Gold ended the week up 0.96% at $1233.44 an ounce, helped by political uncertainties and a weakened case for a rapid course of U.S. interest rate increases. The recent slowdown in U.S. wage growth lead many investors to believe the Federal Reserve may have to slow down its intended pace of hikes this year. Iran tensions, the risk of global trade and currency wars and protectionism in the U.S. are pushing money into the safe-haven hedge of gold. Concerns about the upcoming French elections and the Greek bailout program are also playing a part. Gold has rebounded nearly 7.2% since the beginning of the year.

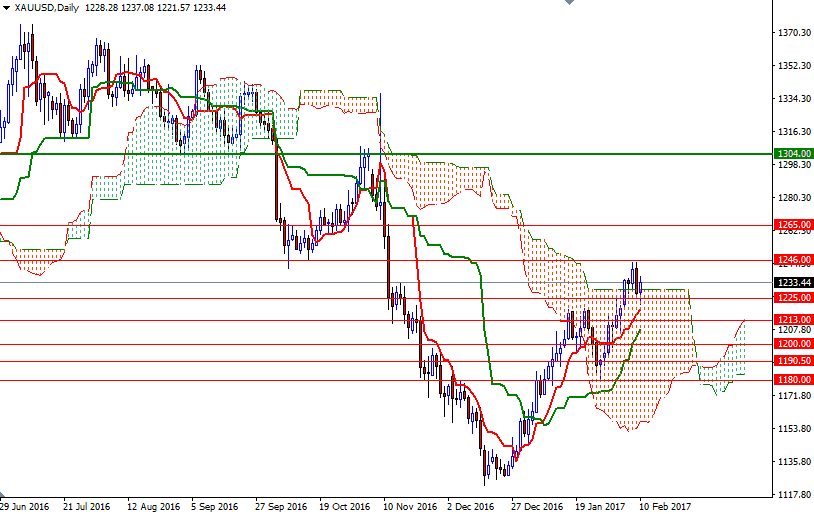

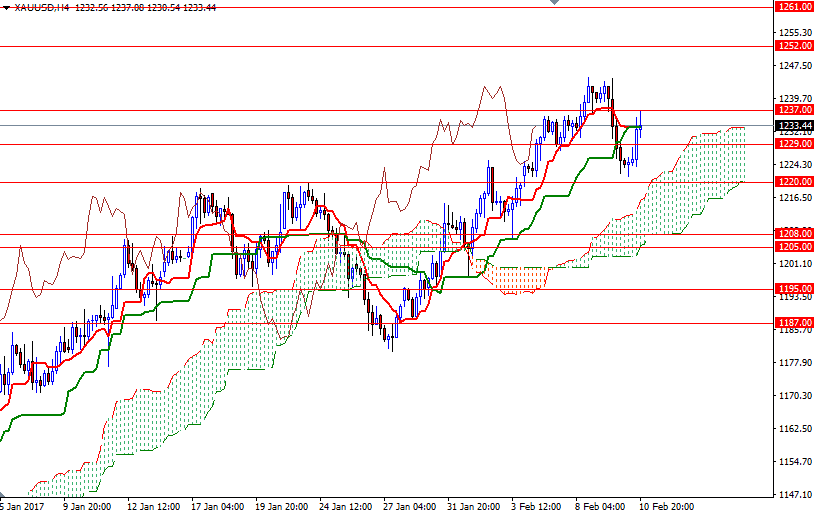

From a technical point of view, there are two things to pay attention. First of all, XAU/USD is trading above the Ichimoku cloud on the daily and the 4-hourly charts, plus the Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) lines are positively aligned on the daily chart. Adding to the bullish outlook is the Chikou-span (closing price plotted 26 periods behind, brown line) which resides above prices. Secondly, despite a positive near-term outlook, note that XAU/USD is currently trading within the borders of the weekly cloud.

That said, if the 4-hourly cloud continues to support the market, the current upside momentum could send prices towards 1252. But of course, in order to reach there the bulls will have to overcome a couple of barriers ahead. The initial resistance stands at around the 1237 level, followed by 1247/6. A close above the solid technical resistance at 1252 indicates that 1261 and 1265 will be the next targets. If the bears intend to take the reins, they have to demolish nearby supports such as 1229 and 1225 so that they can challenge the first strategic camp in the 1220/19 region. Closing below 1219 would open up the risk of a move towards 1213/1, where the bottom of the weekly cloud stands. A break down below 1211 could send prices back to 1208/5 area.