Gold prices ended Wednesday’s session up $20.45 as a softer dollar lured investors back into the market. The XAU/USD pair traded as high as $1221.93 an ounce, the highest level in five sessions, after the Federal Reserve decided to raise short-term interest rates but signaled a more gradual pace of monetary tightening than people expected. “We continue to expect that the ongoing strength of the economy will warrant gradual increases in the federal funds rate to achieve and maintain our objectives,” Fed Chair Yellen said.

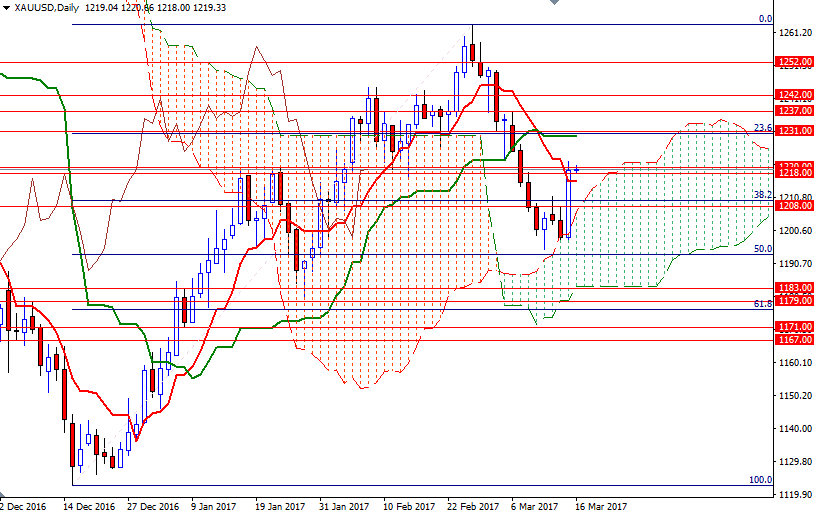

Yesterday’s rally pushed prices above the Ichimoku clouds on the H1 and the M30 charts; plus the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) lines are positively aligned on both time frames. The short-term charts suggest that a test of the key resistance in the 1226/5 zone is likely if the market passes through 1220. I think the bulls will have to push the market convincingly beyond the 1226 level so that they can challenge the bears on the 1231 battlefield. Clearing the resistance at the 1231 level, which happens to be the top of the 4-hourly Ichimoku cloud, might prolong the bullish momentum and push prices towards the 1238/7 area.

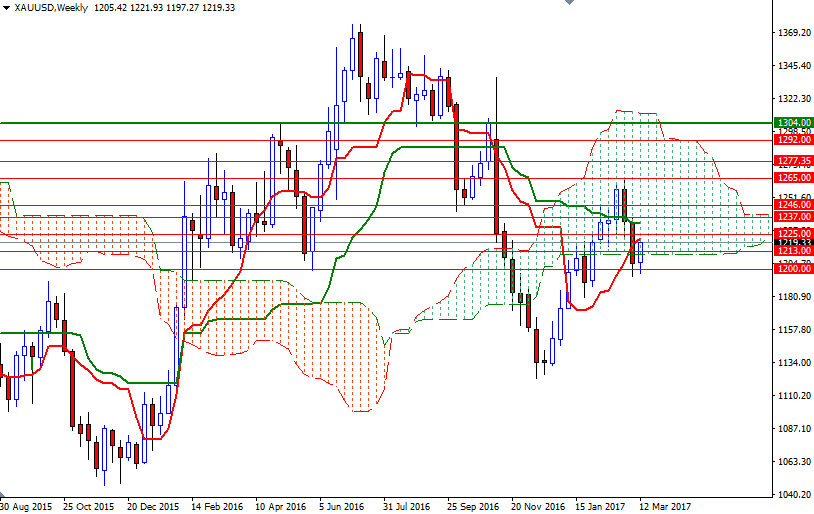

To the downside, the initial support stands in the 1214/3 zone. The bears will have to drag prices back below 1213 so that they can tackle the support in the 1210/08 region, where the bottom of the weekly cloud resides. A break down below the strategic technical support in 1210/08 implies that XAU/USD is about to revisit 1200-1198.