Gold prices rose $6.45 on Monday, benefited from growing doubts over Trump’s economic plans. After the resistance in the $1253/2 zone was broken, the XAU/USD pair reached the $1265/1 region as expected, but recovering U.S. stock markets took some momentum away from the market. The XAU/USD is currently trading at $1253.53, slightly lower than the opening price of $1253.73.

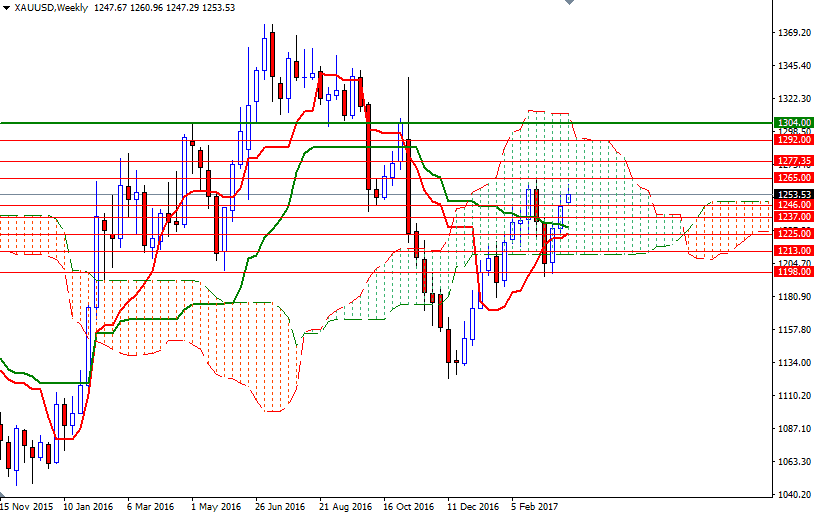

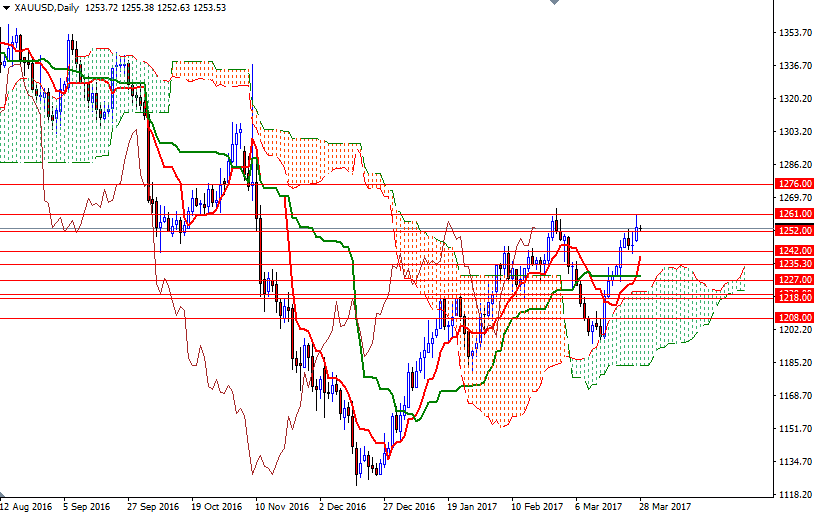

The market is trading above the Ichimoku clouds on the daily and the 4-hour charts. We have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on both charts, along with Chikou Span (closing price plotted 26 periods behind, brown line)/Price crosses in the same direction. All these suggest that the bulls have the near-term technical advantage; however, the upside potential will be limited until prices passes through the aforementioned barrier located in 1265/1.

If XAU/USD manages to climb and hold above 1265, we might see a bullish attempt targeting 1277.35-1276. A break through there would pave the way for a test of the 1292 level. To the downside, keep an eye on the 1252/0 zone. If the market dives below the Ichimoku cloud on the H1 chart, we may head back to the 1246/2 area. Falling through 1242 would indicate that the 1237/5 area might be the next port of call.