Gold prices climbed for a third day and settled at $1257.03 an ounce, gaining $21.25 over the course of the week, as stock markets turned lower and the American dollar weakened. The XAU/USD pair tested support at the $1225 level earlier in the week before penetrating the $1247/6 region. Not surprisingly, breaking above a solid technical resistance at $1252 pushed prices higher, towards the $1261 levels. Also supporting gold prices was the Fed’s neutral tone. Federal Reserve meeting minutes released last week showed that that an interest rate hike could be forthcoming fairly soon but some Fed members were concerned about the strength of the U.S. dollar and the effects of possible changes in fiscal and other government policies.

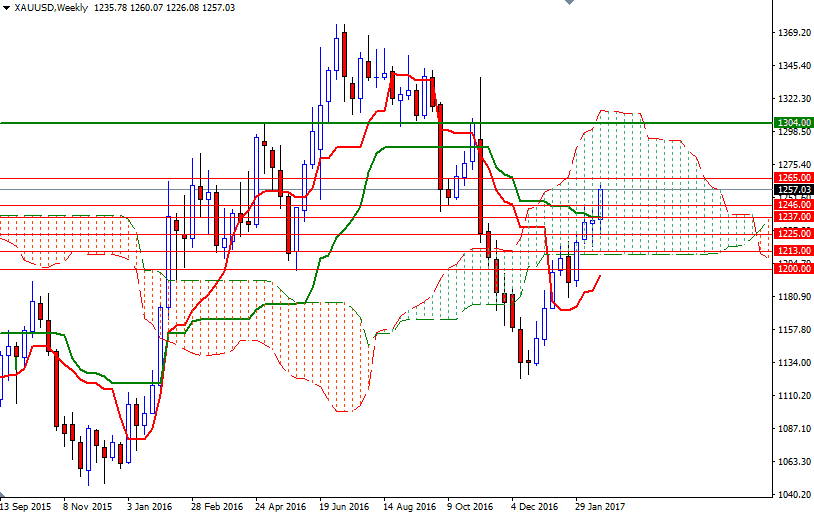

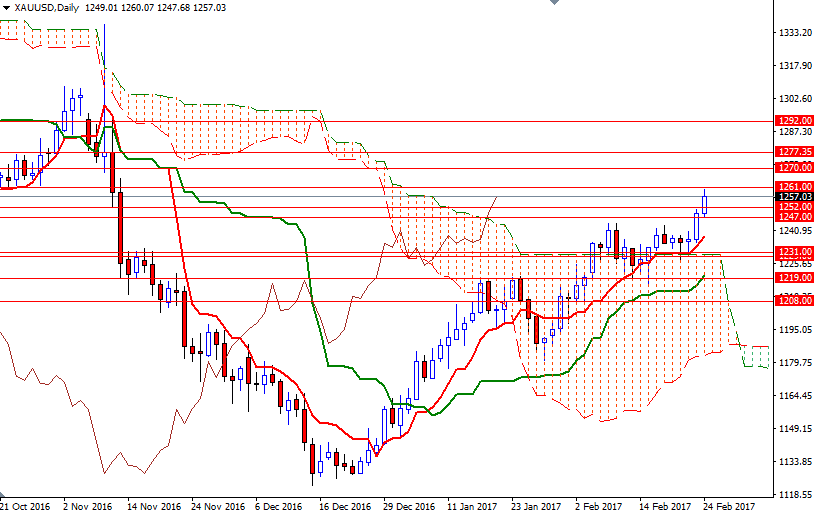

The latest data from the Commodity Futures Trading Commission (CFTC) revealed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 123763 contracts, from 109752 a week earlier. The XAU/USD pair is trading above the Ichimoku clouds on the daily and the 4-hourly charts. We have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on both charts, along with Chikou Span/Price crosses in the same direction. For quite some time I have been repeating that the short-term technical picture for gold remained positive and an upswing to the 1252 level (even an extension to the 1270/65 area) was possible. Since we have approached this are, I would I advise a bit of caution. Also note that XAU/USD is somewhere in the middle of the weekly Ichimoku cloud.

To the upside, the initial resistance stands at around the 1261 level, followed by 1265. If the bulls manage to climb and hold prices above 1265, then the 1270 level will be the next stop. A break up above 1270 could see a test of the 1277.35-1275 zone which happens to be the first solid technical resistance. Closing above 1277.35 could trigger a push up to 1292. However, if the aforementioned resistance in the 1265/1 region remains intact, XAU/USD will probably revisit 1252 and 1247/6. The bears will have to drag prices below the 1243/2 area so that they can tackle the first strategic support in the 1238/5 zone. Dropping through the 1235 level indicates that the bears are getting ready to make an assault on 1231/29. Once below 1229, the market will be aiming for 1225.