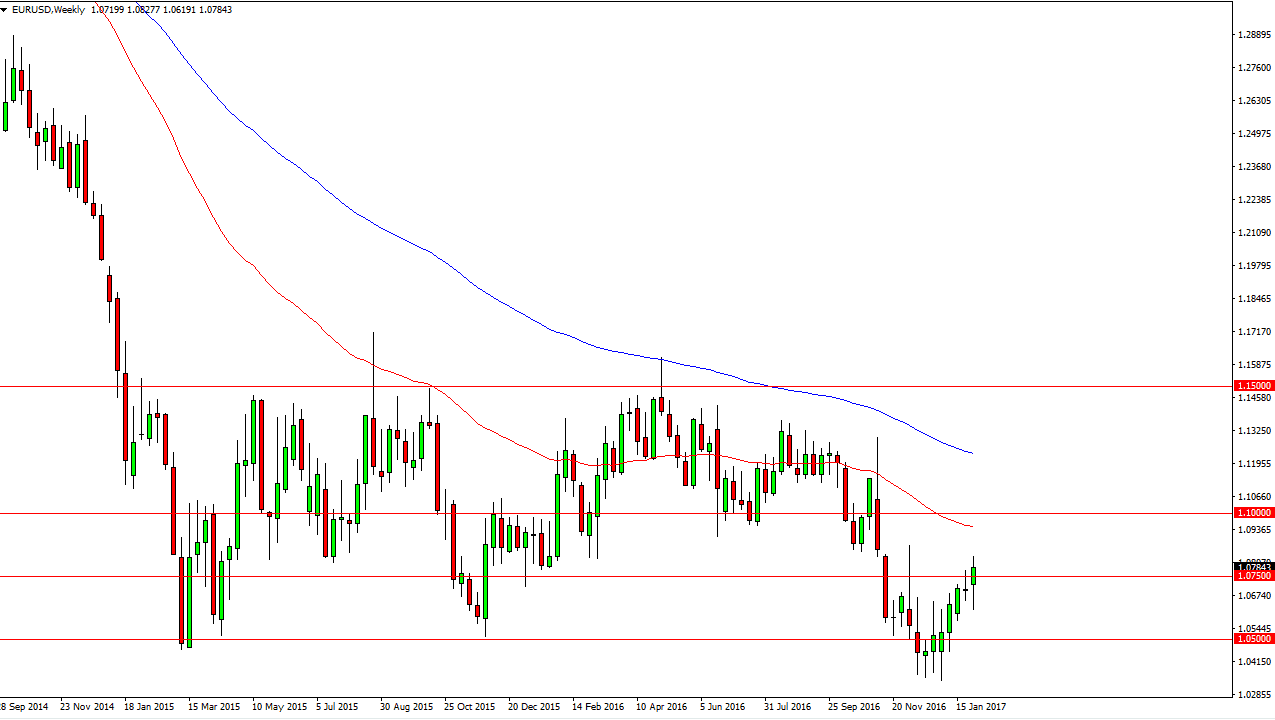

EUR/USD

The EUR/USD pair broke down initially during the week, but found enough support underneath to turn things back around. It looks as if the market is going to continue to find buyers, and if we break above the top of the candle for the week, the market should then reach towards the 1.09 level. I don’t have any interest in selling this week, even though we could have a bit of a pullback.

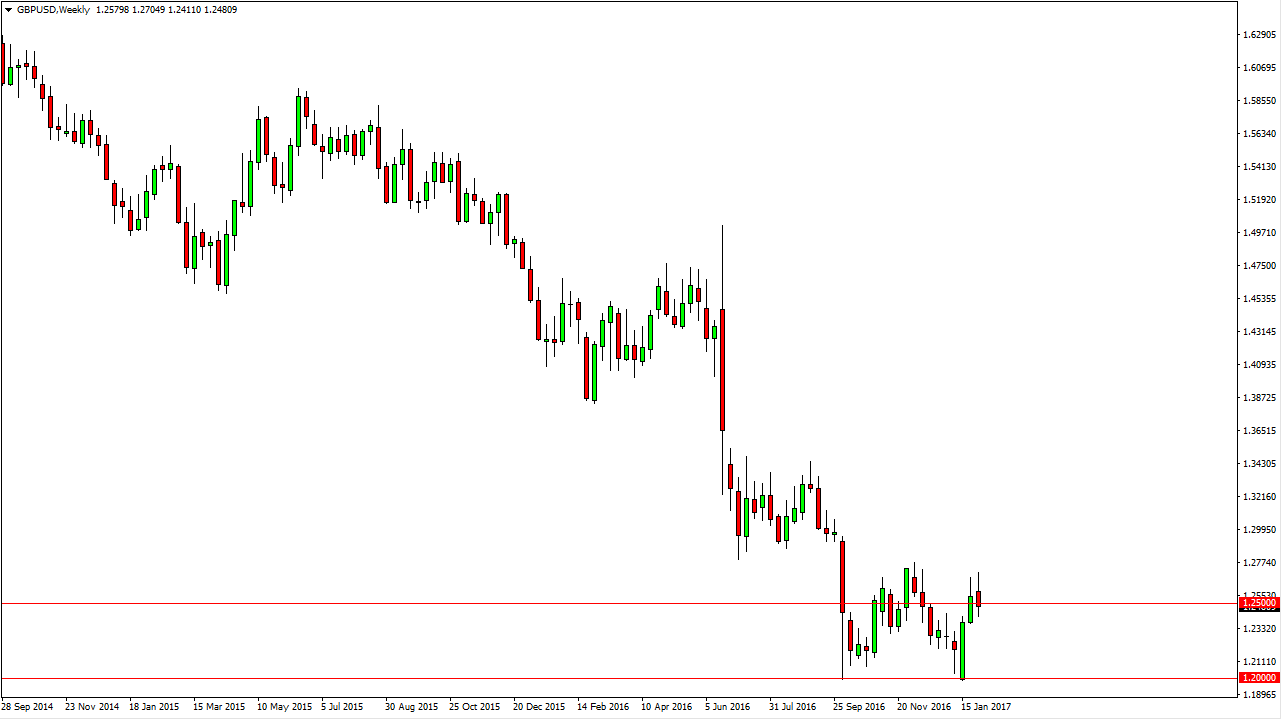

GBP/USD

The British pound initially rally during the week but turned around to form a somewhat negative candle. I do think the given enough time the British pound will turn around and go higher, but we may get a little bit of softness this week as we are trying to build up enough momentum. If we break above the top of the candle for the week, that is a very bullish sign.

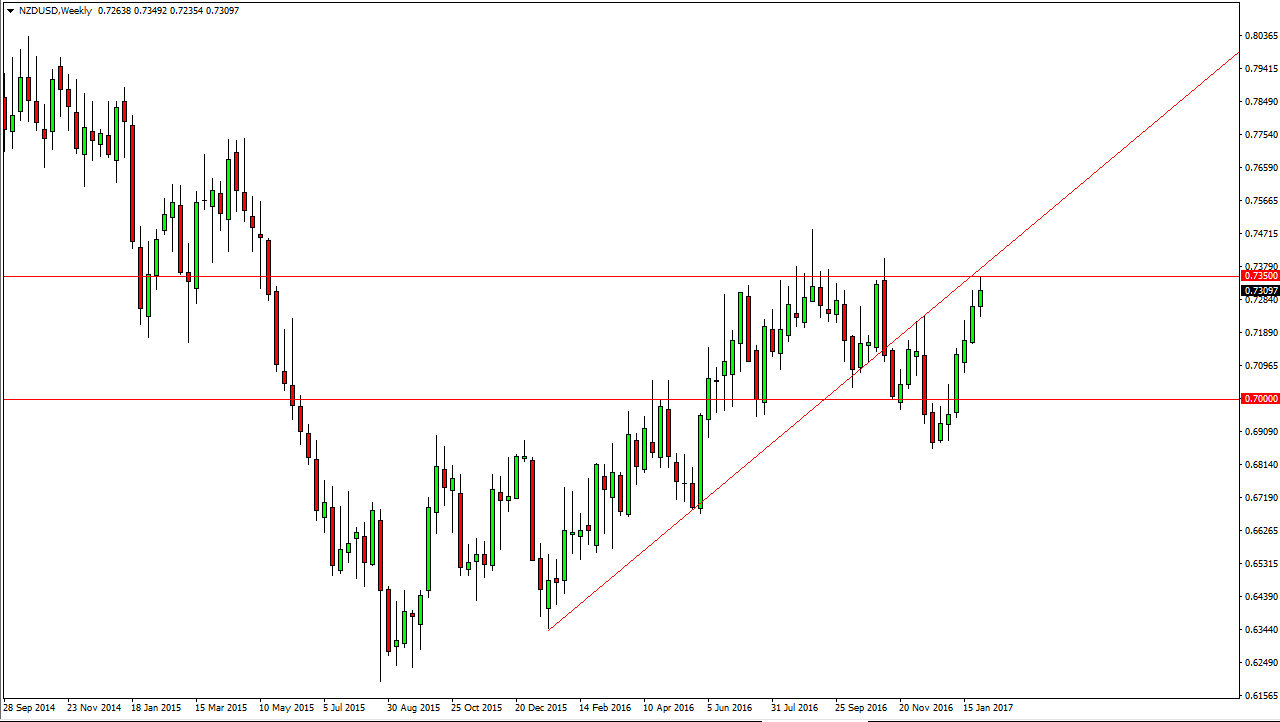

NZD/USD

The New Zealand dollar rallied a bit during the week, testing the 0.7350 level for resistance. We did find it there, and I think now we are looking at a very interesting place for this market. If we can break above the top of the uptrend line and the 0.7350 level, the market could go higher. Alternately, a breakdown below the bottom of the candle for the week is a very negative sign.

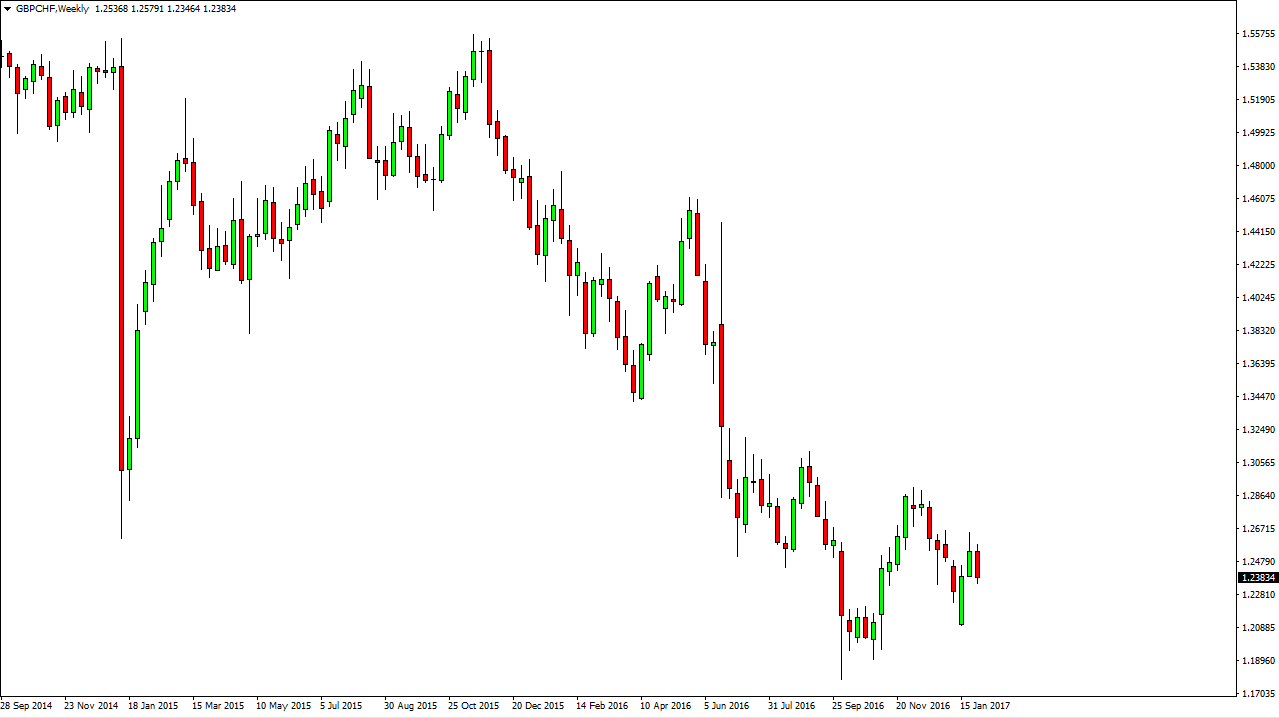

GBP/CHF

The GBP/CHF pair fell during the week, showing the 1.25 level as resistance. However, I think the British pound in general is starting to see a bit of life, so on the first signs of support, I’m willing to serve buying this pair but I recognize of this may be more of a longer-term “buy-and-hold” type of situation. I don’t have any interest in selling currently, I believe that the candle from 3 weeks ago, continues to be massively supportive.