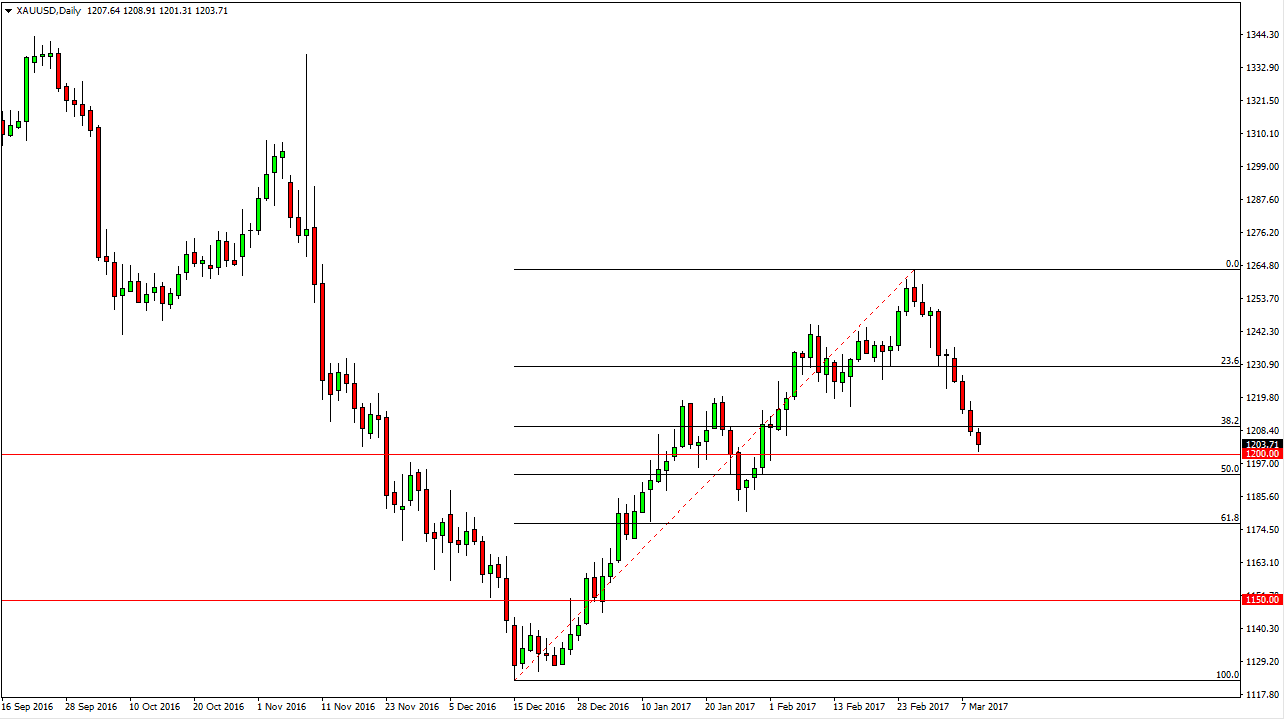

Gold markets fell initially during the day on Thursday, testing the $1200 level. This is an area that I think will offer quite a bit of interest though, mainly because of the psychological significance. However, I do recognize that the 50-day exponential moving average is just below, and because of this am waiting to see whether we can get some type of bounce to start buying again. A break above the top of the candle will be a buying opportunity, and I will not hesitate to go long. I will of course pay attention to the volatility, and must give stops a bit of room to move.

I have no interest in selling this market until we break down below the hammer that sits just above the 61.8% Fibonacci retracement level, from late January. I think there is potential for support or a bounce all the way down to that level, so I’m very hesitant to start selling now. Quite frankly, if you wanted to short this market you should have done so several days ago, at this point, you would be “chasing the trade.”

I think they’re still an argument to be made for hire gold, but the Federal Reserve raising interest rates course has thrown a bit of a spanner in the works. Nonetheless, I think the gold can still rise due to other currencies, not necessarily the US dollar. Because of this, I remain bullish, but I’m also cautious. I recognize that it may take some real work to go higher and thus I’m not wanting to jump into this market right away. The daily charts and more importantly, the daily close, is what I will be waiting to see to decide. I will not place a trade in the middle of the day as I think today could be especially volatile due to the jobs number.