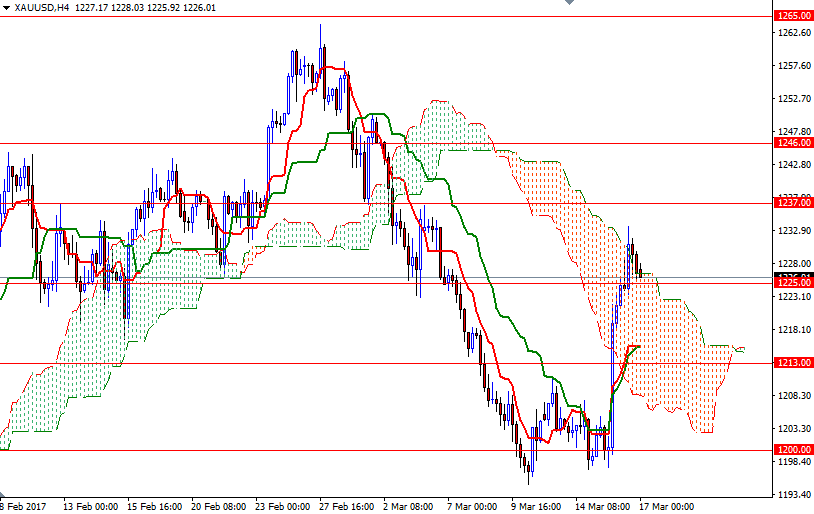

Gold rose for a second straight session on Thursday as weakness in the dollar bolstered demand for the precious metal. The XAU/USD pair extended its gains and reached the $1231 area after the $1220 resistance was broken. However, the market ended up finding a bit of resistance in the vicinity and returned to the $1225 level.

The market is currently trying to hold above the previous resistance now flipped to support at 1225, so I will keep an eye on there. If the bulls successfully defend this area, we will probably have another chance to tackle the resistance at around the 1231 level. A break through there brings in 1237. Beyond that, the 1246/2 zone stands out as an obvious key resistance.

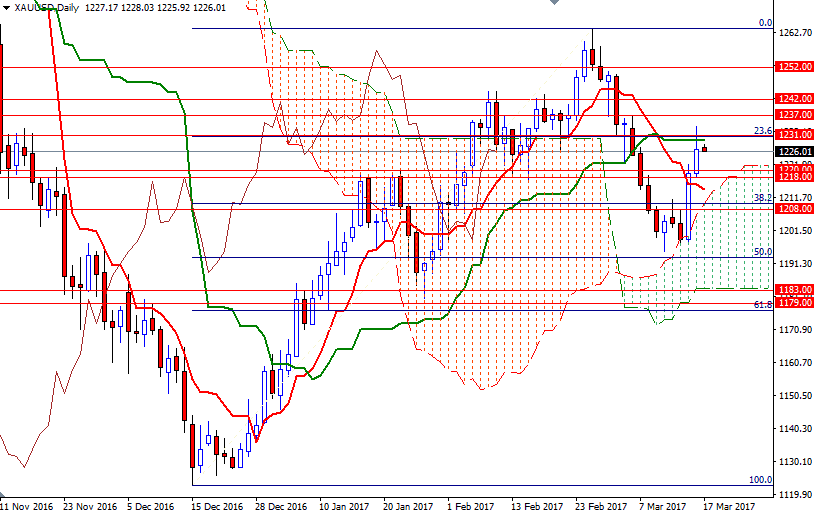

Although the technical picture suggests that the bulls have the near-term technical advantage, beware that the daily Chikou-span (closing price plotted 26 periods behind, brown line) is still inside the cloud. A break down below 1225/3.30 could lead to some profit taking and pull us back to the 1220-18 zone. The bears have to capture this strategic support if they intend to increase the pressure and drag prices towards 1214/3.