Gold prices fell $4.14 on Friday, giving up most of the gains made in the previous session, and closed the week $1235.12 an ounce. The XAU/USD pair initially headed lower after the support at $1225 gave way, trading as low as $1216.63, but erased losses as haven buying amid political uncertainty outweighed a brighter outlook for higher U.S. interest rates.

Apparently there is an underlying bid for gold as a safe haven diversification due to political uncertainties in the U.S. and Europe, the strong rally in equities and the prospect of early rate hikes weigh on prices. Last week, Federal Reserve Chair Janet Yellen opened the door for a possible rate hike at the March 14-15 meeting. The minutes of the U.S. central bank’s January 31-February 1 policy meeting due on Wednesday could give a better read of the odds it will happen.

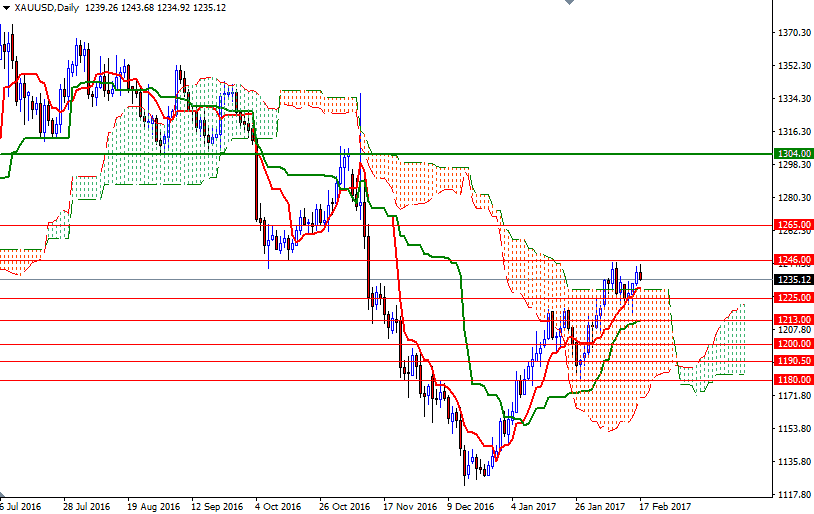

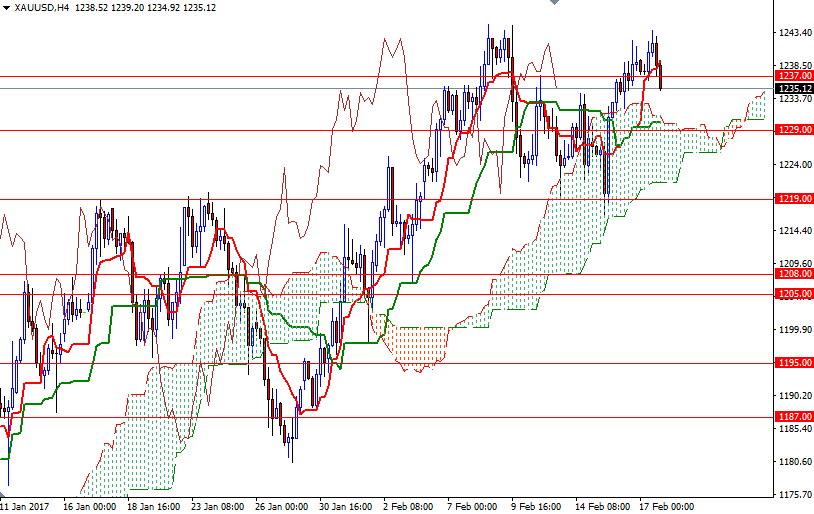

From a technical perspective, near-term charts suggest that a test of the key resistance at 1252 is likely if the market passes through 1247/6. I think the bulls will have to push the market convincingly beyond the 1252 level so that they can set sail for 1261, or perhaps 1265. Closing above 1265 suggests that 1270 and 1277/5 will be the next possible targets. Although XAU/USD resides above the Ichimoku clouds on the daily and 4-hourly time frames, prices are inside the cloud and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are negatively aligned on the weekly chart. If the aforementioned resistance in the 1247/6 region remains intact, keep an eye on the 1229 level, which happens to be the top of the 4-hourly cloud. Below that, the bears will have to clear nearby supports such as 1225 and 1220/19 in order to put extra pressure on the market. Once below 1219, look for further downside with 1213/1 and 1208/5 as targets.