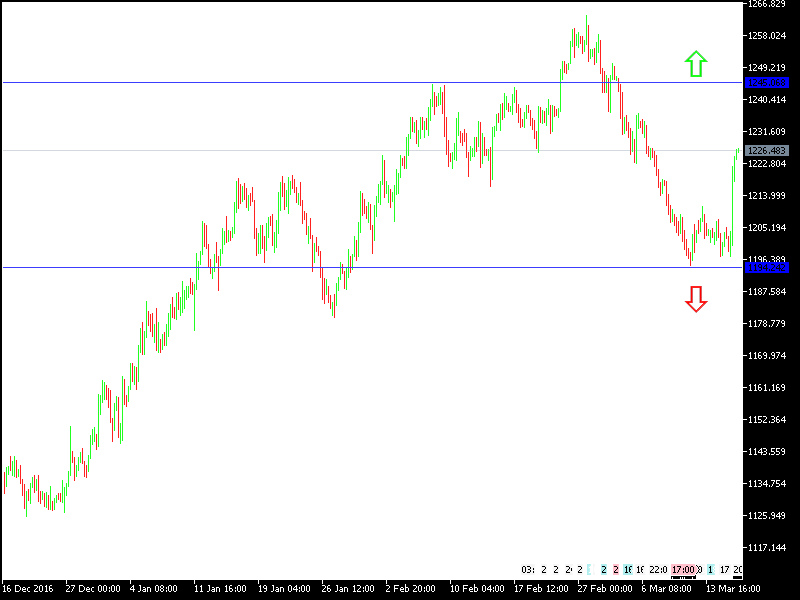

Before the Federal Bank announced raising the US interest rates, the Gold prices were around 1200$ an ounce. Upon the announcement of raising the US dollar interest rates, and the Fed’s economic outlooks followed by a press conference by “Janet Yellen” the Fed’s President, the dollar retreated, against expectations. Gold benefited a lot as well, raising towards 1229$ at the time of writing. The nearest resistance levels are currently at 1235 and 1245, which are supporting the gold’s bullish trend.

From the bearish side: the nearest support levels for gold are currently 1215 and 1210, and any move below the later would mean the end the bullish trend and resumption of the bearish momentum of gold.

From the economic data side: gold will continue to benefit from the market reaction to the Fed’s decisions before the announcement of the US Unemployment Benefits, Philly Manufacturing Index and Housing data.