The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 26th March 2017

Last week, I predicted that the best trades for this week were likely to be long AUD/NZD and short NZD/CHF. The AUD/NZD fell by 0.98%, but the NZD/CHF also fell by 0.48%, tempering the overall average loss to only 0.25%.

The Forex market has shifted to a more settled mood, with the U.S. Dollar out of favor and falling. There has been a flow into such perceived safe havens such as the Japanese Yen, Swiss Franc, Euro, and precious metals such as Gold and Silver.

The most bearish currency in general against a long-term basket of currencies remain the New Zealand and U.S. Dollars. Therefore, I suggest that the best trade of the coming week will be long the Japanese Yen, Swiss Franc, and Euro, and short of the U.S. Dollar.

Fundamental Analysis & Market Sentiment

The major element affecting the market right now is the market’s inability to really believe in the Federal Reserve’s willingness to tighten monetary policy. This has led to weakness in the greenback. The U.S. Dollar is likely to be influenced this week by the failure of President Trump’s healthcare reform to pass through Congress, and his administration has now stated it will abandon the legislation for the time being and switch focus to its much-touted tax cutting agenda. This could boost the greenback if the market begins to see it as credible and immediate, but it had been expected that the health care reform would help finance such cuts.

Technical Analysis

USDX

The U.S. Dollar printed another bearish candle, although it has a lower wick which hints at a possibly bullish double bottom formation in line with the previous key swing low from two months back. The price has broken the supportive trend line as expected. The price is now within a zone likely to provide support, but there is bearish momentum, suggesting there may be an indecisive movement. Also, the price is below its level from 3 months back, which is a bearish sign.

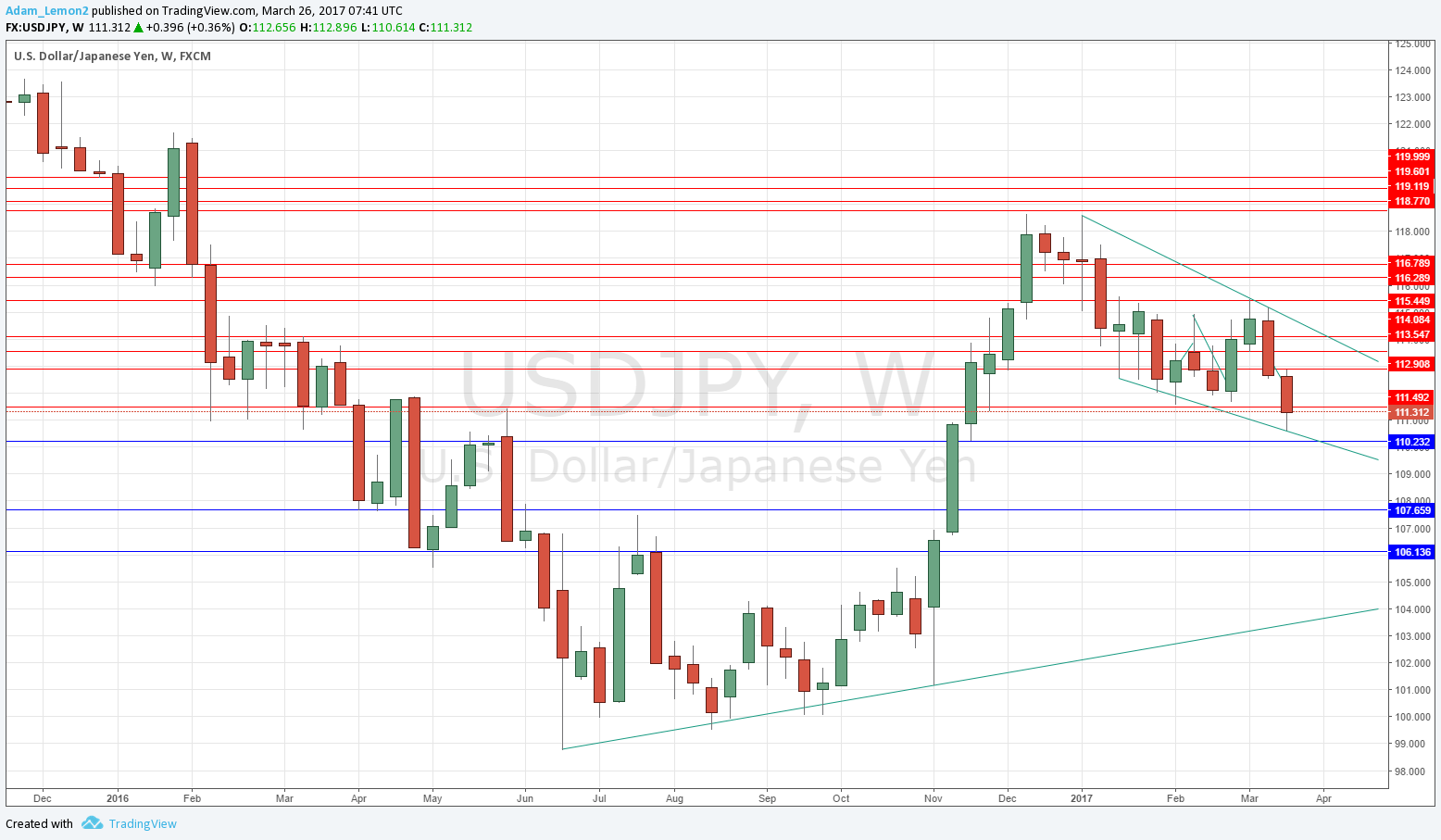

USD/JPY

This week we see another large bearish candle, breaking down to a four-month low and into “blue sky”. The price is also below its levels from 3 months back, indicative of a bearish trend. All the signs are bearish except one: the area between 110.00 and 111.00 was very pivotal during 2016 and may therefore provide some support.

EUR/USD

The candlesticks in the chart below show a very bullish pattern, although the moves have not been very volatile. We have now had four strongly bullish weekly candles with a nice bullish bottoming pattern of lower wicks. The price is well above its level of 3 months back. Everything looks bullish, except the price is now approaching a key area which has twice provided swing highs in recent months, as well as previously acting as support, so the area between 1.0825 and 1.0865 may prove tough to break.

Conclusion

Bullish on the Japanese Yen, Euro and Swiss Franc; bearish on the U.S. Dollar.