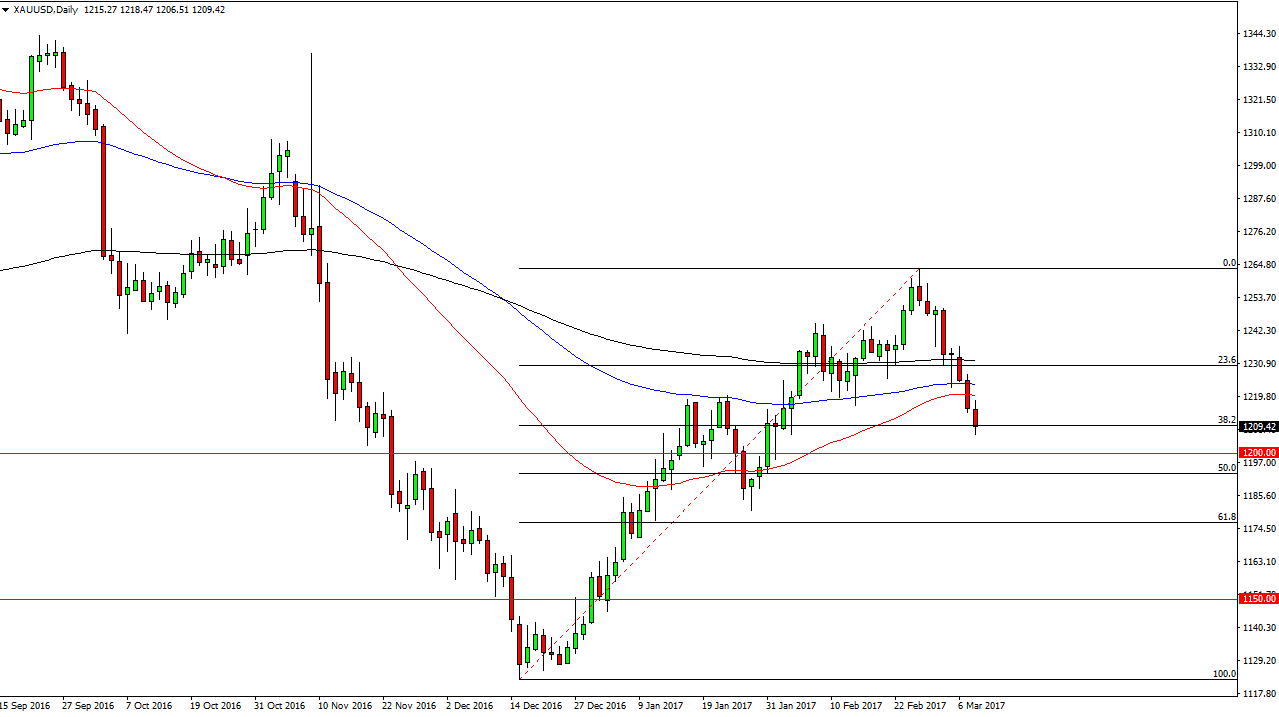

Gold markets fell again during the day on Wednesday, as we continue to see bearish pressure. We are now approaching the $1200 level, which should be rather psychologically important. However, the market has been very negative as of late, so I’m not willing to go long at the first signs of a bounce. I would need to see a daily supportive candle to start buying, and I must admit that the market has been very negative as of late. Because of this, I think a little bit of prudence may go a long way in this market. The 50% Fibonacci retracement level is just below the $1200 level, and that of course will have a bit of influence on this market as well.

The US dollar has been working against the value of the gold markets recently, and quite frankly I think that this could continue. Technically, I don’t believe that a move is over with until we breakdown below the 61.8% Fibonacci retracement level, and there’s a lot of work to do before we can do that. However, I also believe that it would be foolish to just simply assume that we are going to go higher.

Currently, looks as if the market is very volatile in general, as we can’t make up our collective minds in several different futures and currency pairs. Because of this, I think that you may be better served to let the market react first, and then follow. This is the type of market that can get you into real trouble, because anticipating a move almost always ends up in you guessing the wrong way. I don’t know what it is, it just seems to be Murphy’s Law.

Given enough time, I believe that a bounce could send this market looking towards the $1250 level, but as of late there doesn’t seem to be any real commitment in one direction, making this a very difficult market to deal with.